Definition Goodwill is an intangible asset that places an enterprise in an advantageous position due to which the enterprise is able to earn higher profits without extra effort. For example, if the enterprise has rendered good services to its customers, it will be satisfied with the quality of its sRead more

Definition

Goodwill is an intangible asset that places an enterprise in an advantageous position due to which the enterprise is able to earn higher profits without extra effort.

For example, if the enterprise has rendered good services to its customers, it will be satisfied with the quality of its services, which will bring them back to the enterprise.

Features

The value of goodwill is a subjective assessment of the valuer.

• It helps in earning higher profits.

• It is an intangible asset.

• It is an attractive force that brings in customers to the business.

• It has realizable value when the business is sold out.

Need for goodwill valuation

The need for the valuation of goodwill arises in the following circumstances :

• When there is a change in profit sharing ratio.

• When a new partner is admitted.

• When partner retires or dies.

• When a partnership firm is sold as a going concern.

• When two or more firms amalgamate.

Classification of goodwill

Goodwill is classified into two categories:

• Purchased goodwill

• Self-generated goodwill

Purchased goodwill :

Is that goodwill acquired by the firm for consideration whether paid or kind?

For example: when a business is purchased and purchase consideration is more than the value of net assets the difference amount is the value of purchase goodwill.

Self-generated goodwill

It is that goodwill that is not purchased for consideration but is earned by the management’s efforts.

It is an internally generated goodwill that arises from a number of factors ( such as favorable location, efficient management, good quality of products, etc ) that a running business possesses due to which it is able to earn higher profits.

Methods of valuation

1. Average profit method

2. Super profit method

3. Capitalization method

Average profit method: goodwill under the average profit method can be calculated either by :

• Simple average profit method or

• Weighted average profit method

See less

Definition Bad debts are a debt owed to an enterprise that is considered to be irrecoverable or we can say that it is owed to the business that is written off because it is irrecoverable. Bad debts will be treated in the following ways : On the debit side of the profit and loss account. In the curreRead more

Definition

Bad debts are a debt owed to an enterprise that is considered to be irrecoverable or we can say that it is owed to the business that is written off because it is irrecoverable.

Bad debts will be treated in the following ways :

On the debit side of the profit and loss account.

In the current assets side of the balance sheet, these are deducted from sundry debtors.

For example loans from banks are declared as bad debt, sales made on credit and amounts not received from customers, etc.

