Net credit sales can be defined as the total sales made by a business on credit over a given period of time less the sales returns and allowances and discounts such as trade discounts. Net Credit Sales = Gross Credit Sales – Returns – Discounts – Allowances. Credit sales can be calculated from the ARead more

Net credit sales can be defined as the total sales made by a business on credit over a given period of time less the sales returns and allowances and discounts such as trade discounts.

Net Credit Sales = Gross Credit Sales – Returns – Discounts – Allowances.

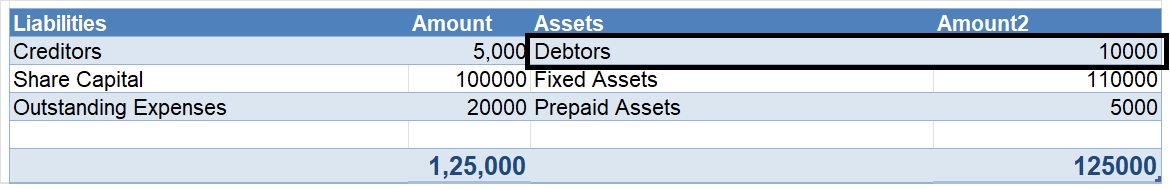

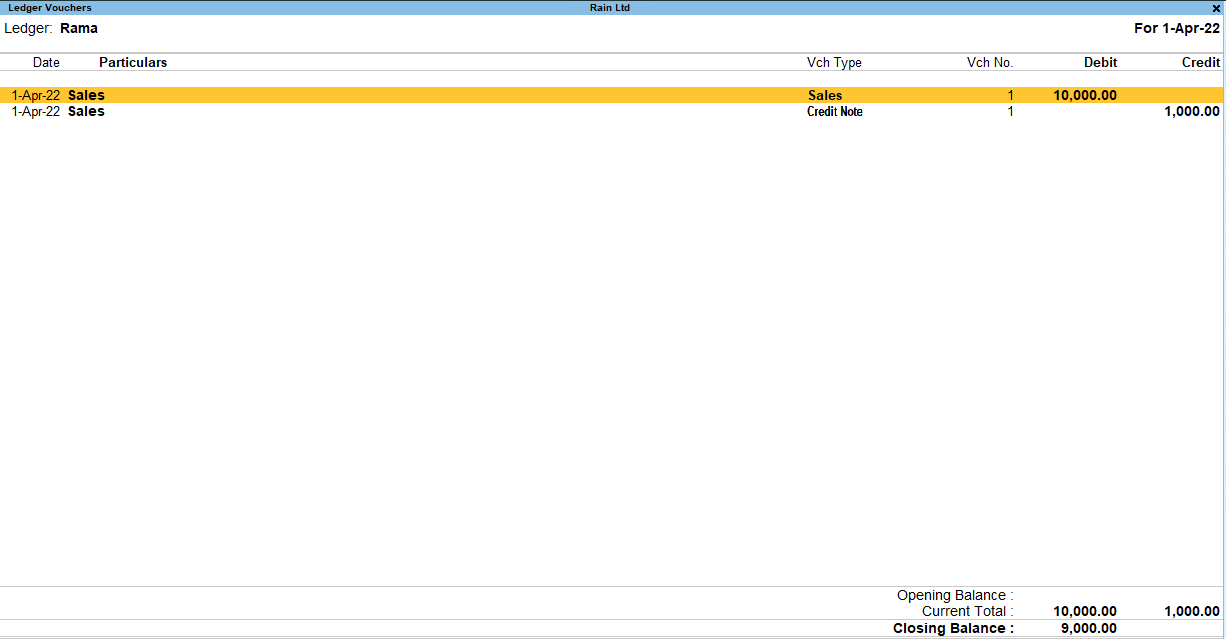

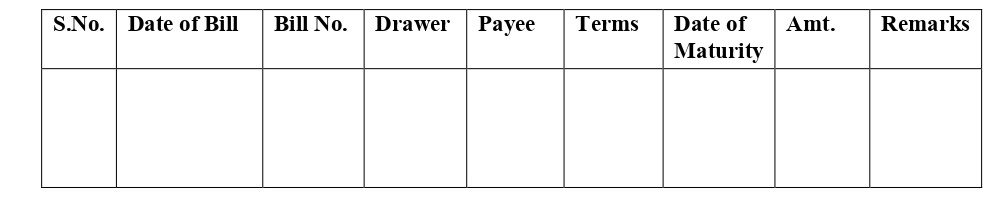

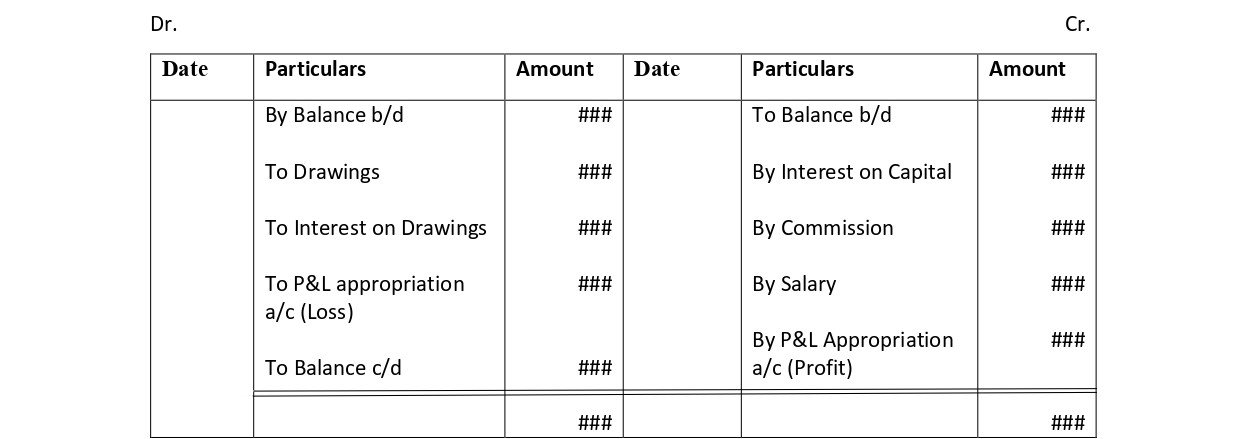

Credit sales can be calculated from the Accounts receivable/ Bills Receivable/ Debtors figure in the Balance Sheet. It will be normally shown under the Current Assets head in the Balance Sheet.

Credit sales = Closing debtors + Receipts – Opening debtors.

Alternatively, you may observe the bills receivable ledger account to locate the figure of credit sales.

