What is Impairment of Assets? Impairment of assets means a decline in the value of assets due to unforeseen circumstances. Assets are impaired when the carrying value of assets increases its market value or “realizable value”. Impairment can be caused due to factors that are internal or external toRead more

What is Impairment of Assets?

Impairment of assets means a decline in the value of assets due to unforeseen circumstances. Assets are impaired when the carrying value of assets increases its market value or “realizable value”.

Impairment can be caused due to factors that are internal or external to the firm. Internal factors such as physical damage, obsolescence or poor management and external factors such as a change in legal or economic circumstances, increased competition or reduction in asset’s fair value in the market result in impairment.

Impairment Vs Depreciation

Asset impairment is often confused with asset depreciation, which is rather a recurring and expected event, unlike impairment that reflects an abrupt decrease in the value of the asset.

Impairment Loss

Impairment is always treated as a loss in accounting. It is the amount by which the carrying value or the asset’s book value exceeds its fair market value.

Before recording Impairment loss, a company must determine the recoverable value of the asset which is higher of the asset’s net realizable value or value in use. Then it is to be compared with the book value of the asset.

If the carrying value exceeds the recoverable value then the impairment loss is to be recorded at the exceeding value i.e. difference of carrying value and realizable value.

Example

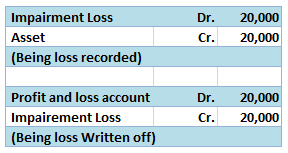

Suppose a company Royal Ltd. has an asset with a carrying value of 50,000, which has suffered physical damage. According to the company’s calculation, the asset has a net realizable value of 30,000 and a value in use of 25,000.

Then, the recoverable value would be higher of the asset’s net realizable value or value in use, i.e., 30,000 which is still lower than the carrying amount of 50,000. Therefore, Royal ltd. will have to record 20,000 (50,000-30,000) as impairment loss.

This is will increase Royal Ltd’s expenses by 20,000 and decrease the asset’s value by the same amount.

See less

Let us first understand the concepts of Amortization and Impairment. Amortization refers to the expense recorded on the decline of the value of intangible assets of a company. Intangible assets include goodwill, patents, copyrights, etc. It reflects the reduction in the value of Intangible assets ovRead more

Let us first understand the concepts of Amortization and Impairment.

Amortization refers to the expense recorded on the decline of the value of intangible assets of a company. Intangible assets include goodwill, patents, copyrights, etc. It reflects the reduction in the value of Intangible assets over its life span.

Amortization is similar to Depreciation, however, while depreciation is over tangible assets amortization is over Intangible assets of the company.

For example, Cipla Ltd. acquired a patent over a new drug for a period of 10 years. The cost of creating the new drug was 80,000 and the company must record its patent at 80,000. However, the company must amortize this cost by dividing the cost over the patent’s life, i.e., the amortization cost would be 8,000 (80,000/10) p.a. for the next 10 years.

Impairment means a decline in the value of fixed assets due to unforeseen circumstances. Assets are impaired when the carrying value of assets increases its market value or “realizable value” and such increase is recorded as an impairment loss.

Now suppose, Cipla Ltd. had existing machinery which suffered physical damage and is recorded at 50,000 in the books but the realizable value of the asset would only be 20,000. Hence, the asset would be written down to 20,000 and an impairment loss of 30,000 will be recorded.

Impairment Vs Amortization

Differences between the two can be shown as follows:

Suppose Unilever Ltd. has a patent over one of its products for a period of 5 years. The cost of the patent was 1,00,000. Then after 2 years one of its rivals, say ITC Ltd., launches a new product which is more preferred by the consumers over the one produced by Unilever Ltd. and the fair market value of the patent of Unilever Ltd. changes to 10,000.

Now in this scenario, Unilever Ltd. would have amortized the patent (costing 1,00,000) at 20,000 (1,00,000/5) p.a. for 2 years and the book value at the end of the 2nd year is 60,000 (1,00,000 – 40,000). Now due to the new launch by ITC Ltd. the drastic change in the value of the asset from the book value of 60,000 to the realizable value of 10,000 will be recorded as an Impairment loss. Hence Impairment loss would be recorded at 50,000 (60,000 – 10,000).

See less