Credited to Debtors Account Debited to Fixed Asset Account Shown in Branch Account Not shown in Branch Account

The total depreciation of an asset cannot exceed its 3. depreciable value. Depreciable value means the original cost of the asset minus its residual/salvage value. The asset's original cost is inclusive of the purchase price and other expenses incurred to make the asset operational. To put it simplRead more

The total depreciation of an asset cannot exceed its 3. depreciable value.

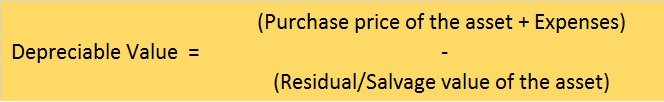

Depreciable value means the original cost of the asset minus its residual/salvage value. The asset’s original cost is inclusive of the purchase price and other expenses incurred to make the asset operational. To put it simply,

The accumulated depreciation on an asset can never exceed its depreciable value because depreciation is a gradual fall in the value of an asset over its useful life. Only a certain percentage of the asset’s book value/original cost is shown as depreciation every year. So, it is impossible/illogical for the accumulated depreciation of an asset to exceed its depreciable value.

Let me show you an example to make it more understandable,

Amazon installs machines to automate the job of packing orders. The original cost of the machine is $1,000,000. Now let’s assume,

The estimated useful life of the machine – 10 years.

Residual value at the end of 10 years – $50,000.

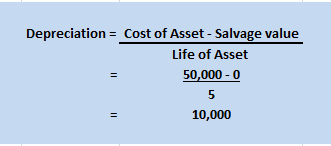

Method of depreciation – Straight-line method.

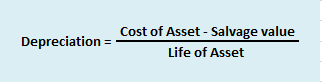

The depreciable value of the machine will be $950,000 (1,000,000 – 50,000). The depreciation for each year under SLM will be calculated as follows:

Depreciation = (Original cost of the asset – Residual/Salvage Value) / (Useful life of the asset)

Applying this formula, $95,000 (1,000,000 – 50,000/10) will be charged as depreciation every year. The accumulated depreciation at the end of 10 years will be $950,000 (95,000*10). As you can see, the accumulated depreciation ($950,000) of the machine does not exceed its depreciable value ($950,000).

Thus, the total depreciation of an asset cannot be more than its depreciable value.

See less

The correct answer is 4. Not shown in Branch Account. The value of depreciation of fixed assets will be not shown in the branch accounting because the opening value of the asset is recorded at the start of the period on the debit side and the closing value of the asset is shown on the credit side atRead more

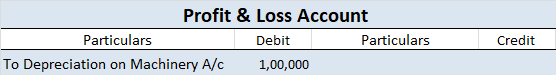

The correct answer is 4. Not shown in Branch Account.

The value of depreciation of fixed assets will be not shown in the branch accounting because the opening value of the asset is recorded at the start of the period on the debit side and the closing value of the asset is shown on the credit side at the end of the period.

The difference between the opening and closing values of the asset is the value of depreciation which is automatically charged. In this case, if depreciation is also shown it will be counted twice.

Example:

XYZ Ltd purchased furniture for one of its branches on 1st January. Following are the details of the purchase:

Depreciation is provided on furniture at @10% per annum on the straight-line method.

As additional furniture was purchased after 6 months, depreciation will be charged on that and the total depreciation of 3,250 will be charged on the furniture of $35,000 ($30,000+$5,000) and the difference will be the closing balance which will be shown in the branch account on the credit side.

The depreciation amount will not be shown in the Branch Account as the difference between the opening and closing values of the furniture reflects the value of depreciation. If depreciation is shown in the account it will be counted twice.

See less