The entry for a loan (taken for any purpose) and a car loan are quite different. When you take a bank loan, you'll receive the money from the bank and subsequently, you'll start paying interest on it. In the case of a car loan, you don't receive the money from the bank. Once the car has been purchasRead more

The entry for a loan (taken for any purpose) and a car loan are quite different. When you take a bank loan, you’ll receive the money from the bank and subsequently, you’ll start paying interest on it.

In the case of a car loan, you don’t receive the money from the bank. Once the car has been purchased you’ll make the down payment and the remaining amount will be paid by the bank on your behalf. This car loan should then be paid to the bank in installments.

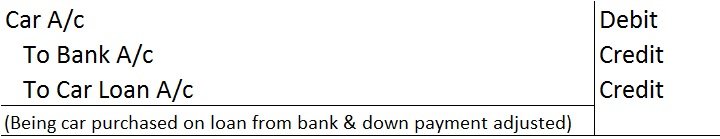

The following journal entry is posted to record the car loan taken for office use:

Car A/c is debited as there is an increase in the asset. Bank A/c is credited as the down payment for the car is made which reduces the assets. Car Loan A/c is credited as it increases liability.

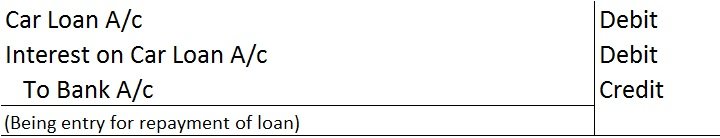

The following entry is recorded for the repayment of the loan (first installment) to the bank.

Let me explain this with an example,

Kumar purchased a car for 25,00,000 for his office use. He made a down payment of 2,00,000 and took a car loan from HDFC Bank for 23,00,000. The following entry will be made to record this transaction.

| Car A/c | 25,00,000 |

| To Bank A/c | 2,00,000 |

| To Car Loan A/c | 23,00,000 |

| (Being car purchased through a loan from HDFC bank) |

See less

Outstanding expenses are those expenses that have been incurred during the accounting period but are yet to be paid. Basically, any expense which has become due for payment but is not paid will be called an outstanding expense. Outstanding expenses are treated as a liability as the business is yet tRead more

Outstanding expenses are those expenses that have been incurred during the accounting period but are yet to be paid. Basically, any expense which has become due for payment but is not paid will be called an outstanding expense.

Outstanding expenses are treated as a liability as the business is yet to make payment against them. Examples of outstanding expenses include outstanding rent, salary, wages, etc.

At the end of the accounting year, outstanding expenses have to be accounted for in the book of accounts so that the financial statements reflect the accurate profit/loss of the business.

Journal entry for recording outstanding expenses:

The concerned expense A/c is debited as there is an increase in expenses. Outstanding expenses are a liability, hence they are credited.

Let me give you a simple example,

Max, a sole proprietor pays 1,00,000 as salary for his employees at the end of every month. Due to the Covid-19 lockdown, he could not pay his employees’ salaries for March month. So the salary for March (1,00,000) will be treated as an outstanding expense. The following entry is made to record outstanding salaries for the year.

At the end of the year, outstanding salary will be adjusted in the P&L A/c and it will be shown as a Current Liability in the Balance Sheet.

See less