The correct option is option A. Journal is the book of original entry. It is from the journal, the postings in the ledgers are made. As it is the journal first to record the transactions, it is called the book of original entry. It is from the journal, the postings in the ledgers are made. Ledgers aRead more

The correct option is option A.

Journal is the book of original entry. It is from the journal, the postings in the ledgers are made. As it is the journal first to record the transactions, it is called the book of original entry.

It is from the journal, the postings in the ledgers are made. Ledgers are called the books of principal book of entry.

Option B Duplicate is wrong as there is no such thing as the book of duplicate entry in financial accounting. Journal entries are the first-hand record of business transactions. Hence, it cannot be the book of duplicate entries.

Option C Personal is wrong. This classification of ‘personal’ is a type of account as per traditional rules of accounting, not books of accounts

Option D Nominal is wrong. It is also a type of account as per the traditional rules of accounting.

See less

Interest on capital Interest on capital is interest payable to the owner/partners for providing a firm with the required capital to commence the business. Normally, it is charged for a full year on the balance of capital at the beginning of the year unless some fresh capital is introduced during theRead more

Interest on capital

Interest on capital is interest payable to the owner/partners for providing a firm with the required capital to commence the business. Normally, it is charged for a full year on the balance of capital at the beginning of the year unless some fresh capital is introduced during the year.

When the business firm faces a loss, the interest on capital will not be provided. It is permitted only when the business earns a profit. Such payment of interest is generally observed in partnership firms. It is provided before the division of profits among the partners in a partnership firm.

If an owner or partner introduces additional capital to the business then, it is also taken into account for providing interest on capital.

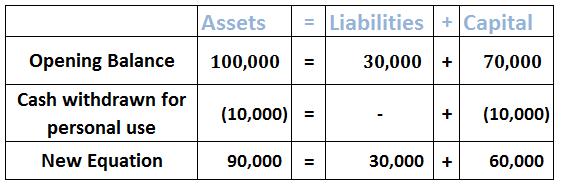

Interest on capital in the accounting equations

Interest on capital is an expense from a business point of view, as it is payable to the owner and is not paid in cash. Being an income from the owner’s point of view, it is added to his capital account. And being a business expense from the business point of view, it is therefore deducted from the capital.

Hence, it further doesn’t create any change in the accounting equation mathematically but it’s mandatory to be shown as it plays a vital role in the profit and loss a/c and even helps the business save tax.

Example

Z started a business with cash and stock of ₹45,000 and ₹5,000 respectively. Further, he received interest on capital of ₹1,000. The accounting equation for the following transactions will be as follows:

Accounting Equation

See less