Interest on capital Interest on capital is interest payable to the owner/partners for providing a firm with the required capital to commence the business. Normally, it is charged for a full year on the balance of capital at the beginning of the year unless some fresh capital is introduced during theRead more

Interest on capital

Interest on capital is interest payable to the owner/partners for providing a firm with the required capital to commence the business. Normally, it is charged for a full year on the balance of capital at the beginning of the year unless some fresh capital is introduced during the year.

When the business firm faces a loss, the interest on capital will not be provided. It is permitted only when the business earns a profit. Such payment of interest is generally observed in partnership firms. It is provided before the division of profits among the partners in a partnership firm.

If an owner or partner introduces additional capital to the business then, it is also taken into account for providing interest on capital.

Interest on capital in the accounting equations

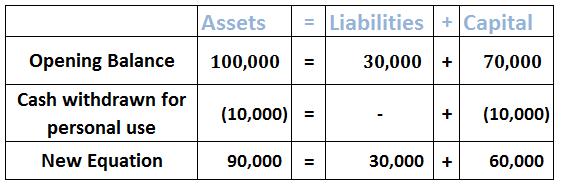

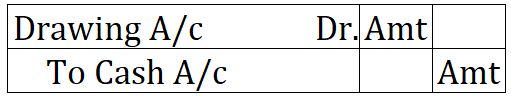

Interest on capital is an expense from a business point of view, as it is payable to the owner and is not paid in cash. Being an income from the owner’s point of view, it is added to his capital account. And being a business expense from the business point of view, it is therefore deducted from the capital.

Hence, it further doesn’t create any change in the accounting equation mathematically but it’s mandatory to be shown as it plays a vital role in the profit and loss a/c and even helps the business save tax.

Example

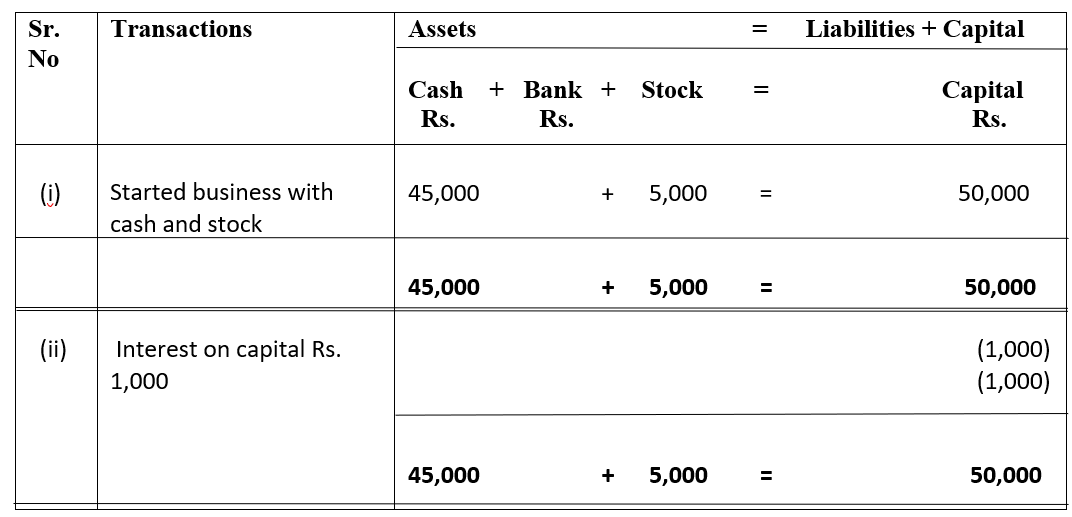

Z started a business with cash and stock of ₹45,000 and ₹5,000 respectively. Further, he received interest on capital of ₹1,000. The accounting equation for the following transactions will be as follows:

Accounting Equation

See less

Let the business in our example be X Trading. The 15 transactions are as follows: 1st April - X Trading started its business with Rs. 10,000 cash and furniture of Rs. 5,000. 5th April - Purchased 1,000 units of goods for Rs. 1,000 in cash from Ram. 10th April – Bought stationery for Rs. 100 in cash.Read more

Let the business in our example be X Trading. The 15 transactions are as follows:

We will prepare the journal, ledgers and the trial balance from the above transactions.

Journal

Journal is known as the book of primary entry or book of original entry. It is because every transaction is recorded in form of journal entries in the journal. Every journal entry affects at least two accounts (dual effect). A transaction has to be a monetary transaction otherwise it cannot be recorded as a journal entry.

The procedure of recording transactions as journal entries is simple if we follow the modern rules of accounting.

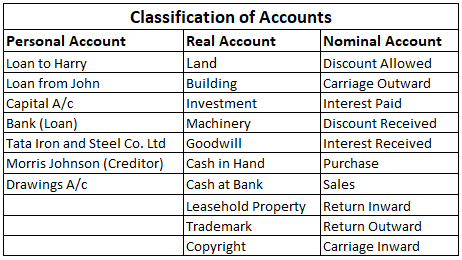

So first we have to identify which and what type of account does a transaction affect. The types of accounts are:

Ledger

Ledgers are known as the books of principal entry or book of final entry. All the journal entries recorded in the journal are posted to the ledgers. A Ledger is where the entries related to a particular account are recorded. For example, all the transactions related to salary will be recorded in the salary account ledger.

It is very important to prepare the ledger to arrive at the balance of each account in the books of concern so that it can prepare its trial balance.

The procedure of posting journal entries in the ledger account is done is as follows:

The ledgers are as follows:

Trial Balance

The trial balance is not a part of the books of accounts. It is just a statement prepared to check the arithmetical accuracy of the books of the accounts. It also helps to know about the omission and posting mistakes. It is prepared after the ledger accounts have been drawn and their balances have been ascertained.

The balance of all the ledger accounts is posted on either side of the trial balance. Debit balance of the account on the debit side and credit balance of the account on the credit side.

Also, the closing stock from the financial statements of the previous year is posted on the debit side of the trial balance as opening stock to account for the stock with the business at the beginning of the financial year.

Following is the trial balance of X trading:

See less