Today, mobile phones especially smartphones are an indispensable part of most businesses and they qualify as fixed assets as they usually last for more than a year. Being a fixed asset, the depreciation on mobile phones is to be provided. The rate of depreciation to be charged on mobile phones is 15Read more

Today, mobile phones especially smartphones are an indispensable part of most businesses and they qualify as fixed assets as they usually last for more than a year. Being a fixed asset, the depreciation on mobile phones is to be provided.

The rate of depreciation to be charged on mobile phones is 15% WDV* as per the Income Tax Act. The rates as per the companies act, 2013 are 4.75% SLM** and 13.91% WDV*.

*Written Down Value **Straight Line Method

A company has to charge depreciation on mobiles in their books as per the rates of Companies Act, 2013.

Any business or entity other than a company can choose the rate as per the Income Tax Act, 1961 which is 15% WDV. It is a general practice for non-corporates to charge depreciation in their books as per the rates of the Income Tax Act.

An important thing to know is that as per the Income Tax Act, 1961, mobile phones are treated as plants and machinery and the general rate of 15% is applied to it.

One may consider mobile phones as computers and charge depreciation at the rate of 40%. However, such a practice is not correct. Mobile phones are not considered equivalent to computers and there is case judgment given by Madras High Court which backs this consideration. The case is of Federal Bank Ltd. vs. ACIT (supra).

Therefore we are bound to this case judgment and should treat mobile phones as part of plant and machinery and charge depreciation on it accordingly for the time being.

See less

Let me brief you about the nature of computers, their parts, laptops according to the companies act 2013. Basically, these are treated as non-current tangible fixed assets. This is because these types of equipment are used in business to generate revenue over its useful life for more than a year. AsRead more

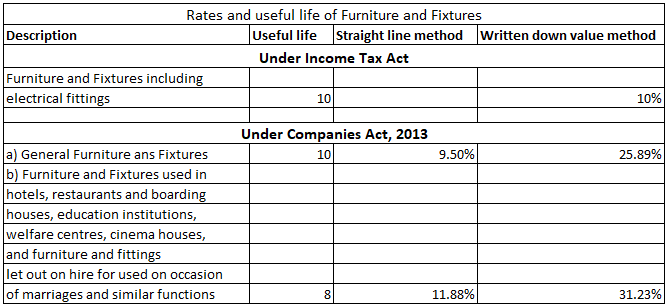

Let me brief you about the nature of computers, their parts, laptops according to the companies act 2013. Basically, these are treated as non-current tangible fixed assets. This is because these types of equipment are used in business to generate revenue over its useful life for more than a year. As per the companies act 2013, the following extract of the depreciation rate chart is given for computers.

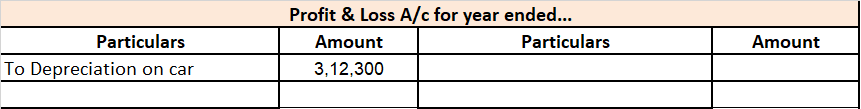

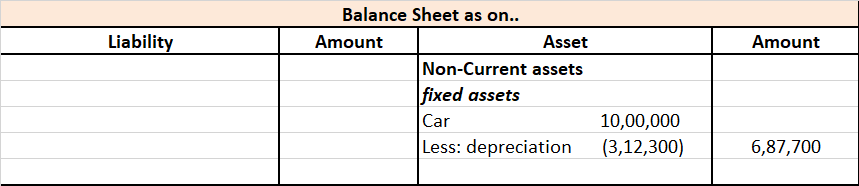

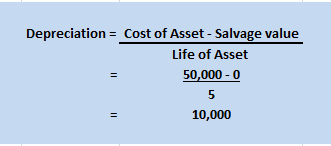

Giving you a short example, suppose M/s spy Ltd purchased 20 computers worth Rs 30000 each. As per the companies act 2013, the computer’s useful life is taken to be 3 years, and the rate of depreciation rate is 63.16%. Applying the WDV method we can calculate depreciation as follows:

So for the first year, the depreciation amount will be

Cost of computers = Rs 6,00,000 (20*30000)

Salvage value = NIL

Rate of depreciation as per the Act = 63.16%

Therefore depreciation = (6,00,000 – NIL)* 63.16%

= Rs 3,78,960

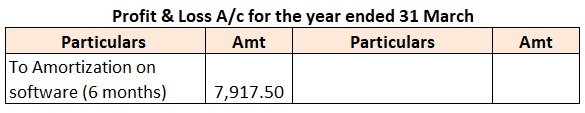

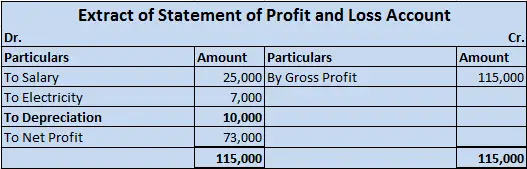

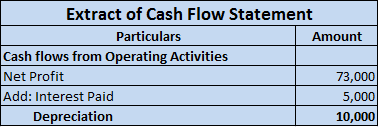

this amount of depreciation will be shown in the profit & loss account as depreciation charged to computers and the same will be adjusted in the balance sheet. The extract of Profit & Loss and corresponding year Balance sheet is shown below.

See less