Shareholder's Equity Meaning - Shareholder's Equity is the amount invested into the Company. It represents the Net worth of the Company. It is also where the owners have the claim on the Assets after the Debts are settled. It Calculation of Shareholder's Equity Method 1 Shareholder's Equity = TotalRead more

Shareholder’s Equity

Meaning – Shareholder’s Equity is the amount invested into the Company. It represents the Net worth of the Company. It is also where the owners have the claim on the Assets after the Debts are settled. It

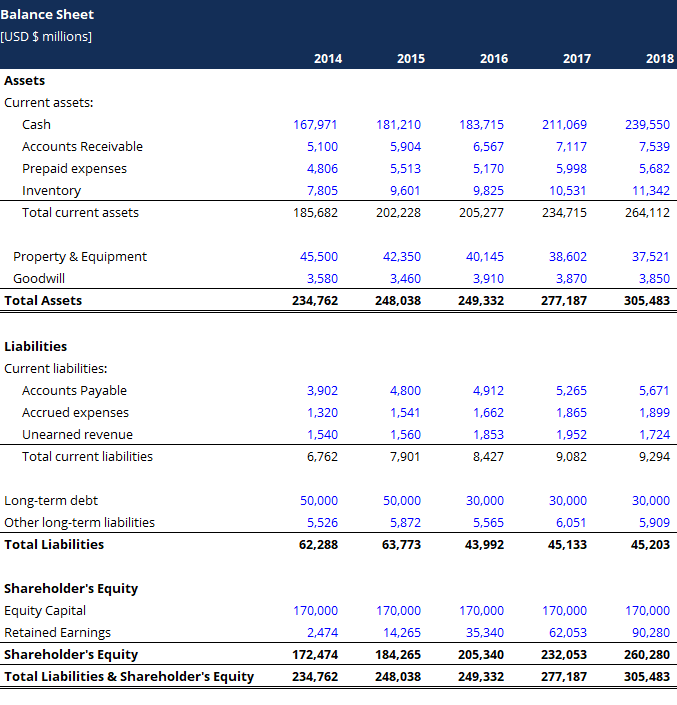

Calculation of Shareholder’s Equity

Method 1

Shareholder’s Equity = Total Assets – Total Liabilities

Method 2

Shareholder’s Equity = Share Capital + Retained Earnings – Treasury Stock/Treasury Shares

Components of the Shareholder’s Equity

From the above Method 1, it can be understood that shareholder’s equity comprises of

Net Assets = Current Assets + Non-current Assets, reduced by

Net liabilities = Current liabilities + Long-term liabilities

where Long-term liabilities = Long-term debts + Deferred long-term liabilities + Other liabilities

Also from the method 2,

Share Capital = Outstanding shares + Additional Paid-up share capital

Retained Earnings are the sum of the company’s earnings after paying the dividends

Treasury stocks = Shares repurchased by the company

Example of Shareholder’s Equity

The shareholder’s Equity is represented in the Balance Sheet as below;

See less

Overview And Definition Shareholder's equity represents the net value of a company. As an accounting measure, shareholders’ equity (also referred to as stockholders’ equity) is the difference between a company’s assets and liabilities. It is also called the book value of equity. For example – retainRead more

Overview And Definition

Shareholder’s equity represents the net value of a company. As an accounting measure, shareholders’ equity (also referred to as stockholders’ equity) is the difference between a company’s assets and liabilities. It is also called the book value of equity.

For example – retained earnings, common stock, etc.

Liabilities

Liabilities are the obligation or something a company or a person owes to another party. normally it is in cash form but it can be in other forms also.

And these liabilities need to be settled as per the terms agreed upon by the party.

For example – taxes owned, trade payables, etc.

Assets

Assets are those which has ownership of a company and controlling power with the company. In other words, Or something which will generate profits today and in the future.

For example – cash, building, etc.

Conclusion

Therefore I can conclude that stockholders’ equity refers to the assets remaining in a business once all liabilities have been settled, or I can say as it is not the same thing as the company’s assets. Assets are what the business owns.

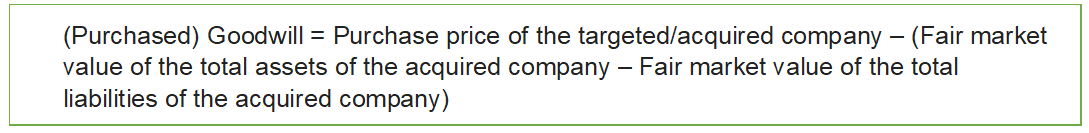

How to Calculate Shareholders’ Equity

Shareholders’ equity is the owner’s claim when assets are liquidated, and debts are paid up. It can be calculated using the following two formulas:

Formula 1:

Shareholders’ Equity = Total Assets – Total Liabilities

Formula 2:

Shareholders’ Equity = Share Capital + Retained Earnings – Treasury Stock

Let me now take the example of a small business owner who is into the business of chairs in India.

As per the balance sheet of the proprietorship firm for the financial year ending on March 31, YYYY, the following information is available. Determine the shareholders’ equity of the firm.

Given, Total Assets = Net property, plant & equipment + Warehouse premises + Accounts Receivable + Inventory

= Rs (1000,000 + 300,000 + 500,000 + 800,000)

Total Assets = Rs 2600,000

Again, Total liabilities = Net debt+ Accounts payable + Other current liabilities

= Rs (700,000 + 700,000 + 600,000)

Total Liabilities = Rs 2,000,000

Therefore, the shareholders’ equity of the firm as on March 31, YYYY, can be calculated as,

= Rs (2600,000 – 2,000,000)

Shareholders’ Equity = Rs 600,000

Therefore, the shareholders’ equity, as of March 31, YYYY, stood at Rs 600,000.

See less