Meaning of Opening Stock Opening stock is the inventory or stock of goods that are available at the beginning of the new accounting year carried down from the previous year's closing stock which is recorded in the books of accounts. In simple words, Opening stock is the goods/quantity/products thatRead more

Meaning of Opening Stock

Opening stock is the inventory or stock of goods that are available at the beginning of the new accounting year carried down from the previous year’s closing stock which is recorded in the books of accounts.

- In simple words, Opening stock is the goods/quantity/products that are held by a business at the beginning of a new accounting period and it is the closing stock of the preceding year carried down.

- Similarly, the closing stock is the number of unsold goods that remain with the business at the end of an accounting year and is further carried down to the next year as Opening Stock.

Formula

There are 3 main formulas used for Opening Stock’s calculation. They are-

- For manufacturing companies

Opening Stock = Raw Material Cost + Work in Progress + Finished Goods Cost

- When only Sales, GP, COGS, and Closing Stock are given

Opening Stock = Sales – Gross Profit – Cost of Goods Sold + Closing Stock

- You can use this one when only limited information is provided

Opening Stock = COGS + Closing Inventory – Purchases

Types of Opening Stock

There are three types of Opening Stock or we may also say that Opening Stock consists of these 3 elements. They are-

- Raw Materials- These are the unprocessed goods held by a business that is yet to be converted into finished goods.

- Work in Progress- These include the goods that are in process but not converted into finished goods.

- Finished Goods- These are the goods/products that have completed the manufacturing process but have not yet been sold.

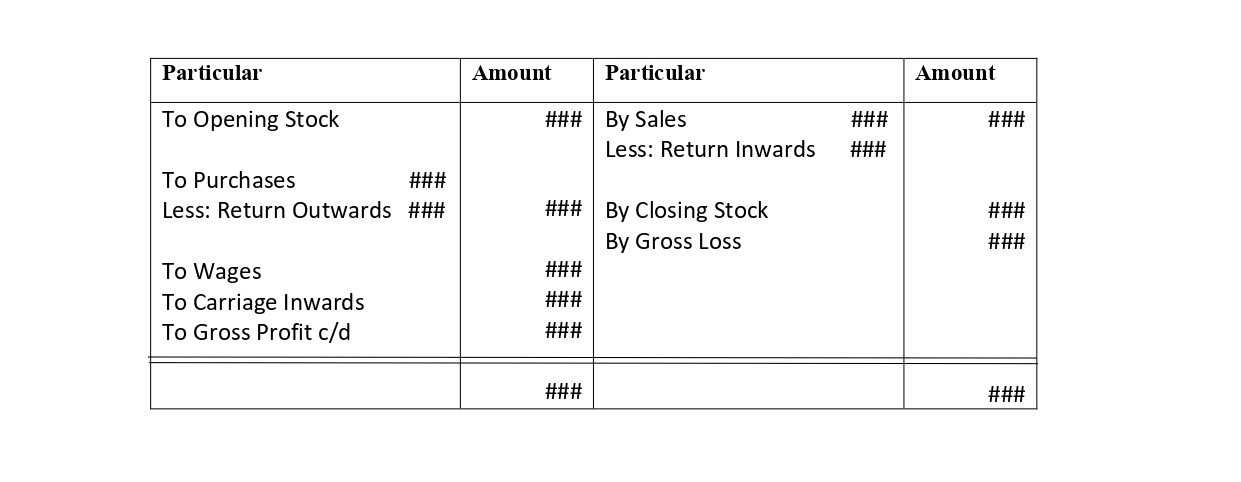

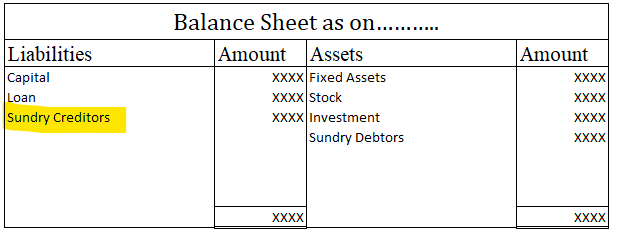

Opening Stock in Final Accounts

Opening stock is a part of the Trading Account while preparing the Final Accounts. And this is how it is posted in the Trading A/c.

