The journal entry for the opening stock will be: Particulars Amt Amt Trading A/c INR To Opening Stock A/c INR (Being opening stock transferred to Trading A/c) Opening stock is the value of inventory that is available with the company for sale at the beginning of the accounting period. ORead more

The journal entry for the opening stock will be:

| Particulars | Amt | Amt |

| Trading A/c | INR | |

| To Opening Stock A/c | INR | |

| (Being opening stock transferred to Trading A/c) |

Opening stock is the value of inventory that is available with the company for sale at the beginning of the accounting period. Opening stock may include stock of raw material, semi-finished goods, and finished goods. It is a part of the cost of sales.

Closing stock is the value of unsold inventory left with the company at the end of the year. The previous year’s closing stock is the current year’s opening stock.

Trading Account is a nominal account. According to the golden rules of accounting, the nominal account is the account where “Debit” all expenses and losses, and “Credit” all income and gains.

In the above journal entry, the opening stock account is credited because it is the balance that is carried forward from the previous year and carried forward with the aim of selling it and gaining profit from it. The trading account here is debited as opening stock is carried forward to the next year from the trading account only.

According to modern rules of accounting, “Debit entry” increases assets and expenses, and decreases liability and revenue, a “Credit entry” increases liability and revenues, and decreases assets and expenses.

Here, Trading A/c is debited because an expense is incurred while bringing stock into the business. Opening Stock A/c is credited because indirectly it is creating a source of income for the business.

The formula for calculating opening stock is as follows:

Opening Stock = Cost of Goods Sold + Closing Stock – Purchases

For example, AB Ltd. started a new accounting period for dairy products and introduced opening stock worth Rs.1,00,000 in the business.

Here, the journal entry will be,

| Particulars | Amt | Amt |

| Trading A/c | 1,00,000 | |

| To Opening Stock A/c | 1,00,000 | |

| (Being opening stock transferred to Trading A/c) |

Prepaid expenses are those expenses that have not been expired yet but their payment has already made in advance. There are many examples of prepaid expenses such as rent paid in advance, interest paid in advance, unexpired insurance You might be wondering what kind of account it is? As the name sugRead more

Prepaid expenses are those expenses that have not been expired yet but their payment has already made in advance. There are many examples of prepaid expenses such as rent paid in advance, interest paid in advance, unexpired insurance

You might be wondering what kind of account it is? As the name suggests it should be an expense but actually it’s an asset. When we initially record prepaid expenses we consider them as current assets and show them in the balance sheet. It turns out to be an expense when we use the service/item for what we have paid for in advance.

The entry for the above explanation is as follows:

From the modern rule, we know Assets and expenses increased are debits while decrease in assets and expenses are credit.

As this is asset, increase in asset therefore we debit prepaid expense and on the other hand we pay cash/ bank on behalf of that asset in advance hence there is decrease in assets hence credited. The entry will be as follows:

when this prepaid expense actually becomes expense we pass the adjusting entry. The entry will be as follows:

Let me give you simple example of the above entry.

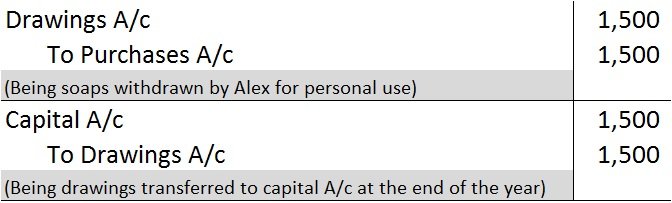

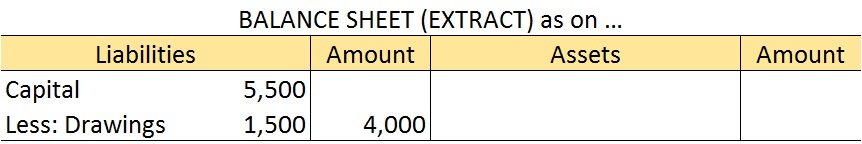

Suppose you pay advance rent of Rs 9,000 for six months for the space you haven’t used yet. So you need to record this as prepaid expense and show it on the asset side of the balance sheet under current assets. Since you paid for the same the entry would be as follows:

As each month passes we will adjust the rent with prepaid rent account. Since the rent was advanced for 6 months, therefore (9,000/6) Rs 1500 will be adjusted each month with the rent expense account. The adjustment entry will be:

The process is repeated until the rent is used and asset account becomes nil.

See less