Specimen of Bill of Exchange Important points of Bill of Exchange: Date: When a bill of exchange is drawn, the drawer has to specify the date in the top right corner. The date is important for the purpose of calculating the due date of the bill. Generally, the drawee is given three days as a grace pRead more

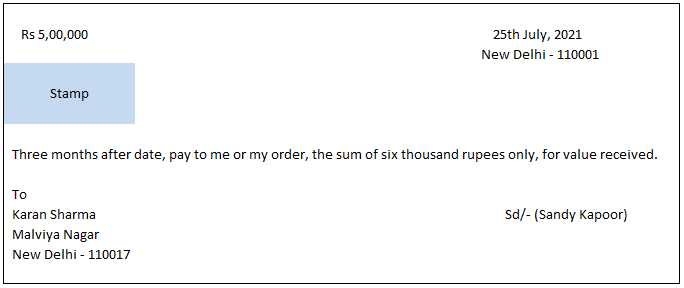

Specimen of Bill of Exchange

Important points of Bill of Exchange:

Date: When a bill of exchange is drawn, the drawer has to specify the date in the top right corner. The date is important for the purpose of calculating the due date of the bill. Generally, the drawee is given three days as a grace period over and above the due date of maturity.

In the above specimen, the date mentioned is 25th July 2021, so the due date will be three months + 3 days( grace period) i.e. to say 28th October 2021.

Term: In the above, the term as agreed by the drawer and drawee is 3 months. So the maturity date will be after 3 months.

Stamp: The Stamp is affixed in the left corner in every bill of exchange, the value of which depends upon the amount specified in the bill.

Parties involved in Bill of Exchange:

- Drawer: The one who makes the bill, i.e. the creditor.

- Drawee: The one on whom the bill is drawn, i.e. the debtor.

- Payee: The one to whom the amount is to be paid is the payee.

Sometimes, the drawer and the payee are the same people.

For Example,

i) A bill of exchange for Rs 10,000 is drawn by Sandy on Karan which is due after three months. Karan accepted the bill which is met at maturity and hence becomes the acceptor of the bill by putting his signature.

Here, Sandy is the drawer and Karan is the drawee. As the payment on maturity is received by Sandy so the payee will be Sandy.

ii) A bill of exchange for Rs 10,000 is drawn by Sandy on Karan which is due after three months. Karan accepted the bill. Thereafter Sandy endorsed the bill in favor of his creditor, Vikash. The bill is met at maturity.

So in this case, Sandy is the drawer, Karan is the drawee and Vikash is the payee as he received the amount at maturity.

Acceptance: Acceptance by the drawee is given on the face of the bill as-

Meaning of BOE:

In a business, in the case of credit sales, the payment is received after a certain period of time. In such a case the seller i.e. the creditor makes a credit note and the purchaser i.e. the debtor accepts the same by giving his acceptance by signing the instrument, to pay the amount of money mentioned to a certain person or the bearer of the instrument.

It is generally a negotiable instrument i.e. can be transferred from one person to another.

Features of Bill of Exchange.

- It is a written document.

- It is an unconditional order to pay.

- It must be signed by the maker of the bill i.e. the drawer.

- It must be properly stamped.

- The amount is payable either to a specified person or to his order or to the bearer.

- It contains an order to pay the amount mentioned in the instrument both in figures and words.

- The amount is to be paid either on the expiry of a fixed period from the date of the bill or on-demand.

See less

Advantages of Bill of Exchange: Bill of Exchange is generally used as an instrument of credit as it offers many advantages to its users. The advantages are as follows: CONCLUSIVE EVIDENCE: It acts as a shred of conclusive evidence in case of any dispute between the parties like seller-buyer, drawer-Read more

Advantages of Bill of Exchange:

Bill of Exchange is generally used as an instrument of credit as it offers many advantages to its users. The advantages are as follows:

- MUTUAL ACCOMMODATION: Sometimes bills are mutually accommodated for the benefit of the parties. The Bill is drawn and accepted by drawer and drawee. Then the same bill is discounted by the drawer and the agreed sum is remitted to the drawee. This is basically done mutually to provide financial help to each other.

See less