Credited to Debtors Account Debited to Fixed Asset Account Shown in Branch Account Not shown in Branch Account

The correct answer is 4. Revenue Expenditure. Depreciation is a non-cash expense and is charged on the fixed asset for its continuous use. Revenue expenditure is a day-to-day expense incurred by a firm in order to carry on its normal business. Depreciation is considered a revenue expense due to theRead more

The correct answer is 4. Revenue Expenditure.

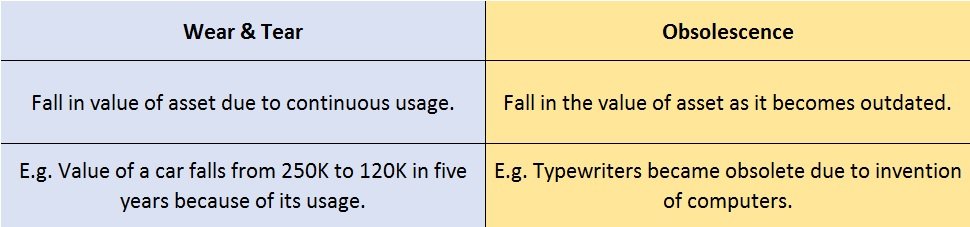

Depreciation is a non-cash expense and is charged on the fixed asset for its continuous use. Revenue expenditure is a day-to-day expense incurred by a firm in order to carry on its normal business. Depreciation is considered a revenue expense due to the regular use of the fixed assets.

Depreciation is the systematic and periodic reduction in the cost of a fixed asset. It is a non-cash expense. Mostly, depreciation is charged according to the straight-line method or written down method as per the policy of the company.

Depreciation is the systematic and periodic reduction in the cost of a fixed asset. It is a non-cash expense. Mostly, depreciation is charged according to the straight-line method or written down method as per the policy of the company. It is calculated as-

Depreciation = Cost of the asset – Scrap value / Expected life of the asset.

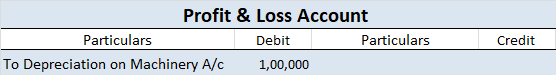

For Example, ONGC bought machinery at the beginning of the year for Rs 10,00,000

It charges depreciation @10% at the end of the year.

10,00,000 x 10/100 = 1,00,000 will be depreciation for the year and will be shown on the debit side of Profit & Loss A/c.

As the fixed assets are used in the day-to-day activities of the firm and hence the depreciation charged on it on the daily basis would be revenue in nature. so depreciation is said to be an item of revenue expenditure.

See less

The correct answer is 4. Not shown in Branch Account. The value of depreciation of fixed assets will be not shown in the branch accounting because the opening value of the asset is recorded at the start of the period on the debit side and the closing value of the asset is shown on the credit side atRead more

The correct answer is 4. Not shown in Branch Account.

The value of depreciation of fixed assets will be not shown in the branch accounting because the opening value of the asset is recorded at the start of the period on the debit side and the closing value of the asset is shown on the credit side at the end of the period.

The difference between the opening and closing values of the asset is the value of depreciation which is automatically charged. In this case, if depreciation is also shown it will be counted twice.

Example:

XYZ Ltd purchased furniture for one of its branches on 1st January. Following are the details of the purchase:

Depreciation is provided on furniture at @10% per annum on the straight-line method.

As additional furniture was purchased after 6 months, depreciation will be charged on that and the total depreciation of 3,250 will be charged on the furniture of $35,000 ($30,000+$5,000) and the difference will be the closing balance which will be shown in the branch account on the credit side.

The depreciation amount will not be shown in the Branch Account as the difference between the opening and closing values of the furniture reflects the value of depreciation. If depreciation is shown in the account it will be counted twice.

See less