Net Credit Sales and related terms

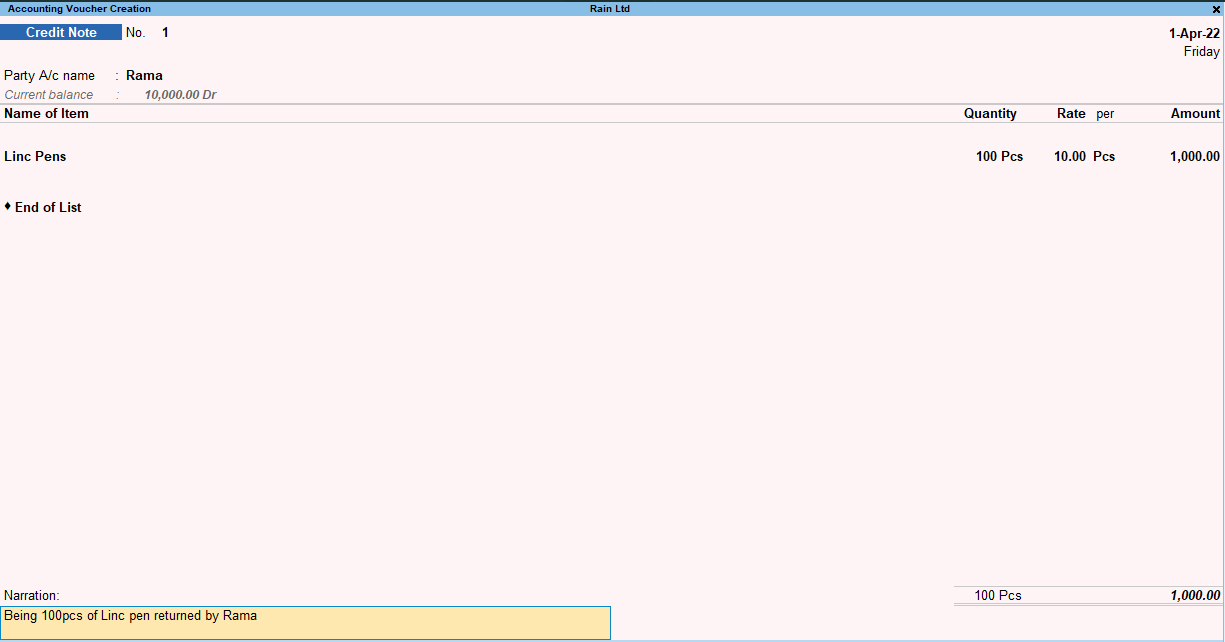

Before we try to understand the concept of net credit sales with an example, let us discuss the term sales return. Sales return means the goods returned by the customer to the seller. It may be due to defects or any other reasons.

Now let us take an example. John is a retail businessman. He sells smartphones. He buys 100 smartphones from Vivo on credit. The smartphones are worth ₹1.5 lahks. He then returns smartphones worth 20,000 rupees to Vivo. He also gets an allowance of rupees 5,000 from Vivo.

In the above example, the credit sales of Vivo are of rupees 1.5 lakh. The net credit sales is of

1.5 lakh – 20,000 – 5, 000 = 1.25 lakh rupees.

Importance of Net Credit Sales

- Net Credit Sales figure together with the accounts receivable figure acts as an indicator of the credit policy of the company.

- It offers insights into the ability of the company to meet short-term cash obligations.

- The credit policy also affects the total current assets that the company has in the manifestation of Accounts Receivable

Advantages and Disadvantages of Credit Sales.

Advantages

- Increased Sales – The credit Policy facilitates increased sales for the company. The company can attract more customers with a liberal credit policy. For example, Apple got more customers when it started to sell its products on an EMI basis.

- Customer Loyalty / Retention- Regular customers can be retained and made to feel honored by offering them more liberal credit terms.

Disadvantages

- Delay in Cash Collection – Credit Sales imply that the company would get cash on a delayed basis. This money could have otherwise been put to use for some other profitable venture or could have borne interest for the company

- Collection Expenses– The company had to incur additional expenditures for collecting money from debtors.

- Risk of Bad Debts – With credit sales, there is always the risk that the buyer may become bankrupt and may not be able to pay the money due to the seller.

What is net credit sales? Net credit sales are those revenues by a business entity, less all sales returns and allowances. Immediate payment in cash is not included in net credit sales. Formula The formula for net credit sales is as follows: Net credit sales = Sales on credit - Sales returns - SalRead more

What is net credit sales?

Net credit sales are those revenues by a business entity, less all sales returns and allowances. Immediate payment in cash is not included in net credit sales.

Formula

The formula for net credit sales is as follows:

Net credit sales = Sales on credit – Sales returns – Sales allowances

In the balance sheet, you can find credit sales in the “short-term assets “section. It can be calculated from account receivables, bills receivables, and debtors of the balance sheet.

Credit sales = closing debtors + receipts – opening debtors

Steps to calculate net credit sales

Terms relevant to understand before calculation

Sales return: A sales return is when a customer or client returns or sends a product back to the seller. And this can happen due to various reasons, including:

Sales allowance: A sales allowance is a discount that a seller offers a buyer as an alternative to the buyer for returning the product.

Because of a problem or issue with the buyer’s order or we can say that he is not satisfied with the product.

Cash sales: Cash sales are sales in which the payment is done at once or I can say that buyer has obligation to make payment to the seller.

Cash sales are considered to include bills, checks, credit cards, and money orders as forms of payment.

