Journal Entry for Calls in Advance Calls in advance mean excess money received by the company than what has been called up. Calls in advance are treated as Current Liability and shown in the Balance Sheet on the liability side. Journal Entry will be : Here we will "Debit" Bank A/c as it will increaRead more

Journal Entry for Calls in Advance

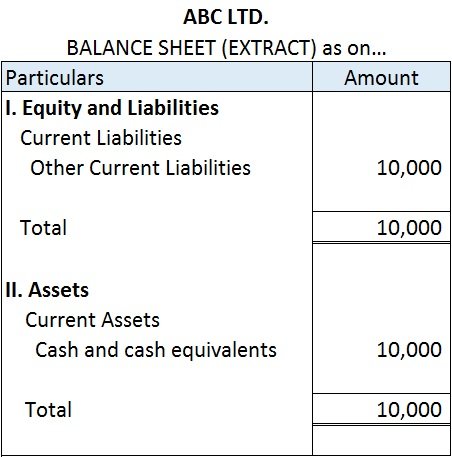

Calls in advance mean excess money received by the company than what has been called up. Calls in advance are treated as Current Liability and shown in the Balance Sheet on the liability side.

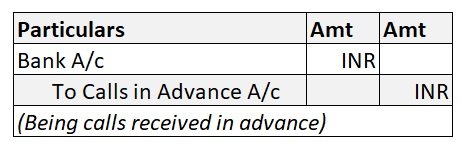

Journal Entry will be :

Here we will “Debit” Bank A/c as it will increase assets of the company and “Credit” Calls in Advance A/c because it will increase the company’s current liabilties.

For Example:

Mr.Z shareholder of ABC Ltd was allotted 2,000 equity shares of Rs.10 each. He paid call money at the time of allotment.

| On Application | Rs 5 |

| On Allotment | Rs 2 |

| On First and final call | Rs 3 |

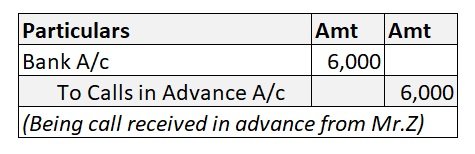

Journal Entry is as follows:

Here, the company received an excess amount of Rs.6,000 (2,000*3) from a shareholder Mr.Z who paid the call money in advance. ABC Ltd will record this under Calls in Advance A/c. While passing journal entry ABC Ltd will debit its Bank A/c by Rs.6,000 and credit calls in advance account by Rs.6,000.

When share calls are called up, calls received in advance are adjusted. The company will hold only the required amount which will make allotted shares fully paid.

Once the amount is transferred to relevant call accounts, calls in advance account will be written off.

See less

To begin with, lets us understand what the Companies Act 2013 tells about calls-in-advance, so basically as per section 50 of the companies act 2013 "A company may if so authorized by its articles, accepts from any members the whole or part of amount remaining unpaid on any share held by him, even iRead more

To begin with, lets us understand what the Companies Act 2013 tells about calls-in-advance, so basically as per section 50 of the companies act 2013 “A company may if so authorized by its articles, accepts from any members the whole or part of amount remaining unpaid on any share held by him, even if no amount has been called up”.

To be more precise whenever excess money is received by the company than, what has been called up is known as calls-in-advance.

Accounting Treatment

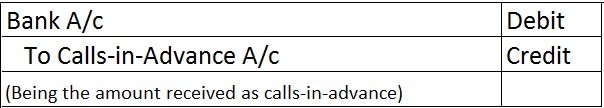

Well, it is to be noted that calls-in-advance is never a part of share capital. A company when authorized by its article can accept those advance amounts and directly credit the amount received to the calls-in-advance account.

As these advance amounts are a liability for the company these are shown under the head current liability of the balance sheet until calls are made and are paid to the shareholders.

Since this is the liability of the company, it is liable to pay the interest amount on such call money from the date of receipt until the payment is done to the shareholders. The rate of interest is mentioned in the articles of association. If the article is silent regarding the rate on which interest is paid then it is assumed to be @6%.

Accounting Entry

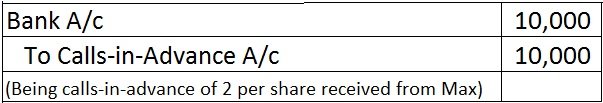

Bonnie let us understand the entries with help of an example

ADIDAS LTD issued 25,000 equity shares of Rs 10 each payable as follows:

ON APPLICATION Rs 5

ON ALLOTMENT Rs 3

ON FINAL CALL Rs 2

Application on 30,000 shares was received. excess money received on the application was refunded immediately. Mr. X who was allotted 1,000 shares paid the call money at the time of allotment and all amounts were duly received assume interest rate @6% for 3 months, so the relevant accounting entry goes as follows:

Important Points to be noted under calls-in-advance as per the companies act 2013

- The shareholder is not entitled to any voting rights on money paid until the said money is called for.

- No dividends are payable on advance money.

- Board may pay interest on advance not exceeding 12%.

- The shareholders are entitled to claim the interest amount as mentioned in the article, if there are no profits, then it must be paid out of capital because shareholders become the creditors of the company.

See less