To understand the difference in Revenue recognition under IFRS and GAAP , it is important to understand what are IFRS and GAAP. Both of these are accounting standards accepted globally. These are discussed below: What is IFRS? IFRS is a set of accounting standards developed by the International AccRead more

To understand the difference in Revenue recognition under IFRS and GAAP , it is important to understand what are IFRS and GAAP. Both of these are accounting standards accepted globally. These are discussed below:

What is IFRS?

IFRS is a set of accounting standards developed by the International Accounting Standards Board. These standards are globally accepted accounting standards.

They were developed and implemented with the objective of providing a consistent, transparent and reliable framework for the presentation and reporting of financial statements.

IFRS ensure uniformity and this helps in comparability of financial statements across the companies of different countries.

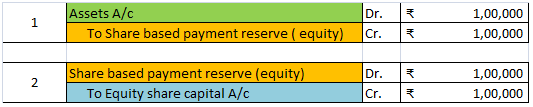

Some examples of IFRS Standards are : IFRS 2 – Share based payments, IFRS 9 – Financial Instruments, IFRS 16 – Leases, etc.

What is GAAP?

GAAP stands for Generally Accepted Accounting Principles. GAAP is primarily used in the USA. These are a set of accounting principles, rules and procedures which are crucial for providing consistency and transparency in the presentation and reporting of financial statements.

Some examples of GAAP Standards are: ASC 606: Revenue Recognition, ASC 842: Leases, ASC 740: Income Taxes, etc.

Difference in Revenue Recognition under IFRS and GAAP

Though both of these standards have the main goal of promoting consistency and uniformity, there are certain differences in the Revenue Recognition under IFRS and GAAP.

This is because of the fact that the nature of IFRS and GAAP is different as IFRS is more principle- based and GAAP is rule based.

See less

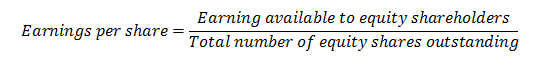

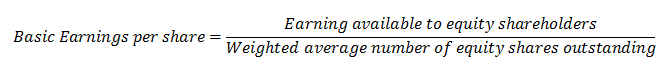

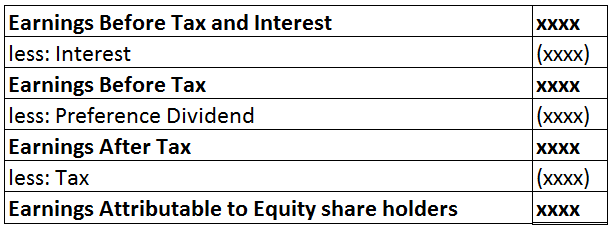

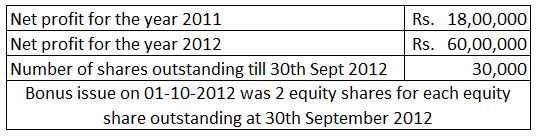

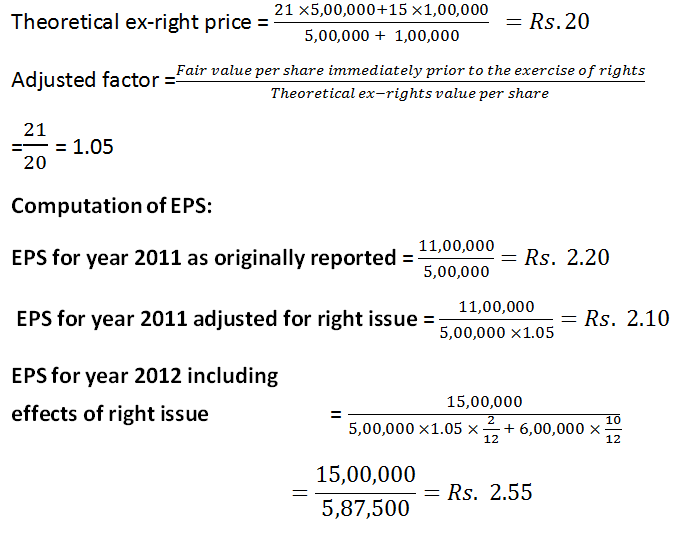

Earnings per share indicate the profit-generating capability of an enterprise and potential investors often compare the EPS of different companies to choose the best investment alternative.

Earnings per share indicate the profit-generating capability of an enterprise and potential investors often compare the EPS of different companies to choose the best investment alternative.

