Interest on capital Interest on capital is interest payable to the owner/partners for providing a firm with the required capital to commence the business. Normally, it is charged for a full year on the balance of capital at the beginning of the year unless some fresh capital is introduced during theRead more

Interest on capital

Interest on capital is interest payable to the owner/partners for providing a firm with the required capital to commence the business. Normally, it is charged for a full year on the balance of capital at the beginning of the year unless some fresh capital is introduced during the year.

When the business firm faces a loss, the interest on capital will not be provided. It is permitted only when the business earns a profit. Such payment of interest is generally observed in partnership firms. It is provided before the division of profits among the partners in a partnership firm.

If an owner or partner introduces additional capital to the business then, it is also taken into account for providing interest on capital.

Interest on capital in the accounting equations

Interest on capital is an expense from a business point of view, as it is payable to the owner and is not paid in cash. Being an income from the owner’s point of view, it is added to his capital account. And being a business expense from the business point of view, it is therefore deducted from the capital.

Hence, it further doesn’t create any change in the accounting equation mathematically but it’s mandatory to be shown as it plays a vital role in the profit and loss a/c and even helps the business save tax.

Example

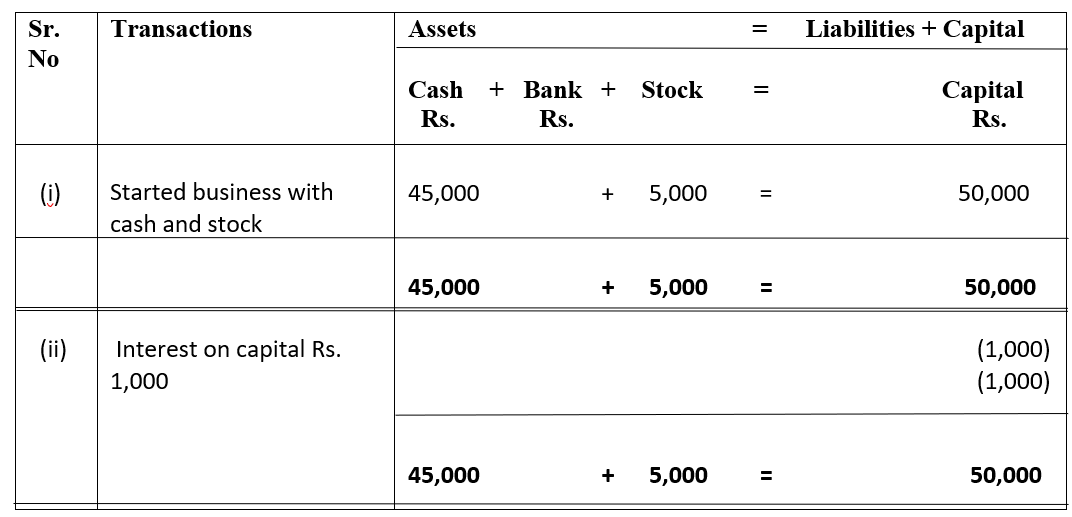

Z started a business with cash and stock of ₹45,000 and ₹5,000 respectively. Further, he received interest on capital of ₹1,000. The accounting equation for the following transactions will be as follows:

Accounting Equation

See less

The accounting equation represents the relationship between assets, capital, and liabilities of a business. It follows the concept of the double-entry bookkeeping system where every debit has an equal credit. The rules state that at any time a business’ assets should equal liabilities. This is alsoRead more

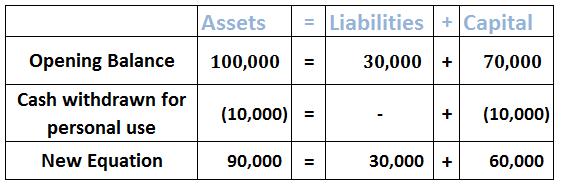

The accounting equation represents the relationship between assets, capital, and liabilities of a business. It follows the concept of the double-entry bookkeeping system where every debit has an equal credit. The rules state that at any time a business’ assets should equal liabilities. This is also known as the statement of financial position equation.

The accounting equation can be shown as follows:

Assets = Capital + Liabilities

For example, Liza starts a business by investing $3,000 as cash. In accounting terms, business and owner are separate and so business owes money to Liza as capital.

In this example,

Capital invested = $3,000

Cash (Asset) = $3,000

If Liza puts this into the accounting equation, it will be shown as:

Further, Liza purchases a market stall from Ben and the cost of the stall was $1,800. She purchases flowers from the wholesale market at a cost of $700. Now she is left with $500 cash out of the original $3,000.

The state of her business has now changed and can be shown as follows: