Let me begin by giving a small explanation of what loose tools are before we dive into their accounting treatment. Loose tools are assets that are used in various steps of the production process and therefore are vital for the conversion of raw materials into finished goods. They are considered as cRead more

Let me begin by giving a small explanation of what loose tools are before we dive into their accounting treatment.

Loose tools are assets that are used in various steps of the production process and therefore are vital for the conversion of raw materials into finished goods. They are considered as current assets of the business as their useful life is limited. They have a small monetary value (cost-efficient) and high turnover. Examples of loose tools include screwdrivers, hammers, etc.

One may say loose tools like screwdrivers and hammers can be used for more than one year and therefore should be classified as non-current assets. But unlike fixed assets, these loose tools have a high probability of being misplaced or lost. Hence they are classified as current assets.

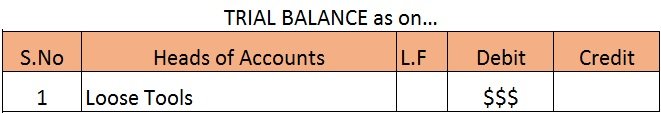

Since loose tools are treated as an asset for the business, they are shown as a debit balance in the trial balance.

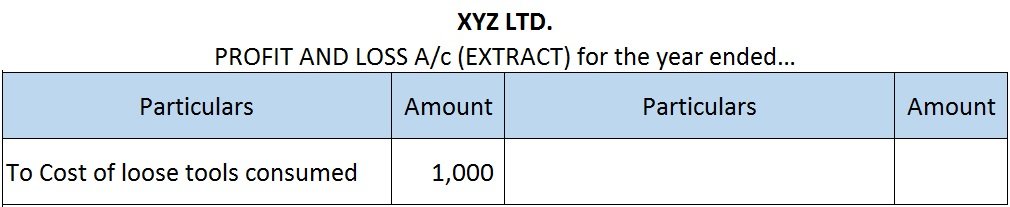

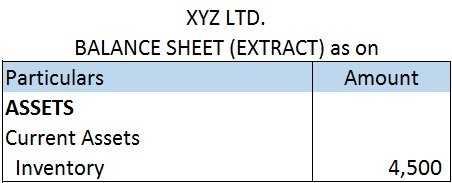

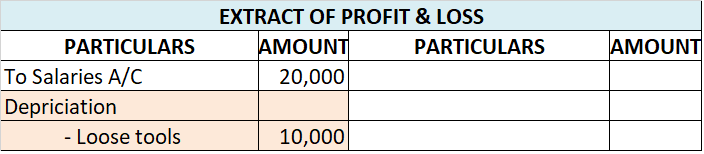

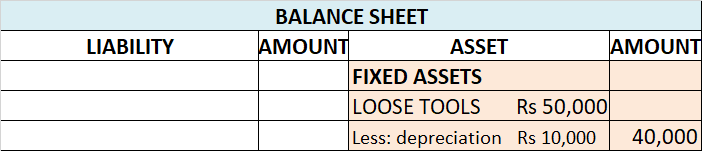

The cost of loose tools consumed for the year will be shown on the debit side of the Profit & Loss A/c as an expense. In the balance sheet, loose tools are shown on the Assets side under the head Current Assets and sub-head Inventories. Since they aid the production process, loose tools are shown as a part of the inventory of the business.

Let us take an example,

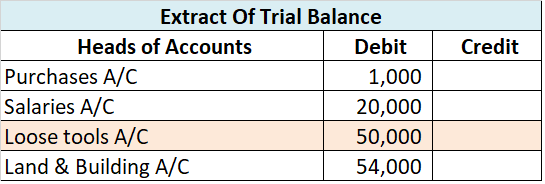

XYZ Ltd. at the beginning of the year had loose tools worth 5,000. During the year they purchased loose tools worth 500. At the end of the year, the company valued its loose tools at 4,500.

Now let us find the cost of loose tools consumed. The formula for finding the cost of loose tools consumed is as follows:

| Cost of loose tools consumed = | Opening inventory of loose tools + Purchases of loose tools – Closing inventory of loose tools |

Cost of loose tools consumed = 5,000 + 500 – 4,500 = 1,000

So, the cost of loose tools consumed (1000) will be shown on the debit side of the P&L A/c as follows:

The closing inventory of loose tools worth 4,500 will be shown on the assets side of the balance sheet under the head current assets and sub-head inventory in the following manner:

One thing to remember here is there is an exception to loose tools. While calculating liquidity ratios like the Current ratio, Quick ratio, etc. loose tools are excluded from current assets. The reason for this is loose tools cannot be easily converted into cash i.e. they are less liquid. The purpose of calculating the current ratio is to check the liquidity of a company. Including loose tools (which cannot be easily converted into cash) in current assets defeats the purpose of calculating the ratio.

See less

Current assets are all the assets of the company which are expected to be used, sold, or consumed within one year. Current assets are those assets that can be converted into cash easily. For example - Inventory, Accounts Receivable, Cash, and Cash Equivalents. Loose tools are parts of machinery or sRead more

Current assets are all the assets of the company which are expected to be used, sold, or consumed within one year. Current assets are those assets that can be converted into cash easily.

For example – Inventory, Accounts Receivable, Cash, and Cash Equivalents.

Loose tools are parts of machinery or spare parts of machinery. Loose can be classified on the nature of use whether it is a fixed asset or a current asset. If loose tools are used regularly or within one accounting year, it is classified as a current asset.

Loose tools are usually classified as a current asset, however, there is one exception i.e it is excluded from the current ratio.

They are excluded from the current ratio because the current ratio takes into account only current assets, and the nature of loose tools is either a fixed asset or a current asset and can’t be converted into cash easily.

The current ratio is calculated to check the liquidity of the company.

Loose tools appear in the Asset Side of the Balance Sheet under the head Current Asset, subhead Inventories.

The extract of the Balance Sheet is as follows:

When the balance sheet prepared under Schedule III loose tools is shown under notes to accounts under sub-head Inventories on the asset side.

When the balance sheet is in a T format loose appears as a current asset after recording fixed assets on the asset side.

See less