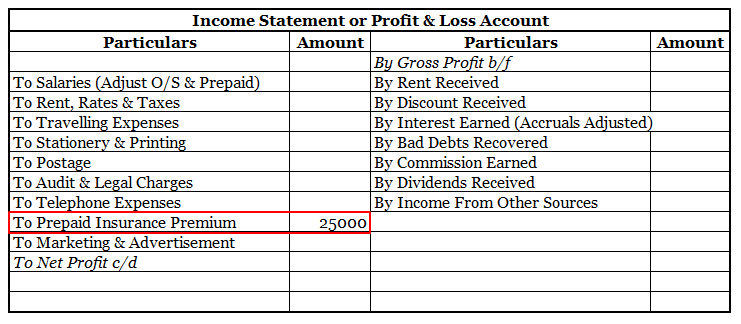

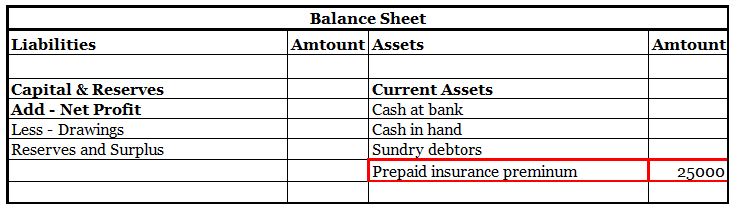

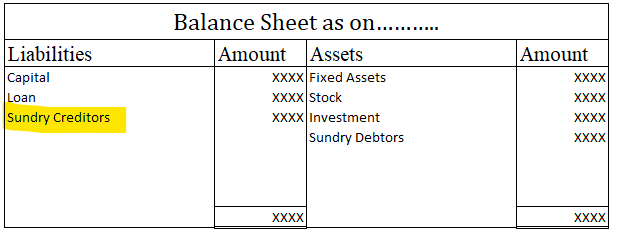

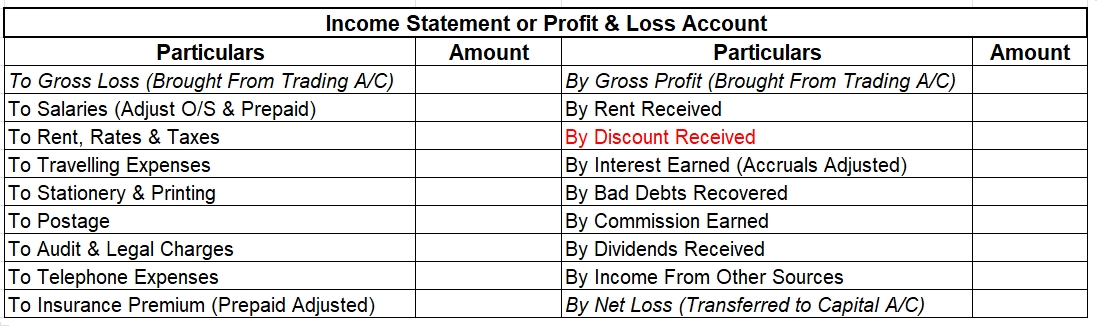

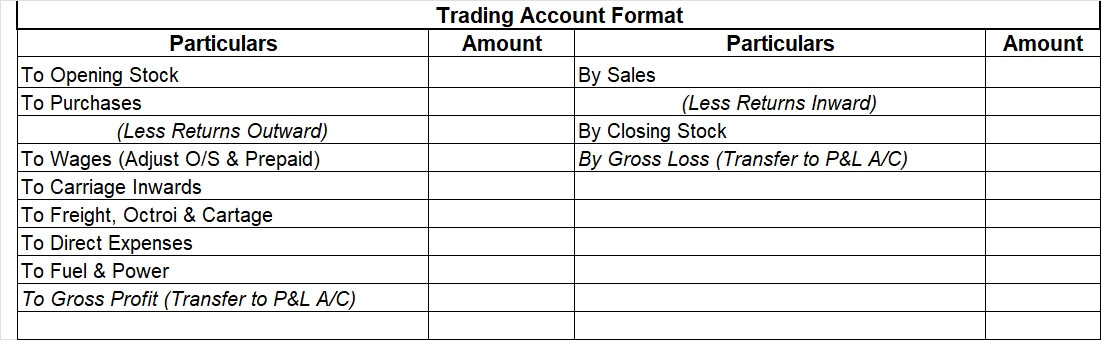

Now I will show you an extract of the profit and loss account and balance sheet

Current assets are defined as cash and other assets that are expected to be converted into cash or consumed in the production of goods or the rendering of services in the ordinary course of business.

For example, debtors exist to convert them into cash i.e., receive the amount from them, bills receivable exist again for receiving cash against it, etc.

Current liabilities are defined as liabilities that are payable normally within 12 months from the end of the accounting period or in other words which fall due for payment in a relatively short period.

For example bills payable, short-term loans, etc.

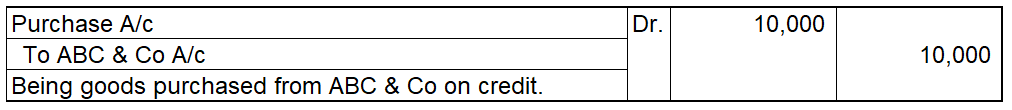

Accounting treatment

Now let me try to explain to you the accounting treatment for bad debts which is as follows :

Reasons for bad debts

There are several reasons why businesses may have bad debts some of them are as follows:-

Accounting methods

There are two methods for accounting for bad debts which are mentioned below:-

Related terms

So there are a few related terms whose meanings you should know

See less