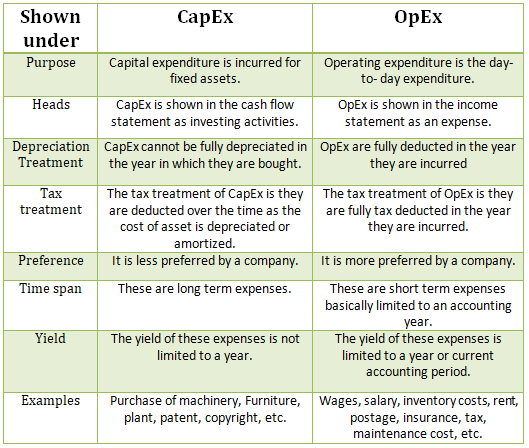

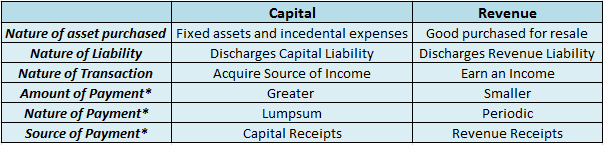

Based on duration, expenses can be categorized as capital expenditure and revenue expenditure. A) Capital expenditure or CAPEX are those funds that are used to acquire or maintain or enhance long-term assets. Such expenses do not occur frequently and are incurred to enhance the company’s utility inRead more

Based on duration, expenses can be categorized as capital expenditure and revenue expenditure.

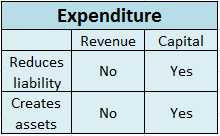

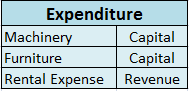

A) Capital expenditure or CAPEX are those funds that are used to acquire or maintain or enhance long-term assets. Such expenses do not occur frequently and are incurred to enhance the company’s utility in the long-term i.e. more than one year.

The formula of CAPEX can be given as –

Capital expenditure = Net increase in PP & E + Depreciation Expense

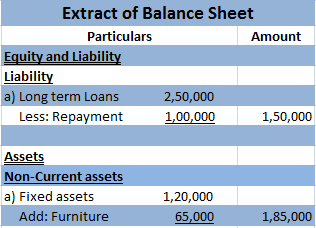

. It is showed in companies’ cash flow statement and in its Balance Sheet under the head of fixed assets. These capital expenditures are capitalized.

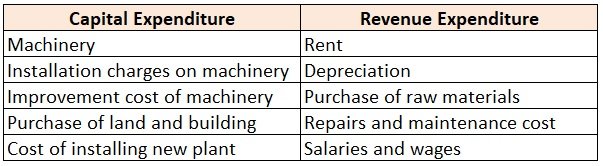

List of some capital expenses –

- Buildings (Including costs of purchase and other cost that extend the useful life of a building)

- Computer equipment (Cost of purchase and installation cost)

- Office equipment (Purchase cost)

- Furniture and fixtures (Cost of purchase and installation cost)

- Intangible assets (i.e. patent, trademark)

- Land (Including the cost of purchasing and upgrading the land)

- Machinery (Purchase cost and costs that bring the equipment to its location and for its intended use)

- Software (Installation cost)

- Vehicles

Example- If an asset costs Rs10,000 when bought and installation cost is Rs2000. The total capital expenditure will be Rs12000 and is expected to be in use for five years, Rs2,500 may be charged to depreciation in each year over the next five years.

B) Revenue expenditure or OPEX are those expenses that are incurred during its course of the operation. It can also be termed as total expenses that are incurred by firms through their production activities. Such costs do not result in asset creation, and the benefits resulting from it are limited to one accounting year. These are for managing operational activities and revenue within a given accounting period.

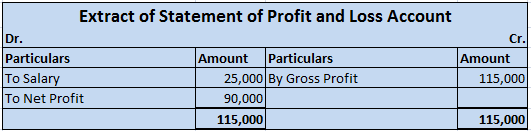

The accounting treatment for revenue expenditure for an accounting period is shown in a companies Income Statement, but it is not recorded in the firm’s Balance Sheet. OPEX is not capitalized and depreciation is not levied on such expenses.

Examples for revenue expenditures are as follows –

- Direct expenses

These types of expenses are mostly incurred directly through the production process. Common direct expenses include – direct wages, freight charge, rent, material cost, legal expenses, and electricity cost.

- Indirect expenses

These expenses are indirectly related to production like during sale, distribution, and management of finished goods or services. They include expenses like selling salaries, repairs, interest, commission, depreciation, rent, and taxes, among others.

See less

The installation expenses for a new machinery will be debited to the "Machinery A/c". Installation expenses are the expense incurred to bring an asset to a working condition where it can be used. For example, installation charges are incurred on machinery to make it operational. Installation chargesRead more

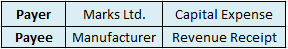

The installation expenses for a new machinery will be debited to the “Machinery A/c“. Installation expenses are the expense incurred to bring an asset to a working condition where it can be used. For example, installation charges are incurred on machinery to make it operational.

Installation charges will be capitalized along with the cost of machinery. It is so because this expense is concerning the machinery and any expense directly related to an asset should be capitalized, as an asset will be with the business for a longer period of time.

This charge will be incurred only once as a part of bringing the machinery to its working condition, and hence it should be capitalized and should be added to the cost of the machine. The whole amount will be shown in the balance sheet on the asset side as a Fixed Asset.

This charge will not be shown in Profit and Loss A/c as it reflects all the revenue expenditure incurred in the period.

Example:

Starbucks purchased a coffee blending machine for the business purpose for $1,00,000. The installation expense incurred on it to make it operational was $20,000. How will Starbucks record this in the Balance Sheet on 31 December?

In the Balance Sheet, Starbucks will add the installation expense incurred on the machine to the cost of the machine as it is the cost incurred to make the machine operational for further business use. Hence, the cost of $20,000 will be shown along with the cost of the coffee blending machine ($1,00,000+$20,000=$1,20,000)

See less