Fixed Working Capital Permanent working capital is also known as fixed working capital. Working capital is the excess of the current assets over the current liability and further, it is classified on the basis of periodicity, into two categories, permanent working capital, and variable working capitRead more

Fixed Working Capital

Permanent working capital is also known as fixed working capital.

Working capital is the excess of the current assets over the current liability and further, it is classified on the basis of periodicity, into two categories, permanent working capital, and variable working capital.

Permanent working capital means the part of working capital that is permanently locked up in current assets to carry business smoothly and effortlessly. Thus, it’s also known as fixed working capital.

The minimum amount of current assets which is required to conduct a business smoothly during the year is called permanent working capital. The amount of permanent working capital depends upon the nature, growth, and size of the business.

Fixed working capital can further be divided into two categories:

- Regular working capital: It is the minimum amount of capital required by a business to fund its day-to-day operations of a business. E.g. payment of wages, salary, overhead expenses, etc.

- Reserve margin working capital: Apart from day-to-day activities, additional working capital may also be required for contingencies that may arise at any time like strike, business depression, etc.

Whereas, on the other hand, variable working capital, also known as temporary working capital refers to the level of working capital that is temporary and keeps fluctuating.

See less

Ledger posting The process of entering all transactions from journal to ledger is called ledger posting. Each ledger account contains an individual asset, person, revenue, or expense. As we're aware the journal records all the transactions of the business. Posting to the ledger account not only helpRead more

Ledger posting

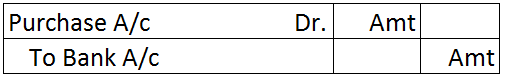

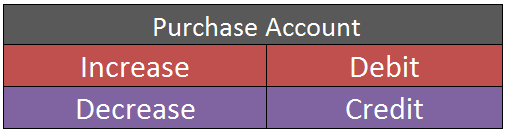

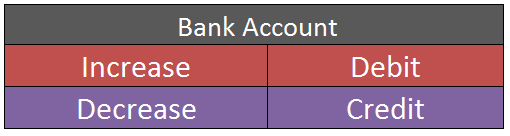

The process of entering all transactions from journal to ledger is called ledger posting. Each ledger account contains an individual asset, person, revenue, or expense. As we’re aware the journal records all the transactions of the business.

Posting to the ledger account not only helps the proper maintenance of the ledger book but also helps in reflecting a permanent summary of all the journal accounts. In the end, all the accounts that are entered and operated in the ledger are closed, totaled, and balanced.

Balancing the ledger means finding the difference between the debit and credit amounts of a particular account, it’s done on the day of closing of the accounting year. Sometimes journal entries are made and maintained monthly. Therefore, the balancing of the ledger’s date depends on the business’ closing date and the way a business maintains its books of accounts.

Example

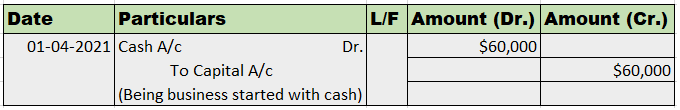

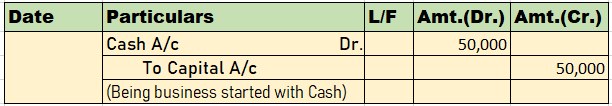

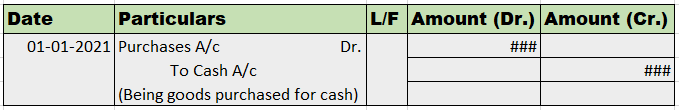

Mr. Jack Sparrow decided to start a new clothing business. On 1st April 2021, He started the business with a total sum of $100,000 cash. He purchased furniture, including desks and shelves for $25,000. Mr. Sparrow then decided to start with women’s clothing and purchased a complete range of clothes from the wholesale market for $50,000. On the next day, he sold all the stock for $75,000. He also hired a worker for $5,000.

We need to journalize these transactions and post them into the ledger account.

Journal Entries

Ledger Accounts

Cash A/c

Capital A/c

Purchases A/c

Sales A/c

Salary A/c

See less