Non-current assets are long-term investments that are not easily converted into cash within an accounting year. They are required for the long term in the business. They have a useful life of more than an accounting year. Non-current assets can be fixed assets and intangible assets. Fixed assets areRead more

Non-current assets are long-term investments that are not easily converted into cash within an accounting year. They are required for the long term in the business. They have a useful life of more than an accounting year.

Non-current assets can be fixed assets and intangible assets. Fixed assets are tangible assets that can be seen and touched. Whereas, intangible assets are those assets that can not be seen and touched.

You can correlate examples of Non-Current Assets with tangible and intangible assets as mentioned below:

Land and building – They are fixed assets that will give long-term benefits and will be classified as noncurrent assets.

Plant and Machinery – They are tangible assets will give future benefits and are thus mentioned under noncurrent assets.

Office Equipment – They are tangible assets that will give future economic benefits to the company, and comes under noncurrent assets.

Vehicles – They are tangible assets that will give long-term benefits, and will be classified as noncurrent assets.

Furniture – They are also tangible assets that will give future benefits and are classified as non-current assets.

Trademarks – These are intangible assets that will not be easily converted into cash and will be classified as noncurrent assets.

Goodwill – They are intangible assets that can’t be easily converted into cash, and are classified as non-current assets.

Patents – They are intangible assets that will not be converted into cash within an accounting period, and are classified as non-current assets.

Copyrights – They are intangible assets that will not be converted into cash within an accounting period, and are classified as non-current assets.

Long-term Investments – They are long-term investments that will not be easily converted into cash within an accounting period and are classified as non-current assets.

Non-current Assets = Total Liabilities – Current Assets

Current Assets are the assets that will be converted into cash within an accounting year. They include cash, bank, debtors, etc.

|

BALANCE SHEET |

|||||

| LIABILITIES | ASSETS | ||||

| Capital | xxx | Fixed Assets | |||

| Reserves and Surplus | xxx | Land and Building | xxx | ||

| Vehicle | xxx | ||||

| Current Liabilities | Furniture | xxx | |||

| Accounts Payable | xxx | ||||

| Bank Overdraft | xxx | Intangible Assets | |||

| Outstanding Expenses | xxx | Goodwill | xxx | ||

| Trademarks | xxx | ||||

| Long-term Investments | xxx | ||||

| Current Assets | |||||

| Cash | xxx | ||||

| Debtors | xxx | ||||

| Others | xxx | ||||

| xxx | xxx |

See less

Generally, Assets are classified into two types. Non-Current Assets Current Assets Non-Current Asset Noncurrent assets are also known as Fixed assets. These assets are an organization's long-term investments that are not easily converted to cash or are not expected to become cash within an acRead more

Generally, Assets are classified into two types.

Non-Current Asset

Noncurrent assets are also known as Fixed assets. These assets are an organization’s long-term investments that are not easily converted to cash or are not expected to become cash within an accounting year.

In general terms, In accounting, fixed assets are assets that cannot be converted into cash immediately. They are primarily tangible assets used in production having a useful life of more than one accounting period. Unlike current assets or liquid assets, fixed assets are for the purpose of deriving long-term benefits.

Unlike other assets, fixed assets are written off differently as they provide long-term income. They are also called “long-lived assets” or “Property Plant & Equipment”.

Examples of Fixed Assets

Valuation of Fixed asset

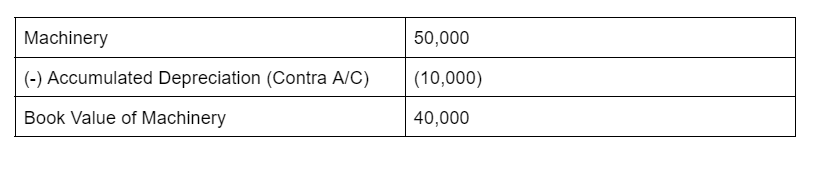

fixed assets are recorded at their net book value, which is the difference between the “historical cost of the asset” and “accumulated depreciation”.

“Net book value = Historical cost of the asset – Accumulated depreciation”

Example:

Hasley Co. purchases Furniture for their company at a price of 1,00,000. The Furniture has a constant depreciation of 10,000 per year. So, after 5 years, the net book value of the computer will be recorded as

1,00,000 – (5 x 10,000) = 50,000.

Therefore, the furniture value should be shown as 50,000 on the balance sheet.

Presentation in the Balance Sheet

Both current assets and non-current assets are shown on the asset side(Right side) of the balance sheet.

Difference between Current Asset and Non-Current Asset

Current assets are the resources held for a short period of time and are mainly used for trading purposes whereas Fixed assets are assets that last for a long time and are acquired for continuous use by an entity.

The purpose to spend on fixed assets is to generate income over the long term and the purpose of the current assets is to spend on fixed assets to generate income over the long term.

At the time of the sale of fixed assets, there is a capital gain or capital loss but at the time of the sale of current assets, there is an operating gain or operating loss.

The main difference between the fixed asset and current asset is, although both are shown in the balance sheet fixed assets are depreciated every year and it is valued by (the cost of the asset – depreciation) and current asset is valued as per their current market value or cost value, whichever is lower.

See less