I mean to ask is it real, nominal, or personal and why?

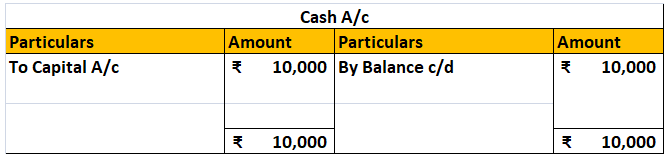

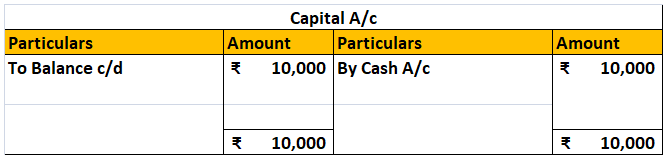

Liabilities are obligations which a business owes to external or internal parties.As per the accounting equation liabilities are equal to the difference between assets and capital. Total Outside Liabilities in relation to the Borrower can be all secured and unsecured loans, including current liabilRead more

Liabilities are obligations which a business owes to external or internal parties.As per the accounting equation liabilities are equal to the difference between assets and capital.

Total Outside Liabilities in relation to the Borrower can be all secured and unsecured loans, including current liabilities of the Borrower.

External Liability or outside liability is an obligation which a business has to pay back to external parties i.e. lenders, vendors, government, etc. Payable to Sundry creditors for the supply of any goods for the business or payable to any contractors for receiving any services or payable to the Govt. or other departments for any statutory payments like taxes or other levies. All these liabilities are known as an external liability to the business and are shown on the liability side of the Balance sheet after charging into the profit & loss account of that period.

Where, Internal Liability – All obligations which a business has to pay back to internal parties such as promoters, employees, etc. are termed as internal liabilities. Example – Capital, Salaries, Accumulated profits, etc.

Example – Borrowings, Creditors, Taxes, etc.

Where, 1) Person A takes a loan from person B (person not associated with the company), person B is an external liability to person A.

2) Person A has a tax liability of Rs.1000, here the government is an external liability to whom A has to pay the liability amount.

3) Person A got goods on credit from person C for 60 days, C is an external liability to A, which A has to pay within the time period.

See less

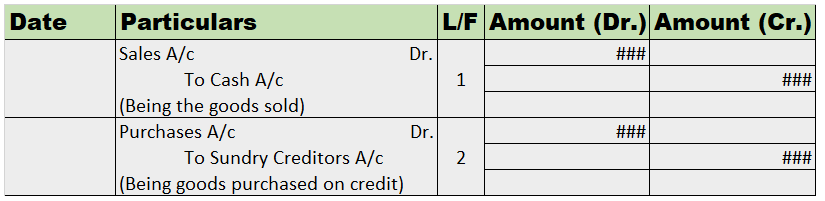

The correct option is option A. Journal is the book of original entry. It is from the journal, the postings in the ledgers are made. As it is the journal first to record the transactions, it is called the book of original entry. It is from the journal, the postings in the ledgers are made. Ledgers aRead more

The correct option is option A.

Journal is the book of original entry. It is from the journal, the postings in the ledgers are made. As it is the journal first to record the transactions, it is called the book of original entry.

It is from the journal, the postings in the ledgers are made. Ledgers are called the books of principal book of entry.

Option B Duplicate is wrong as there is no such thing as the book of duplicate entry in financial accounting. Journal entries are the first-hand record of business transactions. Hence, it cannot be the book of duplicate entries.

Option C Personal is wrong. This classification of ‘personal’ is a type of account as per traditional rules of accounting, not books of accounts

Option D Nominal is wrong. It is also a type of account as per the traditional rules of accounting.

See less