Introduction Often cash is withdrawn by the owner or proprietor of a business for his or her personal use. Such withdrawal of cash is an outflow of capital from business and it is known as drawings. The accounting treatment of cash withdrawn for personal use is expressed in the accounting equation aRead more

Introduction

Often cash is withdrawn by the owner or proprietor of a business for his or her personal use. Such withdrawal of cash is an outflow of capital from business and it is known as drawings.

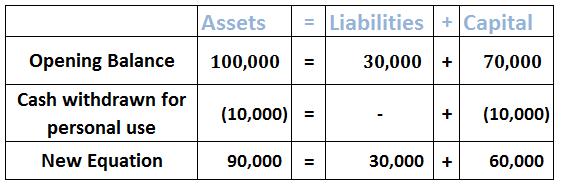

The accounting treatment of cash withdrawn for personal use is expressed in the accounting equation as shown in the example below:

It is shown as a negative figure under both assets and capital heading. I will be explaining why it is so.

Accounting Equation

The accounting equation represents the relationship between assets, liabilities, and capital of an entity whether profit oriented or not, according to which, the total assets of a business equals to the sum of its total capital and total liabilities.

Assets = Liabilities + Capital

This equation holds good in every monetary transaction or event like the event given in the question.

Cash withdrawn for personal use

We know every transaction affects two accounts. In this case, too, the ‘cash withdrawn for personal use’ affects two accounts. Cash withdrawn for personal use is known as drawings.

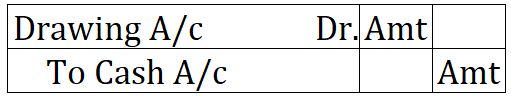

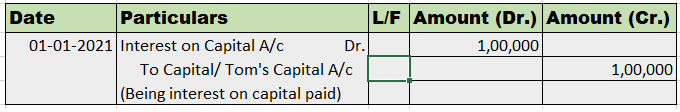

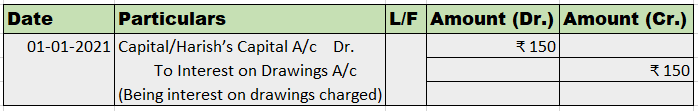

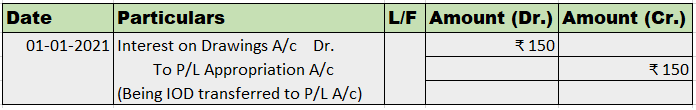

Let’s see the journal entry for drawings of cash from business:

Here the drawing account is debited because it is a contra-equity account i.e. it is a mirror image of the capital account or opposite of the capital account. Here the cash account is an asset account; hence it is credited as it is reduced.

As drawings represent the outflow of capital from the business, it is written off from the Capital account in the balance sheet.

Hence, in the accounting equation, the drawing amount is deducted from the Asset side and from the capital side, indicating a balance.

It does not appear in the statement of profit or loss despite having a debit balance because it is not an expense account.

See less

Business commencement with cash The term 'started the business with cash' is basically the commencement of business. In order to start any business, a certain sum of money has to be invested by the owner, which is known as the business's capital in accounting. Commencement of business refers to theRead more

Business commencement with cash

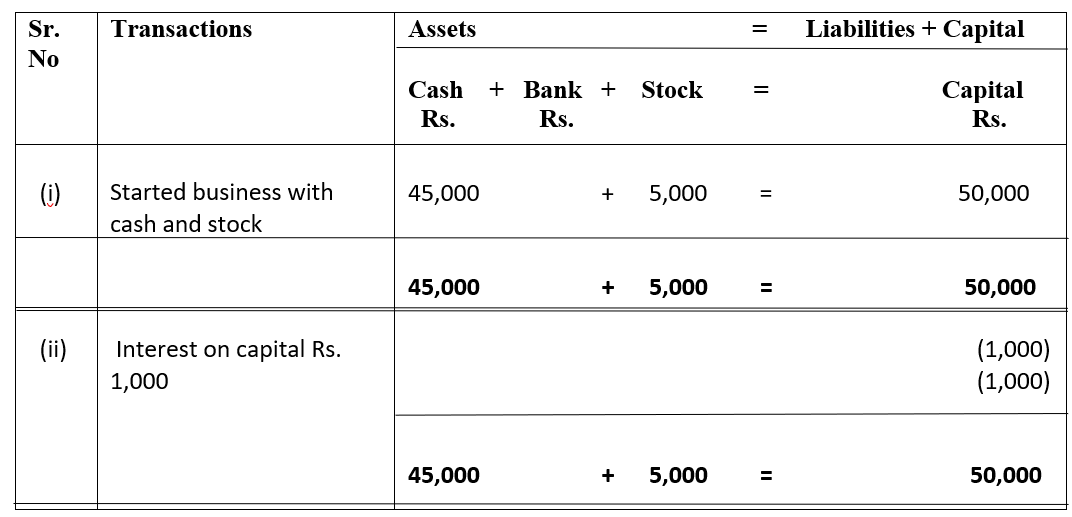

The term ‘started the business with cash’ is basically the commencement of business. In order to start any business, a certain sum of money has to be invested by the owner, which is known as the business’s capital in accounting.

Commencement of business refers to the starting or beginning of the business. In companies, it’s a declaration issued by the company’s directors with the registrar stating that the subscribers of the company have paid the amount agreed. In a sole proprietorship, the business can be commenced with the introduction of any asset such as cash, stock, furniture, etc.

Therefore, we may also call it the first journal entry of business because generally, people tend to start the business with cash rather than something else.

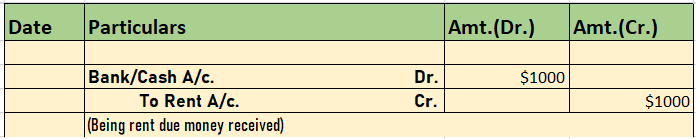

Journal entry

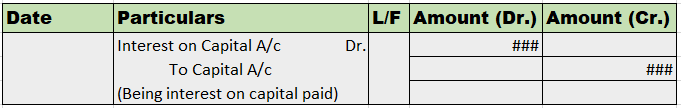

Explanation via rules

As per the golden rules of accounting, the cash a/c is debited as the rule says “debit what comes in, credit what goes out.” Whereas the capital a/c is credited because “debit all expenses and losses, credit all incomes and gains”

As per modern rules of accounting, cash is a current asset, and assets are debited when they increase. Whereas, on the increment on liabilities, they are credited, therefore, capital a/c is credited.

See less