Revaluation of Assets is an adjustment made in the carrying value of the fixed asset in case the company finds there is a difference between the current price and the market value of the asset. Generally, the value of the asset decreases due to depreciation but in some cases like inflation in the ecRead more

Revaluation of Assets is an adjustment made in the carrying value of the fixed asset in case the company finds there is a difference between the current price and the market value of the asset. Generally, the value of the asset decreases due to depreciation but in some cases like inflation in the economy, it may increase. so, in order to know the correct value of the asset Revaluation is to be done.

Accounting standard allows two models.

- Cost model

- Revaluation model

Under the cost model, the carrying value of fixed assets equals their historical cost less accumulated depreciation and accumulated impairment losses.

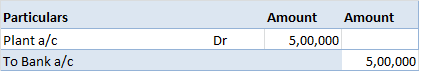

For Example, Amazon ltd purchased a Plant for 5,00,000 on January 1, 2010, with a useful life of 10 years, and uses straight-line depreciation.

Here, the journal entry would be passed as

As the useful life of the asset is 20 years, so the yearly depreciation would be

5,00,000/10 i.e. 50,000.

So the accumulated depreciation at the end of December 31, 2012, would be 50,000×2= 1,00,000 and

the carrying amount would be 5,00,000-1,00,000= 4,00,000.

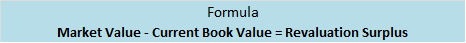

Under the Revaluation method, the assets are revalued at their current market value. If there is an increase in the value of an asset, the difference between the asset’s market value and current book value is recorded as a revaluation surplus.

For Example, Amazon ltd purchased an asset two years ago at a cost of 2,00,000. Depreciation @ 10% under straight-line method.

Therefore, the accumulated depreciation for two years would be 40,000,

i.e. 20,000 for a year.

Carrying cost of the asset = 1,60,000

Assuming, the company revalues its assets and finds that the worth of assets is 1,85,000.

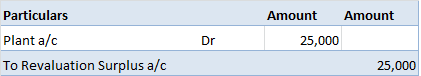

Under this method, the company needs to record 25,000 as a surplus.

Accounting entry for the above will be

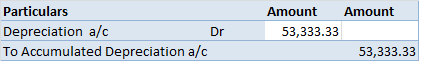

Depreciation calculated during the third year would be based on the new carrying value of 1,60,000.

Therefore, Depreciation for the 3rd year= 1,60,000/3

= 53,333.33

Accounting entry:

Alternatively, the incremental depreciation due to the revaluation i.e. 13,333.33 can be charged to the revaluation surplus account.

In case, if there is a revaluation loss, the entries would be interchanged.

In case of admission of a partner, the new partner may not agree with the value of assets as stated in the balance sheet, with time the values may have arisen or may have fallen, so in order to bring them to their correct values revaluation is done so that the new partner doesn’t suffer.

Where the assets and liabilities are to be shown in the books at the revised (new) values after the admission of the new partner.

The accounting entries are

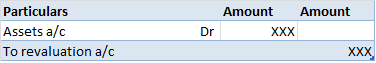

- For Increase in the value of an asset

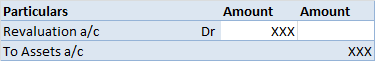

2. For a decrease in the value of an asset

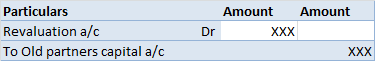

3. For transfer of profit on revaluation i.e. if the total of credit side exceeds the debit side.

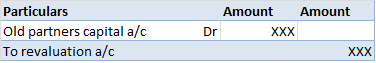

4. For transfer of loss on revaluation i.e. if the total of debit side exceeds the credit side.

Note: If the total of both sides is equal it signifies that there is no profit or loss on the revaluation of assets. Hence no entry is to be passed.

After preparing for the journal entry, a revaluation ledger account is also prepared wherein the accounts carrying a debit balance are transferred to the debit side and the accounts carrying a credit balance are transferred to the credit side.

In the case of retirement of a partner, the same journal entries are to be passed as in the case of Admission of a partner for revaluation of assets.

Generally, the value of an asset decreases with time but it may increase in certain circumstances especially in inflationary economies.

Conclusion

An entity should do the revaluation of its assets because revaluation provides the present value of assets owned by an entity and upward revaluation is beneficial for the entity and hence the company can charge more depreciation on upward revaluation and can get tax benefits.

See less

To begin with, let me explain what is revaluation all about. So basically revaluation is a method of calculating the depreciation of assets where there are multiple identifiable assets of low value such as loose tools, live stocks, etc. Under this method assets like loose tools are revalued at the eRead more

To begin with, let me explain what is revaluation all about. So basically revaluation is a method of calculating the depreciation of assets where there are multiple identifiable assets of low value such as loose tools, live stocks, etc.

Under this method assets like loose tools are revalued at the end of the accounting period and the same is compared with the value at the beginning of the year. the difference amount is considered as depreciation.

The formula goes as :

REVALUATION= OPENING VALUE + PURCHASES – CLOSING VALUE

Let me take an example to show the same. Opening balance of Loose tools amounts to Rs.2,000 during the year, the business purchased loose tools of Rs.500 and at the year-end loose tool amounted to Rs.1,500 then revalued figure which will be shown as depreciation will be

REVALUATION= Rs.(2,000+ 500 – 1,500)

= Rs.1,000

The main discussion is”how to show adjustment of revaluation of the loose tool in financial statements”?

As we all know, loose tools are considered assets for the business, hence shown under the head current assets or fixed assets depending upon the nature of the business and the time for which it is held.

When the trial balance shows the debit value of loose tools, later on in the year-end the loose tools are revalued to a certain amount then the difference amount will be shown as depreciation in the Profit & Loss A/c and the revalued figure will be posted in the balance sheet asset side.

Let me support my explanation with an example,

Given is the extracted trial balance of XYZ & Co.

we see the value of Loose tools in the given trial balance as Rs.50,000. At the year-end, these Loose tools were revalued at Rs.40,000.

Therefore the adjustment in the financial statement would be like Rs (50,000 – 40,000) i.e Rs. 10,000 would be shown as depreciation under Profit & Loss A/c

and the adjusted figure of Rs. 40,000 (i.e Rs.50,000 – Rs.10,000), will be shown on the asset side under the head fixed assets of the Balance Sheet.

See less