IND AS 102: ‘Share-based payments’ in its actual text is considerably lengthy and very detailed. The objective of my answer is to provide a basic understanding of what IND AS 102 is all about. Further reading of the actual text is suggested for a more detailed understanding. IND AS 102 is the IndiaRead more

IND AS 102: ‘Share-based payments’ in its actual text is considerably lengthy and very detailed.

The objective of my answer is to provide a basic understanding of what IND AS 102 is all about. Further reading of the actual text is suggested for a more detailed understanding.

IND AS 102 is the India specific version of IFRS 2 which deals with the accounting of Share-based payments. IND AS 102 and IFRS are almost similar.

It deals with the financial reporting of the share-based payment transactions entered into by an enterprise in the following cases:

- Transactions with suppliers of goods or services that are settled by share-based payments.

- Transactions with employees of the enterprise in nature of Employee Stock Option Plan.

Share-based payments are of three types:

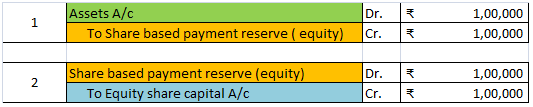

- Equity settled share-based payment: It is a transaction in which an entity receives goods or services from the supplier of those goods and services (including an employee) and settles it by issuing equity instruments of the entity or its parent entity.

Example: A business acquires an asset for Rs. 1,00,000 and makes payment by the issue of its equity shares.

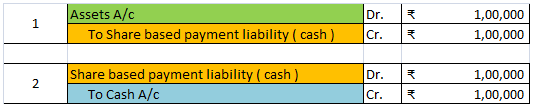

- Cash settled share-based payment: It is a transaction in which an entity incurs a liability and settles the transaction by paying cash or other assets based on the price of the equity instruments of the entity or group’s entity.

Example: A business acquires an asset for Rs. 1,00,000 and makes payment in amounts of case based upon its share price.

- Share-based payment transaction with cash alternatives:- In this case, either the entity or the counterparty has the option of settling the transaction either through with issue of equity or payment of cash by incurring liability.

Things that are not under the scope of IND AS-102

- Transactions with parties who are acting in the capacity of shareholders.

- Where a business acquires net assets of a business in case of amalgamation, joint venture etc and issues shares as consideration.

Recognition

In a share-based transaction,

- goods and services are to be recognised when the goods or services are received by the entity.

- Also, the corresponding increase in equity in equity-settled transactions or liability in the cash-settled transactions is to be recognised.

Measurement

The amount at a share-based transaction is to be recorded depending upon the type of counterparty:

- Non-employee counter-party: The transaction will be measured based on the fair value of the goods or services received on the date when the goods or services are received.

- Employee counter-party: The transaction is to be recorded at the fair value of the equity instruments as on the grant date because the services rendered by the employee cannot be recorded reliably.

I hope this is enough for a basic understanding of the IND AS 102.

See less

Introduction Ind AS 110 stands for Indian Accounting Standard 110. It deals with principles of preparation and presentation of consolidated financial statements when an entity controls one or more other entities. It is often seen that an entity owns and controls one or more entities. Like a parent cRead more

Introduction

Ind AS 110 stands for Indian Accounting Standard 110. It deals with principles of preparation and presentation of consolidated financial statements when an entity controls one or more other entities.

It is often seen that an entity owns and controls one or more entities. Like a parent company have many subsidiaries. For example, Alphabet is the parent company of Google. The parent and its subsidiaries prepare their financial statements separately to present to the true and fair view of their business.

Consolidated financial statements are the financial statements of the whole group i.e. taking the parent and its subsidiaries together. It reports the assets, liabilities, equity, income and expenses of the whole group as a single economic entity.

It helps the stakeholders to know the overall performance and positions of assets and liabilities of the whole group.

When to prepare Consolidated Financial Statements(CFS)

The requirement for the preparation of CFS depends on the control model provided by Ind AS 110. As per this model, an investor controls an investee when:

If both the conditions are fulfilled, then it can be said that the investor controls the investee and the investor has to prepare the consolidated financial statements with its investee. Every type of investor-investee relationship is judged as per Ind AS 110.

Exposure or right to variable returns

Variable returns mean no fixed returns and can vary as per the performance of the investee. Such returns can be both positive and negative. These returns include not only return on investment but also the benefits or expenses to which the investor is entitled to or has to bear respectively. Such returns are:

It is not required by Ind AS 110 for an investor to be exposed or have the right to all such variable returns, but there should be significant exposure or right.

Power to affect the variable returns from investee

An investor has power over an investee if it has existing rights that give it direct ability to affect the relevant activities of the investee

An investor generally has many rights over the investee. These rights are of two types:

However, the investor may other substantive rights like power to appoint or remove the board of directors etc.

These rights should not only exist with investors but the investor should also have the ability to exercise such rights.

Scope of Ind AS 110

The investee can be any type of entity, the structure of the investee does not matter whether it is a partnership firm, LLP, company or any Special Purpose Entity (SPE).

If any investor control one or more other entities it will be called parent entity and it will present the consolidated financial statements.

Exemptions

If any parent entity fulfils any of these conditions, then the presentation of consolidated financial statements is not necessary:

- It is an investment entity.

- Its debt or equity securities are not listed on any recognized stock exchange or any other public market.

- It is a wholly-owned or partially owned subsidiary of another entity and all of its owners have been informed about and do not have any objections to the parent not preparing the consolidated financial statements.

- Its ultimate or any intermediate parent entity has prepared consolidated financial statements for the whole group.

- It did not file or is in process of filing its financial statement with the concerned securities commission or any other regulatory body for issuing its securities in the public market.

See less