I mean to ask is it real, nominal, or personal and why?

Sales return shows the sale price of goods returned by customers. It is deducted from sales or gross sales in the income statement. It is a contra revenue account that represents returns from the customers and deductions to the original selling price, in case of any defective product received by theRead more

Sales return shows the sale price of goods returned by customers. It is deducted from sales or gross sales in the income statement.

It is a contra revenue account that represents returns from the customers and deductions to the original selling price, in case of any defective product received by the customer or any other manufacturing default.

Sales allowances arise when any customer accepts the product at a lower price than the original price or, in other words, a reduction in the price charged by a seller, due to any problem related to the sold product like a quality issue, an incorrect price charged or shipment issue.

Sales allowances are created before the final billing is paid by the buyer.

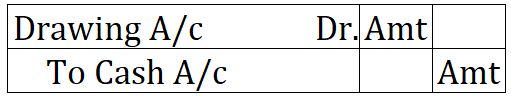

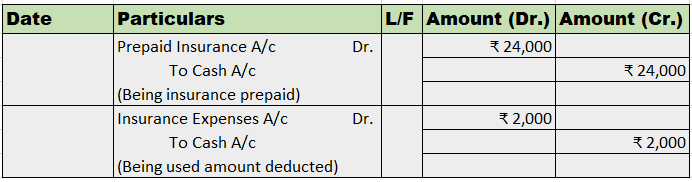

Journal entry for sales return and allowances:

| Dr. | Sales return and allowances | Amt | |

| Cr. | Accounts receivable | Amt |

- Sales Return Account is debited because it is reverse of Sales Account which is credited at the time of sale.

- Account Receivable Account is credited to reverse the debtors debited at the time of sale.

- Hence Sales Return entry is just reverse of the entry recorded at the time of sale.

See less

The correct option is option A. Journal is the book of original entry. It is from the journal, the postings in the ledgers are made. As it is the journal first to record the transactions, it is called the book of original entry. It is from the journal, the postings in the ledgers are made. Ledgers aRead more

The correct option is option A.

Journal is the book of original entry. It is from the journal, the postings in the ledgers are made. As it is the journal first to record the transactions, it is called the book of original entry.

It is from the journal, the postings in the ledgers are made. Ledgers are called the books of principal book of entry.

Option B Duplicate is wrong as there is no such thing as the book of duplicate entry in financial accounting. Journal entries are the first-hand record of business transactions. Hence, it cannot be the book of duplicate entries.

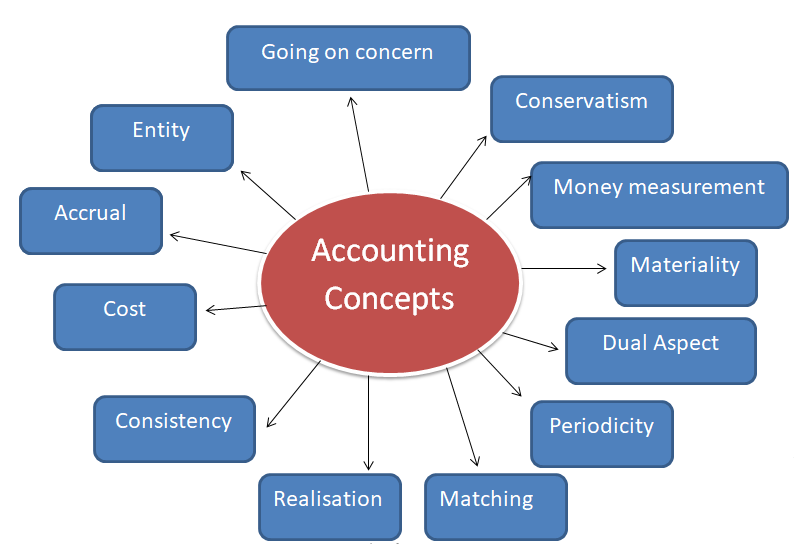

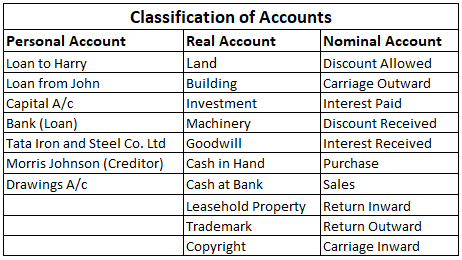

Option C Personal is wrong. This classification of ‘personal’ is a type of account as per traditional rules of accounting, not books of accounts

Option D Nominal is wrong. It is also a type of account as per the traditional rules of accounting.

See less