The correct option is Option (b) at a particular point of time. A balance sheet discloses the financial position of an entity at a particular point of time. The particular point of time is generally the last date of an accounting year. Most of the business concerns follow an accounting year ending oRead more

The correct option is Option (b) at a particular point of time.

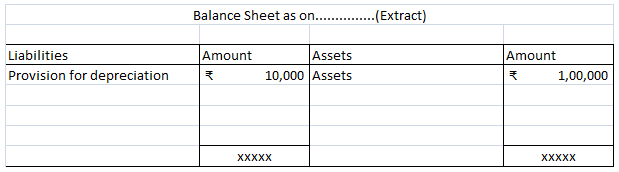

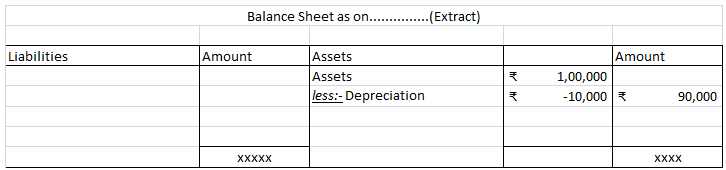

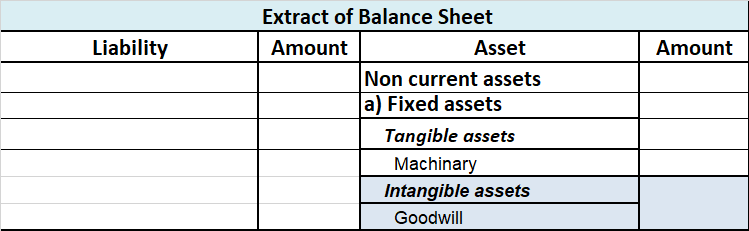

A balance sheet discloses the financial position of an entity at a particular point of time. The particular point of time is generally the last date of an accounting year. Most of the business concerns follow an accounting year ending on 31st March and prepare their balance sheet as at 31st March.

By financial position, it means the value of assets and liabilities of the entity. As an entity may enter into monetary transactions every day, the values of the assets and liabilities may also vary every day. Hence, to prepare the balance sheet of an entity, a particular point of time is to be chosen which is generally the last date of an accounting year

Option (a) for a given period of time is incorrect.

It is because the values of assets and liabilities of concern may differ daily, a balance sheet cannot be prepared to disclose the financial position of an entity for a given period of time.

The statement of profit or loss is prepared for a given period of time as it discloses the overall performance of an entity for a given period of time.

Option (c) after a fixed date is also incorrect.

The phrase, “after a fixed date” does not indicate a particular point of time. It may mean any day after a fixed date. For example, if there is an instruction to prepare a balance sheet that discloses the financial position of a concern after 30th March, it may mean 31st March, 1st April or any day thereafter.

As we know that a balance can be prepared for a particular point of time, this option seems wrong.

Option (d) None of these is incorrect too as Option (b) is the correct one.

See less

In accounting, sales returns are the goods returned by the customer to the seller. This can be due to goods delivered is damaged or defective. A return can also be due to late delivery, or the wrong items being sent to the buyer. Sales return is a subsidiary book in which all the details are recordeRead more

In accounting, sales returns are the goods returned by the customer to the seller. This can be due to goods delivered is damaged or defective. A return can also be due to late delivery, or the wrong items being sent to the buyer.

Sales return is a subsidiary book in which all the details are recorded for the goods returned which were sold on credit. It is also known as return inwards.

Accounting for Sales Return

Whenever there is a sale return, the seller will debit the sales return account and credit the debtor’s account. The total amount of sales returns is deducted from the gross sales for the period giving the figure for net sales. Debtor’s account is credited because the amount receivable from debtors will reduce.

The sales return is a contra account to the sales.

Format of sales return book:

In the above format, a credit note is a statement prepared by the seller and sent to the buyer. In this statement, all the details are mentioned in respect of the goods sent by the buyer and are an indication that the buyer’s account is credited in respect of the goods received.

For example, Mr. A sold goods to Mr. B costing Rs 50,000 on 1 December. On 5 December, goods amounting to Rs 15,000 were found defective and were returned immediately to Mr. A.

Mr. A will account for this in the following way:

See less