Before answering the question let’s understand what a government grant is. Meaning of government grants Government grants are the assistance provided by the government in cash or kind to any enterprise for any past or future compliance. This assistance can be subsidies, cash incentives, duty drawbacRead more

Before answering the question let’s understand what a government grant is.

Meaning of government grants

Government grants are the assistance provided by the government in cash or kind to any enterprise for any past or future compliance. This assistance can be subsidies, cash incentives, duty drawback, or assets provided at concessional rate or at no cost etc.

These grants when provided have some rules and conditions attached to them. If such conditions are not fulfilled or rules are violated, the grant becomes refundable to the government.

Treatment

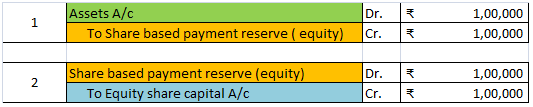

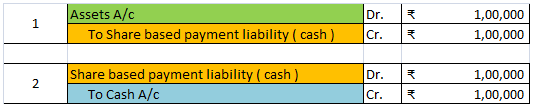

AS-12 ‘Government Grant’ provides two approaches for the treatment of government grants in the books of accounts of an enterprise:

- Income approach: Under this approach, the grant is treated as income and taken to profit and loss A/c in one or more accounting periods.

For example, X Ltd purchase an asset for ₹ 10,00,000 and the government provided a grant of ₹2,00,000 to X Ltd. The useful life of the asset is 4 years and the residual value is nil.

Now there are two methods to treat this grant as income.

Method – 1: The grant amount will be deducted from the asset’s value. This will result in a decreased amount of depreciation. This is an indirect way to recognize government grants as income.

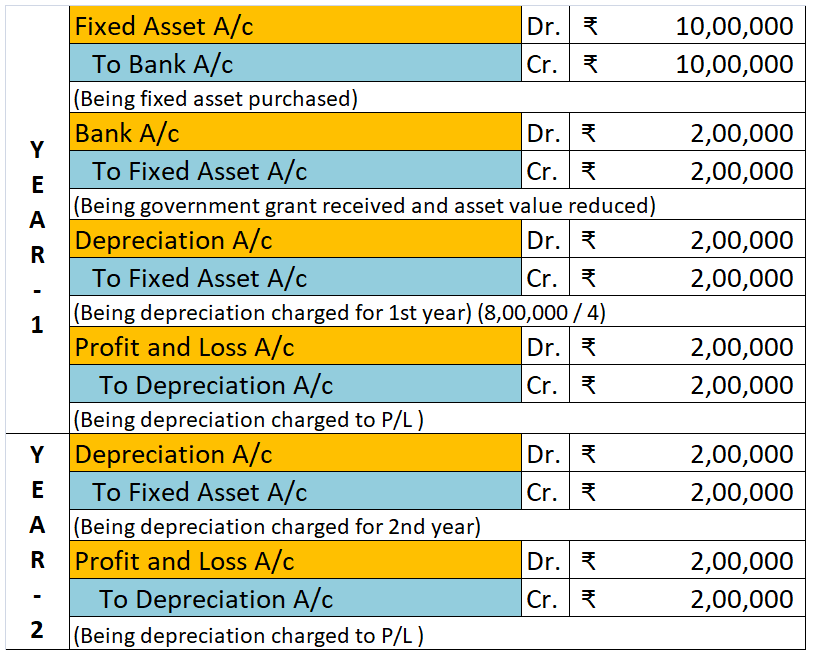

The journal entries are as follows: (Method-1)

The journal entries for the 3rd and the 4th years will be the same as of 2nd year.

In absence of a government grant, the annual depreciation would have been ₹2,50,000 (₹10,00,000 / 4). Hence, due to the grant, the profit will be 50,000 more for the 4 consecutive accounting years.

Method – 2: The grant amount is credited to a special account called the ‘deferred government grant’ account. Over the useful life of the asset, the grant will be credited to the profit and loss account in equal instalments. This is a direct way to recognize government grants as income.