Trading A/c (for the year ending…)

Example of Opening Stock

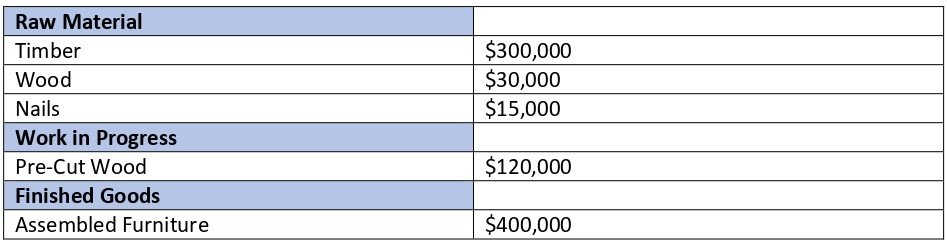

Example

IKEA, the biggest Furniture manufacturer collected this data on April 1, 2021,

Timber – $300,000

Wood – $30,000

Nails – $15,000

Pre-cut Wood – $120,000

Assembled Furniture – $400,000

Now, adding them (as said earlier, Opening stock is a combination of these three.)

Opening Stock (Raw Material + Work in Progress + Finished Goods) = $865,000

Therefore, that’s how one can calculate Opening Stock.

See less

Yes, I agree with your statement that accounting information should be comparable. Comparability is one of the qualitative characteristics of accounting information. It means that users should be able to compare a company's financial statements across time and across other companies. Comparability oRead more

Yes, I agree with your statement that accounting information should be comparable.

Comparability is one of the qualitative characteristics of accounting information. It means that users should be able to compare a company’s financial statements across time and across other companies.

Comparability of financial statements is crucial due to the following reasons:

1. Intra-Firm Comparison:

Comparison of financial statements of two or more periods of the same firm is known as an intra-firm comparison.

Comparability of accounting information enables the users to analyze the financial statements of a business over a period of time. It helps them to monitor whether the firm’s financial performance has improved over time.

The intra-firm analysis is also known as Time Series Analysis or Trend Analysis.

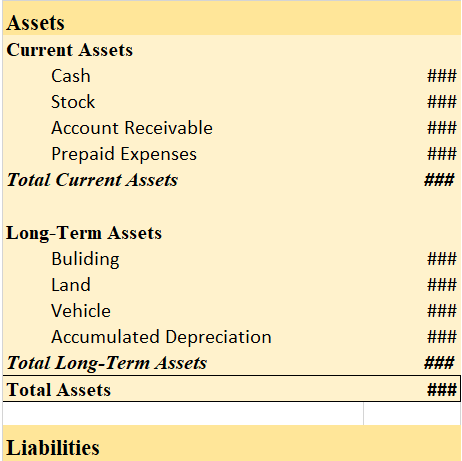

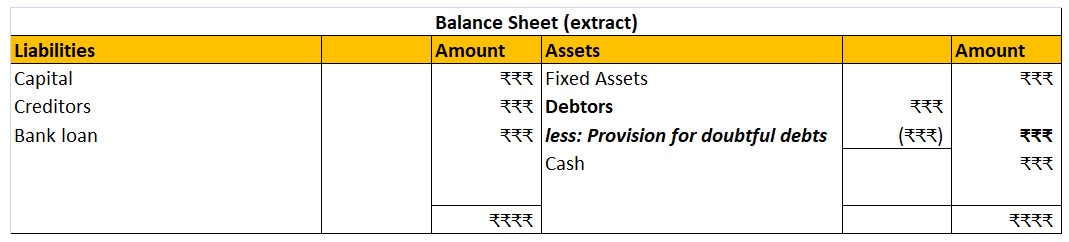

To understand intra-firm analysis, I have provided an extract of the balance sheet of ABC Ltd. for two accounting periods.

2. Inter-Firm Comparison:

Comparison of financial statements of two or more firms is known as an inter-firm comparison.

Inter-firm comparison helps in analyzing the financial performance of two or more competing firms in an industry. It enables the firm to know its position in the market in comparison to its competitors.

Inter-firm comparison is also known as Cross-sectional Analysis.

I’ve provided the balance sheets of Co. A and Co.B to make an inter-firm comparison.

Here is a piece of bonus information for you,

Sector Analysis – it refers to the assessment of economical and financial conditions of a given sector of a company/industry/economy. It involves the analysis of the size, demographic, pricing, competitive, and other economic dimensions of a sector of the company/industry/economy.

One more important thing to note here is that comparability can only be achieved when the firms are consistent in the accounting principles and standards they adopt. The accounting policies and standards must be consistent across different periods of the same firm and across different firms in an industry.

See less