Capital Expenditure: Capital expenditure is the expenditure incurred by an entity or organization to acquire or purchase a fixed asset. This expenditure forms part of non-current assets. The fixed asset is not expensed at the time of purchase instead, it is depreciated or amortized over its useful lRead more

Capital Expenditure:

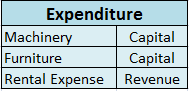

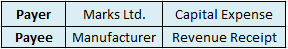

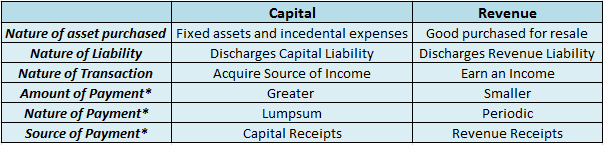

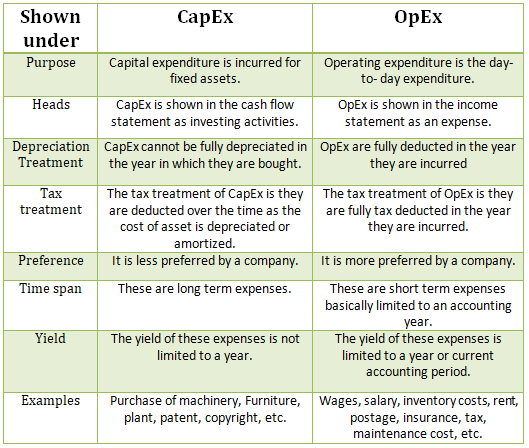

Capital expenditure is the expenditure incurred by an entity or organization to acquire or purchase a fixed asset. This expenditure forms part of non-current assets. The fixed asset is not expensed at the time of purchase instead, it is depreciated or amortized over its useful life.

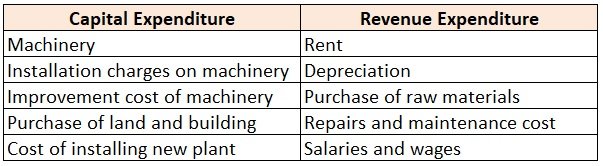

Example of Capital Expenditure:

- Machinery: Machinery is a tangible non-current asset purchased by a company for business purposes. Since it is a non-current asset company will be using it for more than one accounting period hence, it should be capitalized in the balance sheet under the head assets. Capitalization is a method in which cost is included in the value of the asset and expensed over its useful life.

For example, XYZ Ltd purchased machinery worth $1,00,000 and its useful life is 10 years.

In this case, XYZ Ltd will capitalize the amount of machinery because it will be using it for more than one accounting year. Any asset used for more than one accounting year should be capitalized.

- Installation charges on machinery: This expense is incurred while installing machines in the business premises and is a one-time expenditure. The whole amount of installation will be capitalized along with the cost of machinery in the balance sheet.

In the above example cost of the machine is given as $1,00,000 and at the time of installation company incurred a further expenditure of $10,000. Here, the company will add the amount of installation with the cost of machinery because the installation charge is a one-time expense. The total cost of the machine will be $1,10,000.

- Improvement cost of machinery: Any cost incurred in the improvement of the machine will be capitalized. It is so as it will improve the quality or extend the life of the machinery. Hence, this cost should be added to the historic cost of the machine.

In the above example, after installation charges were incurred historic cost of the machine was $1,10,000. After a few years, the company made some improvements to the machine which amounted to $20,000 and the machine’s useful life was extended to more 5 years.

The improvement cost of $20,000 will be added to the historical cost of $1,10,000. The total amount of $1,30,000 ($1,10,000+$20,000) will be shown in the balance sheet.

Revenue Expenditure:

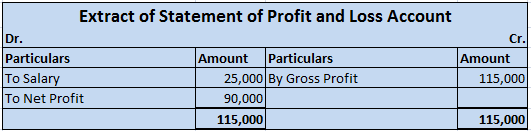

Revenue expenditure is expenditure incurred for the purpose of trade or to maintain non-current assets. These are short-term expenses and consumed within one accounting year and also known as operating expenses.

Examples of Revenue Expenditure:

- Rent: It is an expense paid by the company for using the premises for business purposes to the owner of the premises. It is recurring in nature and hence, should be classified under revenue expenditure.

For example, a company rented premises for business purposes and paid a monthly rent of $10,000. This expenditure of $10,000 incurred will fall under revenue expenditure because the company is incurring this expenditure monthly.

- Depreciation: Depreciation is a non-cash expense and it is added back to the cash flow statement, alongside other expenses. This expense is incurred as a basis of consuming a portion of fixed assets for the current period. Depreciation is charged to the fixed assets to reduce their carrying amount as their value is consumed over time. This expense is of recurring in nature.

For example, a company purchased an asset worth $2,00,000 and charges 10% depreciation every year for 10 years. Since, the company will charge 10% depreciation every year it is recurring in nature and hence, should be considered as revenue expenditure.

- Purchase of raw material: Raw materials are materials used in primary production for the manufacturing of goods. These are needed on a regular basis and the cost of purchasing them is recurring in nature. Hence, they are classified under revenue expenditure.

For example, a manufacturing company orders stock of its raw material every quarter. Here, the company is going to reorder stock in every quarter and hence, this will be a revenue expenditure.

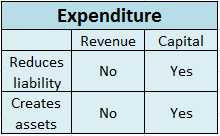

Capital expenditure can be capitalized as a part of non-current assets. Revenue expenditure cannot be capitalized and must be expensed in the statement of profit and loss.

See less

Capital Expenditure Capital expenditure refers to the money a business spends to buy, maintain, or improve the quality of its assets. Capital expenditures are the expenses incurred by an organization for long-term benefits, i.e on the long-term assets which help in improving the efficiency or capaciRead more

Capital Expenditure

Capital expenditure refers to the money a business spends to buy, maintain, or improve the quality of its assets. Capital expenditures are the expenses incurred by an organization for long-term benefits, i.e on the long-term assets which help in improving the efficiency or capacity of the company. These expenses are borne by the company to boost its earning capacity.

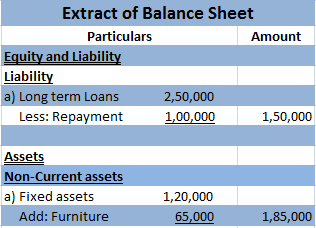

The investment done by the companies on assets is capital in nature and through capital expenditure, the company may use it for acquiring new assets or may use it in the maintenance of previous ones. These expenditures are added to the asset side of the balance sheet.

Example: Purchase of machinery, patents, copyrights, installation of equipment, etc.

Revenue Expenditure

Revenue expenditure refers to the routine expenditures incurred by the business to manage day-to-day expenses. They are incurred for a shorter duration and are mostly limited to an accounting year. These expenses are borne by a company to sustain its profitability. These expenditures are shown in the income statement.

These expenditures do not increase the revenue but stay maintained. These expenses are not capitalized.

They are divided into two sub-categories:

Example: Wages, salary, insurance, rent, electricity, taxes, etc.

See less