Example

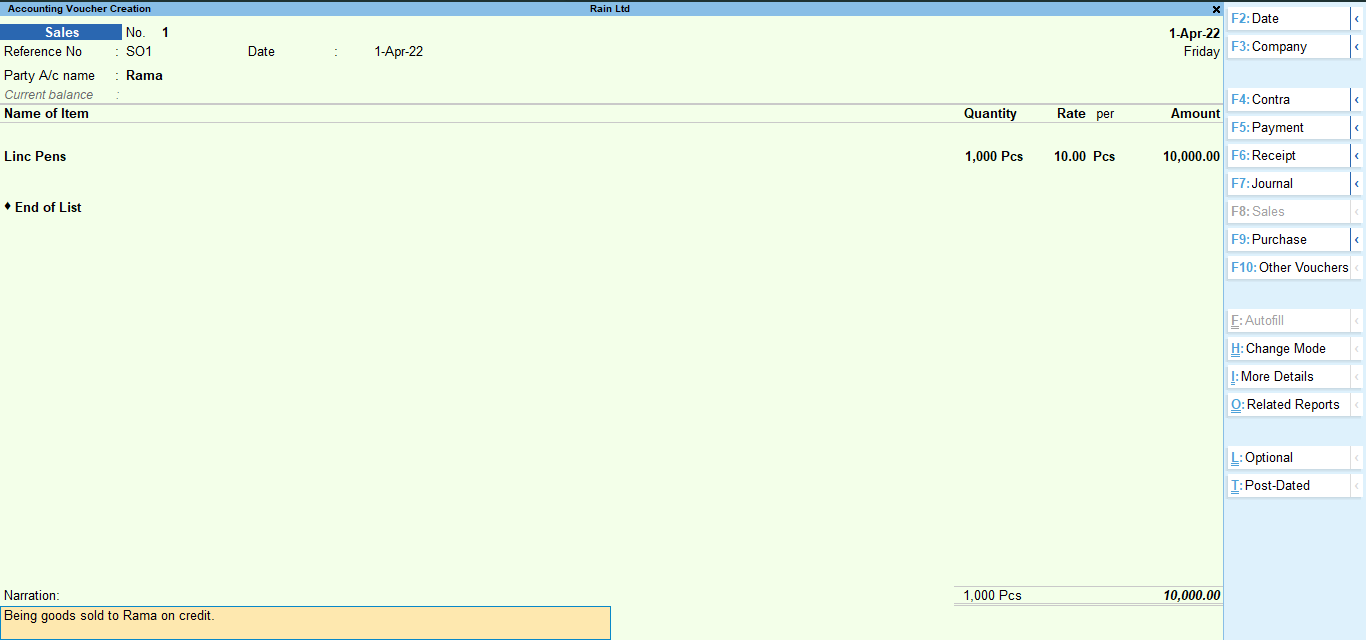

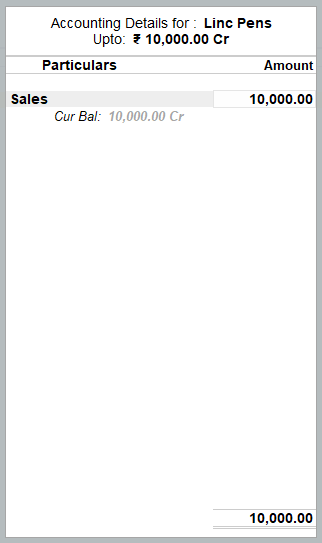

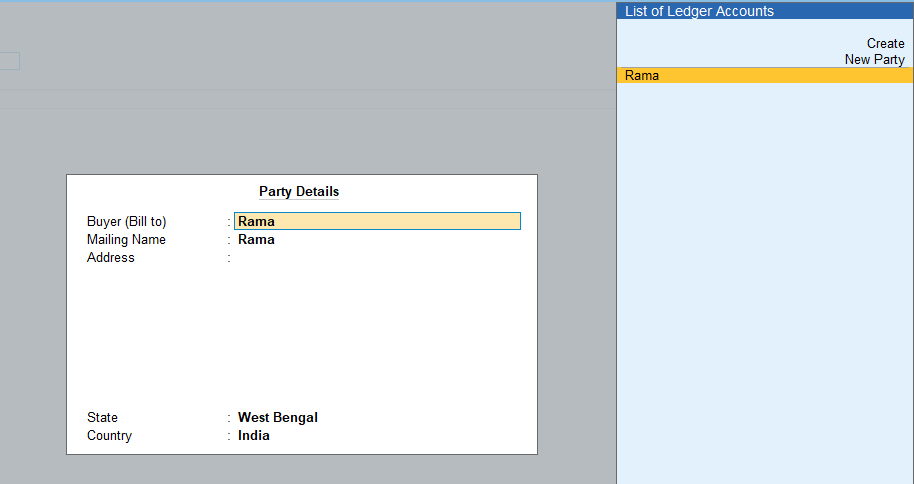

Now after understanding the terms used in the formula let me explain to you with an example which is as follows:-

Why do we need net credit sales?

- Net credit sale is also used to calculate other financial analysis items like days sales outstanding.

See less