Let me brief you about the nature of computers, their parts, laptops according to the companies act 2013. Basically, these are treated as non-current tangible fixed assets. This is because these types of equipment are used in business to generate revenue over its useful life for more than a year. AsRead more

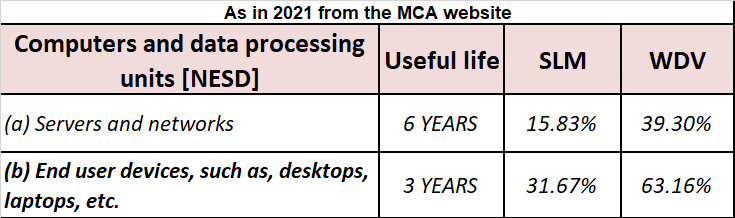

Let me brief you about the nature of computers, their parts, laptops according to the companies act 2013. Basically, these are treated as non-current tangible fixed assets. This is because these types of equipment are used in business to generate revenue over its useful life for more than a year. As per the companies act 2013, the following extract of the depreciation rate chart is given for computers.

Giving you a short example, suppose M/s spy Ltd purchased 20 computers worth Rs 30000 each. As per the companies act 2013, the computer’s useful life is taken to be 3 years, and the rate of depreciation rate is 63.16%. Applying the WDV method we can calculate depreciation as follows:

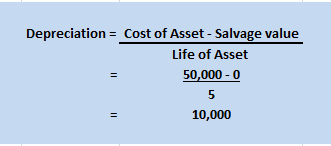

| Depreciation as per WDV = | (Cost of an asset – salvage value)* Depreciation rate |

So for the first year, the depreciation amount will be

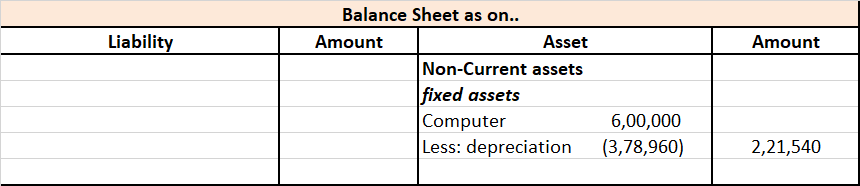

Cost of computers = Rs 6,00,000 (20*30000)

Salvage value = NIL

Rate of depreciation as per the Act = 63.16%

Therefore depreciation = (6,00,000 – NIL)* 63.16%

= Rs 3,78,960

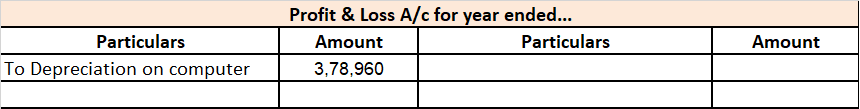

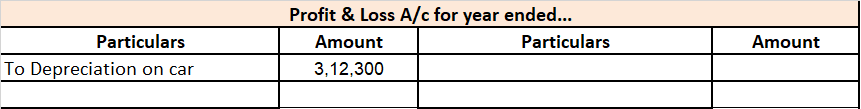

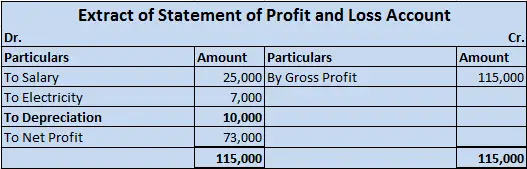

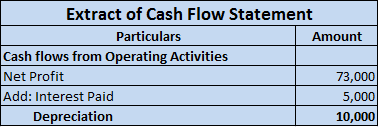

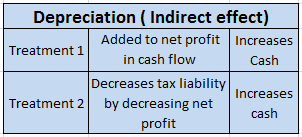

this amount of depreciation will be shown in the profit & loss account as depreciation charged to computers and the same will be adjusted in the balance sheet. The extract of Profit & Loss and corresponding year Balance sheet is shown below.

The Income Tax 1961 does not provide any rate of depreciation specifically for cameras. But we can consider camera within the block of ‘Computer including software’ for which the rate of depreciation is 40% at WDV method. It is a general practice for non-corporates to charge depreciation at rates slRead more

The Income Tax 1961 does not provide any rate of depreciation specifically for cameras. But we can consider camera within the block of ‘Computer including software’ for which the rate of depreciation is 40% at WDV method.

It is a general practice for non-corporates to charge depreciation at rates slightly lower than the rate provided by the Income Tax Act, 1961. But one cannot charge depreciation more than it.

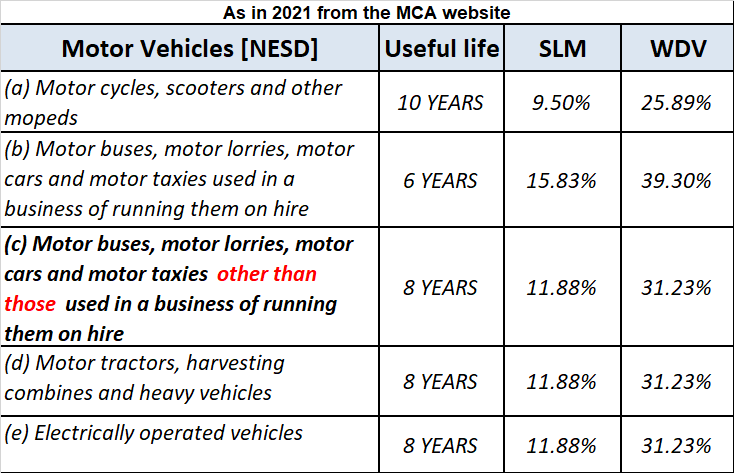

In the case of corporate, the rates for charging depreciation are provided by the Companies Act 2013, which is

Let’s take an example:

Mr X is a jewellery shop owner and has installed CCTV cameras on 1st April 2021, costing ₹ 40,000 at various points in his shop to ensure safety and security. Keeping in mind the Income-tax rates, his accountant decided to charge depreciation @ 30% p.a. on the CCTV cameras.

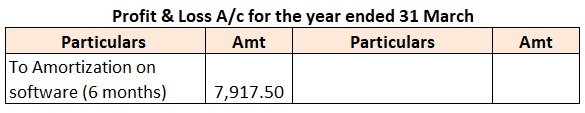

Following is the journal entry:

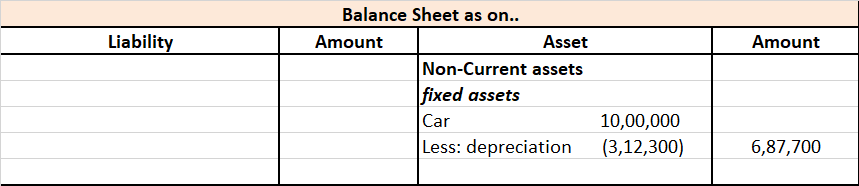

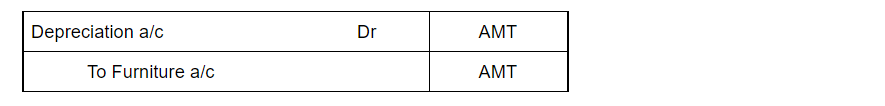

The balance sheet will look like this:

See less