The term set off in English means to offset something against something else. It thereby refers to reducing the value of an item. In accounting terms, when a debtor can reduce the amount owed to a creditor by cancelling the amount owed by the creditor to the debtor, it is termed as set off. It is coRead more

The term set off in English means to offset something against something else. It thereby refers to reducing the value of an item. In accounting terms, when a debtor can reduce the amount owed to a creditor by cancelling the amount owed by the creditor to the debtor, it is termed as set off.

It is commonly used by banks where they seize the amount in a customer’s account to set off the amount of loan unpaid by the customer.

Types

There are various types of set-offs as given below:

- Transaction set-off – This is where a debtor can simply reduce the amount he is owed from the amount he owes to the creditor.

- Contractual set-off – Sometimes, a debtor agrees to not set off any amount and hence he would have to pay the entire amount to the creditor even if the creditor owed some amount to the debtor.

- Insolvency set-off – These rules are mandatory and have to be followed under the Insolvency rules 2016.

- Bankers set-off – Here, the bank sets off the amount of a customer with another account of the customer.

Example

Let’s say Divya owes Rs 20,000 to Sherin for the purchase of goods. But, Sherin owed Rs 6,000 to Divya already for use of her Machinery. Therefore, the amount of 6,000 can be set off against the 20,000 owed to Sherin and hence Divya would effectively owe Sherin Rs 14,000.

This helps in reducing the number of transactions and unnecessary flow of cash.

See less

As per Wiki, it is also called construction in progress. Capital work in progress is a non-current asset of an entity. It is also known as CWIP in short. CWIP is the work which is not yet completed but the amount for which has already been paid. Suppose, at the time of preparing a balance sheet, ifRead more

As per Wiki, it is also called construction in progress. Capital work in progress is a non-current asset of an entity. It is also known as CWIP in short.

CWIP is the work which is not yet completed but the amount for which has already been paid.

Suppose, at the time of preparing a balance sheet, if an asset is not completed, all the costs incurred on that asset up to the balance sheet date are to be transferred to an account called capital work in progress.

Example 1: A machinery under installation.

There are several expenses incurred while installing machinery, expenses such as labor charges, Initial delivery and handling costs, Assembly and installation cost, etc are included in CWIP and when the asset is completed and is ready to use, all the costs are transferred to the relevant accounts.

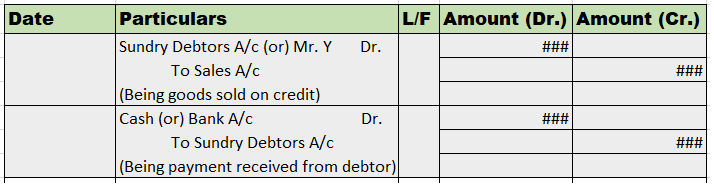

To make it simpler, let me show journal entries relating to this example.

When an expense is incurred/paid:

When an asset is complete and put to use:

Example 2: A Contractor is constructing a building. The following expenditures are being incurred to date:

i) Raw materials – 5,00,000

ii) Payment to Architect – 3,50,000

iii) Advance for Equipments – 1,50,000

Following accounting entries will be passed to record the expenditure on CWIP assets:

The following accounting entry will be passed once assets are ready to use:

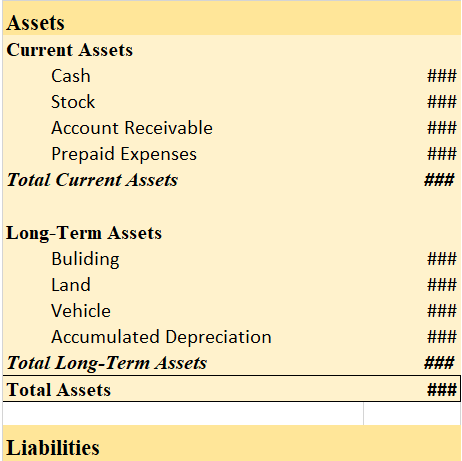

Disclosure in the Balance sheet

CWIP account is shown separately in the balance sheet below the fixed asset.

we cannot depreciate capital work in progress. It can only be depreciated when the asset is put to use.

See less