I mean to ask is it real, nominal, or personal and why?

A Consignment Account is a Nominal Account. It is classified as a nominal A/c because it is prepared to ascertain the profit earned or loss incurred on the consignment. The accounting rule applied to consignment A/c: Debit all Expenses & Losses and Credit all Incomes & Gains. As per the modeRead more

A Consignment Account is a Nominal Account. It is classified as a nominal A/c because it is prepared to ascertain the profit earned or loss incurred on the consignment.

The accounting rule applied to consignment A/c: Debit all Expenses & Losses and Credit all Incomes & Gains.

As per the modern rules, there is no clear-cut classification of consignment A/c. It is prepared from the perspective of the consignor, hence it cannot be outrightly classified as an expense/revenue.

In the context of accounting, consignment refers to an arrangement of goods wherein the consignor sends the goods to the consignee so that the consignee can sell/distribute the goods on behalf of the consignor.

The relationship between the consignor and consignee is that of a principal and agent. The consignee gets a commission for his services.

You should keep in mind that the consignee does not get ownership of the goods even though the goods are in his possession. The ownership remains with the consignor till the sale is made. On sale, the buyer will become the owner.

A Consignment A/c is an account prepared to record the transactions happening in a consignment business. This account is maintained by the consignor. It shows the profit earned or loss incurred by the consignor on a specific consignment.

A consignor may send goods to more than one consignee. In such a case, a separate consignment A/c is prepared for each consignment.

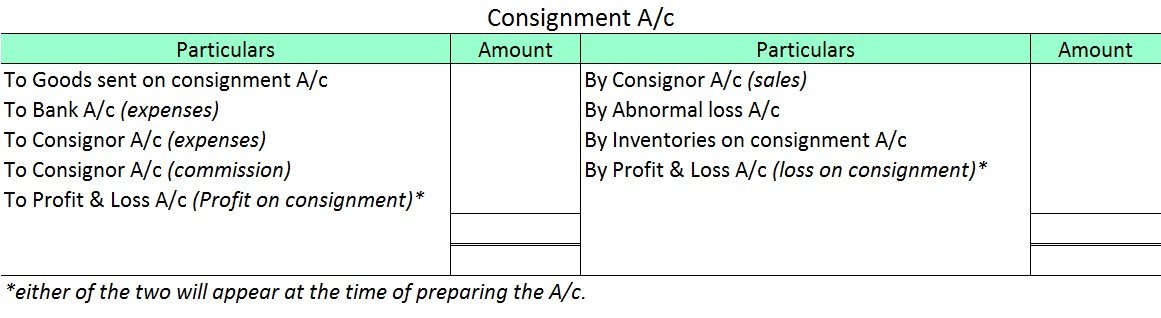

The following items appear on the debit side of the consignment A/c:

- Cost of goods sent on consignment.

- Expenses incurred by the consignor (freight, insurance, etc.)

- Expenses paid by the consignee (storage and warehousing, marketing expenses, packaging and selling expenses, etc.)

- Bad debts in consignment.

- Commission paid to consignee.

The entries appearing on the credit side of the consignment A/c are as follows:

- Gross sales.

- Abnormal loss of goods.

- Inventories on consignment (stock in transit).

The balance in the consignment A/c represents the profit or loss made on the consignment. It is transferred to the P&L A/c and the account is closed.

Below is the format for Consignment A/c:

The correct option is option A. Journal is the book of original entry. It is from the journal, the postings in the ledgers are made. As it is the journal first to record the transactions, it is called the book of original entry. It is from the journal, the postings in the ledgers are made. Ledgers aRead more

The correct option is option A.

Journal is the book of original entry. It is from the journal, the postings in the ledgers are made. As it is the journal first to record the transactions, it is called the book of original entry.

It is from the journal, the postings in the ledgers are made. Ledgers are called the books of principal book of entry.

Option B Duplicate is wrong as there is no such thing as the book of duplicate entry in financial accounting. Journal entries are the first-hand record of business transactions. Hence, it cannot be the book of duplicate entries.

Option C Personal is wrong. This classification of ‘personal’ is a type of account as per traditional rules of accounting, not books of accounts

Option D Nominal is wrong. It is also a type of account as per the traditional rules of accounting.

See less