To understand the accounting treatment of fixed assets under IFRS let us first understand what fixed assets are. What are Fixed Assets? Fixed assets are the assets that are purchased for long-term use by a business and not for resale. Some examples of fixed assets are land, buildings, machinery, furRead more

To understand the accounting treatment of fixed assets under IFRS let us first understand what fixed assets are.

What are Fixed Assets?

Fixed assets are the assets that are purchased for long-term use by a business and not for resale. Some examples of fixed assets are land, buildings, machinery, furniture and fixtures, etc.

Fixed assets are essential for the smooth operations of the business. It often shows the value of the business. The value of fixed assets usually decreases with time, obsolescence, damage, etc.

As per IAS-16 Property, Plant and Equipment, an asset is identified as a fixed asset if it satisfies the following conditions:

What is IFRS?

IFRS stands for International Financial Reporting Standards. It provides a set of standards to be followed globally by all companies to ensure transparency, comparability, and consistency.

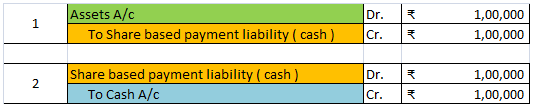

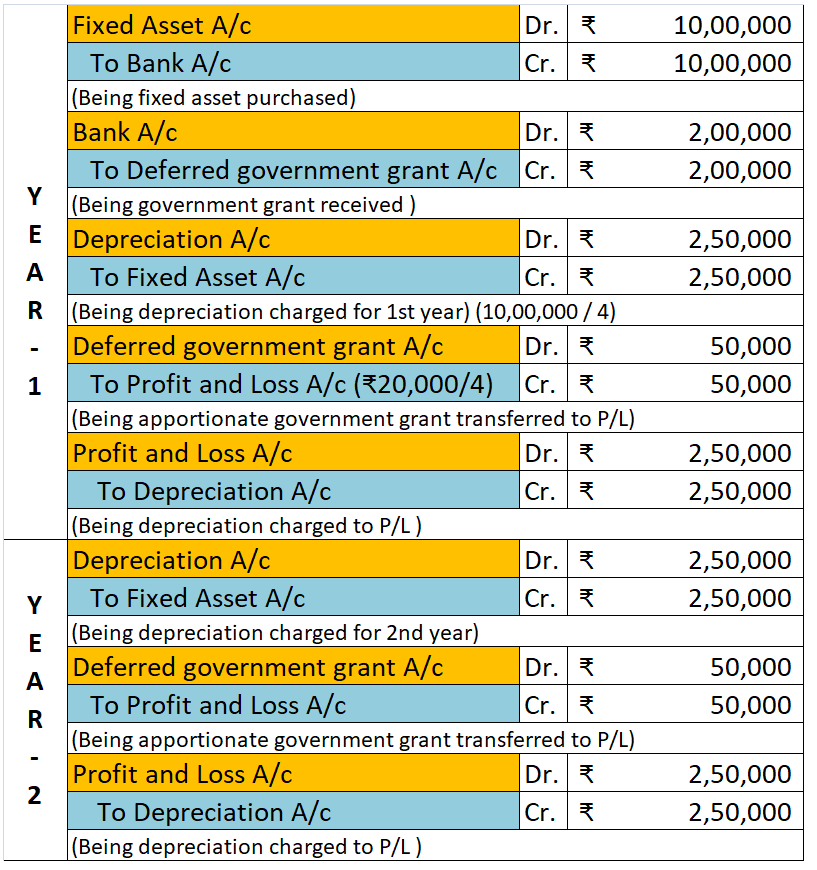

What is the accounting treatment of fixed assets under IFRS?

Under IFRS, the first step is to measure the value of the fixed assets on cost. The cost of the fixed assets includes the following:

After this step, the entity may choose any one of the following two primary methods:

For example, a company bought a piece of machinery for 60,000. 5,000 were spent on its installation. It has a useful life of 10 years. The machinery would be depreciated over its useful life of 10 years based on its cost which is 65,000.

2. Revaluation model: As per this model, the fixed assets are valued on their fair value, as on the revaluation date. The amount of depreciation and impairment losses is subtracted from the fair value.

If the value of an asset increases, the gain goes to equity (revaluation surplus) unless it can be set off with a past loss recorded in profit or loss.

On the other hand, if the value decreases, the loss goes to profit or loss unless it offsets a past surplus in equity.

For example, a building was purchased for 100,000. On the revaluation date, the fair value of this building was 150,000. Hence, there is a revaluation surplus of 50,000 which shall be credited to the revaluation surplus account.

Impact on Financial Statements

Fixed assets are shown on the Assets side of the Balance Sheet.

Conclusion

From the above discussion, it may be concluded that:

See less