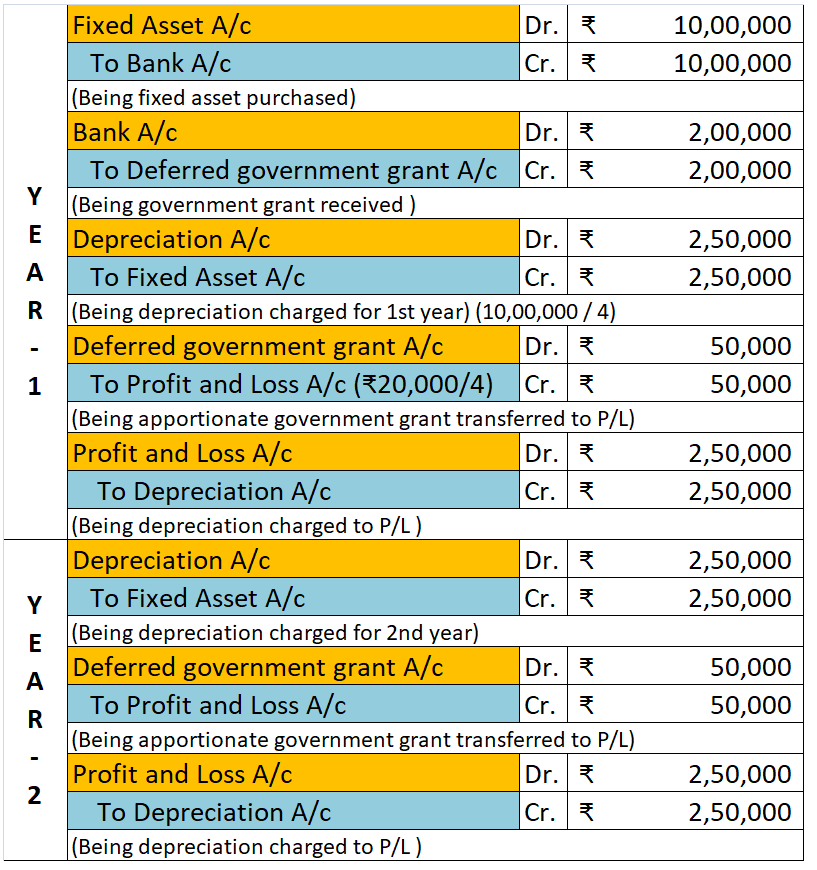

The journal entries are as follows: (Method-2)

The journal entries for the 3rd and the 4th years will be the same as of 2nd year.

- Capital approach: Under this approach, the grant is treated as part of the shareholders’ funds (as capital reserve)

When any grant is given is in nature of promoter’s contribution i.e. as a percentage of total investment to be done by an enterprise, and then such grant received from government will be treated as part of shareholder’s funds.

The grant amount will be transferred to the capital reserve account and it will be treated neither as deferred income nor to be distributed as a dividend.

Example: ABC Ltd has set up its business in a designated backward area which entitles the company to receive from the government a subsidy of 20% of total investment. ABC Ltd fulfilled all the conditions associated with the scheme and received ₹20 crores toward its total investment of ₹100 crores.

This ₹20 crore will be transferred to the capital reserve account.

Special case: If the grant is received in relation to a non-depreciable asset like land, then the entire amount of the grant will be recognized in the profit and loss account in the same year.

Treatment of non-monetary government grant

When a government grant is in the form of non-monetary assets like land or other resources at a concessional rate, then the assets are to be recognised at their acquisition cost.

If the assets are acquired at no cost, then they are to be recorded at their nominal value.

For example, if an enterprise receives land for free as a government grant, then it has to record the land at cost based on prevailing market rates.

