Provisional financial statements are prepared on the basis of past data i.e. for the period which is already over. For example, the bank requested for Q4 financial statement but there were still 15 days left for the quarter to get over. In this case, the business/company will prepare a provisional fRead more

Provisional financial statements are prepared on the basis of past data i.e. for the period which is already over. For example, the bank requested for Q4 financial statement but there were still 15 days left for the quarter to get over. In this case, the business/company will prepare a provisional financial statement.

Provisional financial statements can be requested by banks, investors, and large vendors while making decisions regarding business and want current financial statements which can be obtained easily.

It is prepared with the help of past actual figures on a particular date or before the end of a financial statement. The main purpose of preparing is to show the company’s financial position on a particular date. Items of the provisional financial statement are assets, liabilities, and equity/capital.

See less

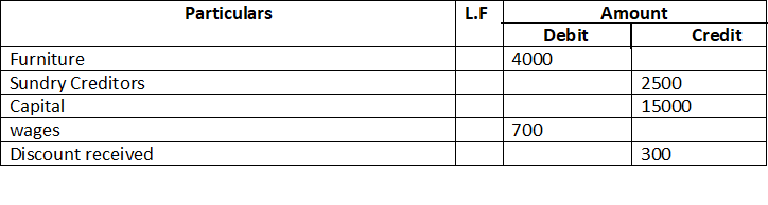

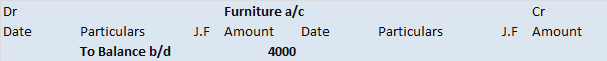

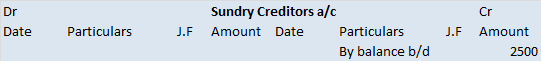

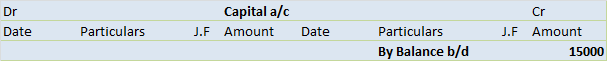

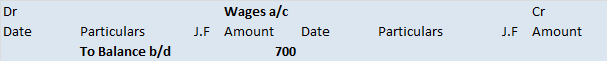

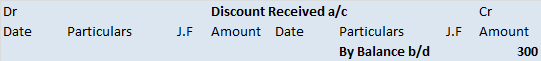

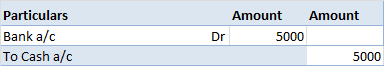

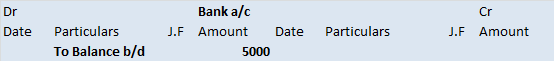

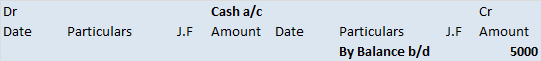

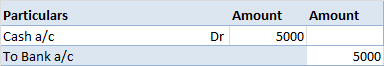

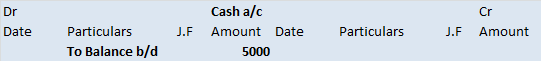

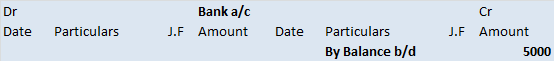

The trial balance shows the opening balance of various accounts. Now posting them in ledger accounts.

The trial balance shows the opening balance of various accounts. Now posting them in ledger accounts.

Return inwards in simple terms means sending back goods by the customer to the seller. Simply speaking when your customer purchases items from your business but is not satisfied with the items so received they return those items back to you. Some of the reasons for sending back the items are statedRead more

Return inwards in simple terms means sending back goods by the customer to the seller. Simply speaking when your customer purchases items from your business but is not satisfied with the items so received they return those items back to you. Some of the reasons for sending back the items are stated below:

In such a case, the return is initiated by the buyer and a credit note is issued to the buyer, and the same is recorded in the books of accounts. Also, this return inward is deducted from the total sales.

Example: M/s Pest ltd sold 4 units of fertilizers spraying tools of Rs 10,000 each to Mr. Zen. On inspection, he found 1 unit worth Rs 10,000 so received to be defective. Therefore the return of Rs 10,000 was initiated and goods were returned to the seller. A credit note of Rs 10,000 will be raised by the seller (M/s Pest ltd) to the buyer (Mr. Zen). The following adjustment will be shown in the trading account.

Return outwards means returning the goods by the buyer to the supplier. In layman language, when you purchase items for your business and you are not happy with the items then you may decide to return them.

In this case, a debit note is issued to the seller and is recorded in the books of accounts, and the same is reduced from the total purchases in the trading account so prepared.

Example: Suppose you are dealing in a business of clothing. You purchased 20 shirts for Rs.10,000 from a wholesale market. When you sold these shirts, you found 10 shirts worth Rs 5,000 to be defective which were returned by your customer. Therefore you will return these shirts to the wholesale market from where you purchased them. The following adjustment will be shown in the trading account.

See less