The journal entry for the dividend collected by the bank is as follows: Bank A/c Dr. Amt To Dividend Received A/c Amt Here, Bank Account is debited and the Dividend Received Account is credited. This treatment is explained below. The logRead more

The journal entry for the dividend collected by the bank is as follows:

| Bank A/c Dr. | Amt | |

| To Dividend Received A/c | Amt |

Here, Bank Account is debited and the Dividend Received Account is credited. This treatment is explained below.

The logic behind the journal entry

This can be explained through the following rules of accounting:

- Golden rules of accounting

- Modern rules of accounting

Golden rules of accounting

A bank account is a real account and the golden rule of accounting for the real account is, “Debit what comes in and credit what goes out”

Hence, the bank account is debited as the money is coming into the bank.

Dividend is an income hence dividend received is a nominal account. The golden rule of accounting for a nominal account is “Debit all expenses and losses and credit all income and gains”

Hence, the dividend received account is credited as income.

Modern rules of accounting

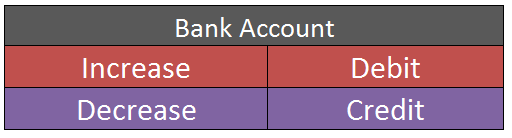

As per modern rules of accounting, a bank account is an asset account.

The asset account is debited when increased and credited when decreased.

Hence, the Bank account is debited here as it is increased.

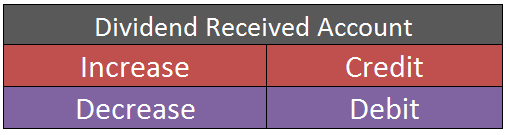

A dividend received account is an income account.

The income account is credited when increase and debited when decreased.

Hence, the dividend received account is credited here as it is increased.

Treatment in the financial statements

Since the dividend received is an income; it is shown on the credit side of the Statement of profit and loss.

The bank account is an asset so it will be shown on the balance sheet.

See less

Meaning of Workmen's Compensation Reserve Workmen compensation reserve is a reserve created to compensate the labourers and employees of a firm in case of an uncertain future event in the line with their work. For example, if a labourer or group of labourers get injured seriously while working on thRead more

Meaning of Workmen’s Compensation Reserve

Workmen compensation reserve is a reserve created to compensate the labourers and employees of a firm in case of an uncertain future event in the line with their work. For example, if a labourer or group of labourers get injured seriously while working on the premises of the firm, then they will be compensated from the money kept aside in the workmen’s compensation reserve.

Workmen’s compensation reserve is created using the profits of a business. The journal entry for the creation of workmen compensation reserve is as follows:

When a claim arises, the claim amount is transferred to Provision for workmen compensation claim A/c

Treatment of workmen compensation reserve in revaluation account

At the time of admission, retirement or death of partner or change in profit sharing ratio, the reserve is distributed among the old or existing partners or kept intact.

Workmen’s compensation reserve is also distributed among the old or existing partners subject to the claim arising on the reserve.

Here are the three situations:

The revaluation account comes into the picture only when the claim is more than the amount available in the reserve. For example, the claim is Rs. 20,000 but the amount in the reserve is only Rs. 15,000.

In such a case, the excess claim will be met by debiting the revaluation account.

The journal will as given below:

Since the revaluation account is debited, it is a loss and this loss will be written from old or existing partners’ capital in the old profit sharing ratio. The journal entry is given below:

See less