See less

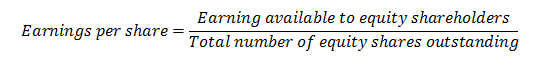

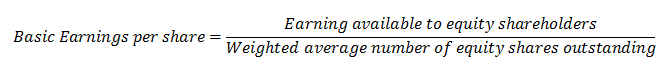

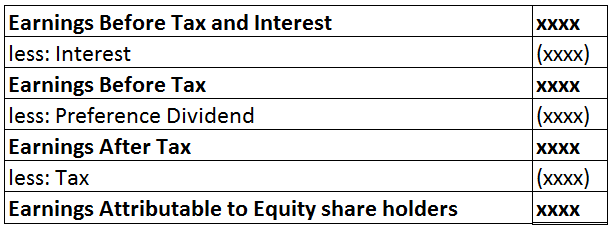

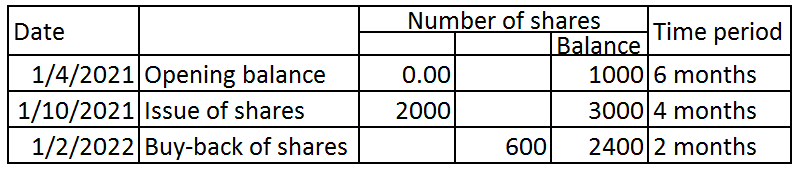

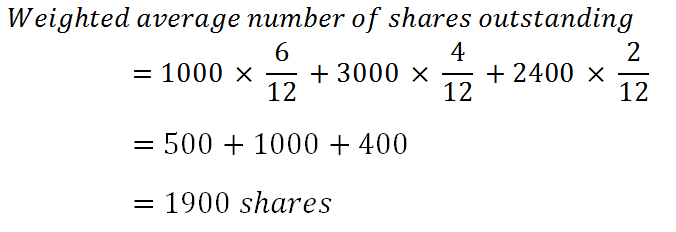

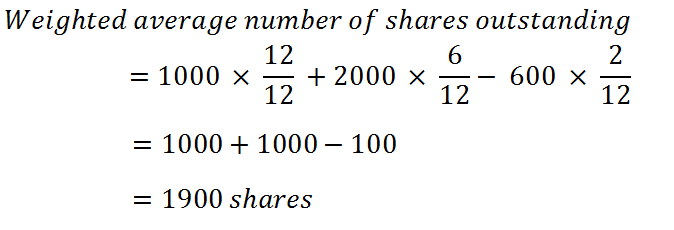

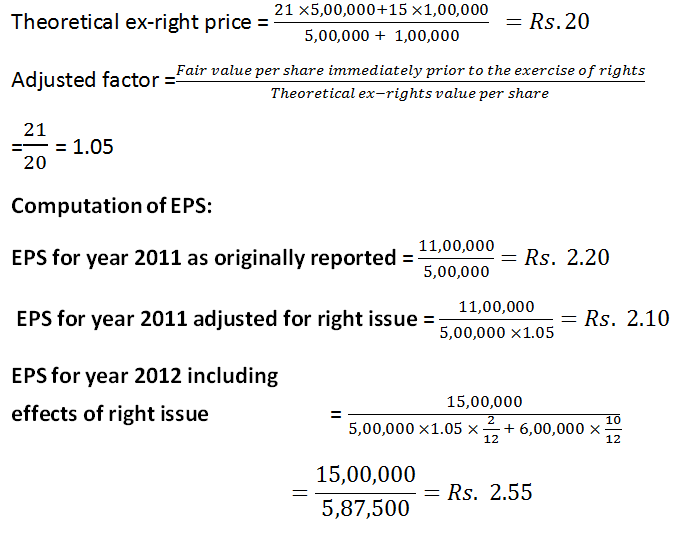

Earnings per share indicate the profit-generating capability of an enterprise and potential investors often compare the EPS of different companies to choose the best investment alternative.

Earnings per share indicate the profit-generating capability of an enterprise and potential investors often compare the EPS of different companies to choose the best investment alternative.

AS-11: The effects of changes in foreign exchange rates deal with the issues in the translation of foreign currency transactions and foreign operations. Foreign operations of a reporting enterprise mean its subsidiary, associate, joint venture or branch which is based or conducted in a country otherRead more

AS-11: The effects of changes in foreign exchange rates deal with the issues in the translation of foreign currency transactions and foreign operations.

Foreign operations of a reporting enterprise mean its subsidiary, associate, joint venture or branch which is based or conducted in a country other than the country of the reporting entity

For simple understanding let’s consider foreign operation as a branch of a business that is based in a foreign country.

Foreign Integral operations

So, integral foreign operations will be a dependent branch that works on the directions of the head office and it is like an extension of the business. The head office consigns goods to it and it sells them and remits cash and reports to the head office.

It is dependent on head office for receiving goods to sell and to cover its expenses.

Further, the difference in foreign exchange rate affects the present and future cash flows to the head office.

Foreign Non-Integral operations

A non-integral foreign operation will be like an independent branch that can operate without the aid of the head office. Apart from selling goods of the head office, it also buys goods from the local market and sells them.

Also, it covers its expenses on its own. It doesn’t remit the cash from sales regularly like a dependent branch. It is like acts an investment of the main business.

The difference in the foreign exchange rate has little or no effect on the present or future cash flows of the head office

See less