The main objective of depreciation is to calculate net profit. Depreciation is an expense allowed on the fixed assets of an entity to provide for the cost of benefit utilized by the entity in that particular year. Since the such assets are used for more than one financial year, profits for the furthRead more

- The main objective of depreciation is to calculate net profit.

Depreciation is an expense allowed on the fixed assets of an entity to provide for the cost of benefit utilized by the entity in that particular year. Since the such assets are used for more than one financial year, profits for the further years would be misstated if such depreciation expense is not provided for.

Further, depreciation in no way shows previous profits or satisfies the tax department and a reduction in tax is secondary since it will only be allowed if charged in the profit & loss account. Thus, B is the correct answer.

2. Depreciation is generated due to wear and tear.

Depreciation is provided for to compensate for the wear and tear of the asset while being used by the entity. Depreciation is not generated due to increase in the value of liability, decrease in capital or decrease in the value of assets. Rather the vice versa is true, that is an increase in liability, decrease in capital and decrease in asset is created due to depreciation.

Thus, C is the correct answer.

3. The purpose of making a provision for depreciation in the accounts is to charge the cost of fixed assets against profits.

Fixed assets are long term assets with useful life of more than one accounting year and therefore the full cost of such assets are not provided for in the year of purchase rather a fixed portion is charged every year in the profit and loss account.

Thus, A is correct and others are incorrect.

4. According to the straight line method of depreciation, the depreciation remains constant.

In the straight line method of depreciation, depreciation is calculated on the historical or purchase cost of the asset and the same amount is charged every year till the useful value of the asset, thus depreciation remains constant.

Also, depreciation decreases each year in case of written down value method but depreciation can never increase. Thus, A is the correct answer.

5. Total amount of depreciation of an asset cannot exceed its depreciable value.

The depreciable value is the purchase cost of the asset less the scrap value. The total amount of depreciation can never exceed the depreciable value since depreciation is allowed on an asset till its useful life at a certain percentage. Even when the value of the asset becomes nil, no further depreciation would be charged and total depreciation would be equal to depreciable value but obviously cannot be more.

Thus, A is the correct answer and other are wrong.

6. According to fixed installment method, the depreciation is calculated on original cost.

In the fixed installment method, also known as the straight line method, depreciation is calculated on the basis of the original or purchase cost of the asset using the formula-

Depreciation = (Original cost – Scrap value)/Useful life of asset

Thus, B is the correct answer.

7. Salvage value means estimated disposal value.

Salvage value is the value of the asset that can be realized by the entity on its sale after the useful life of the asset has been exhausted and is now obsolete for the entity.

Salvage value is not definite but an estimation. Salvage value can be positive or nil but not negative. Thus, D is the correct option.

8. Depreciation is calculated under diminishing balance method, based on book value.

Under the diminishing value method, the depreciation is calculated at a certain percentage of the book value of the asset which is calculated after providing for depreciation in the previous year.

Depreciation cannot be calculated on scrap value since it is the disposable value of the asset and depreciation on original value is calculated under straight line method. Thus, B is the correct option.

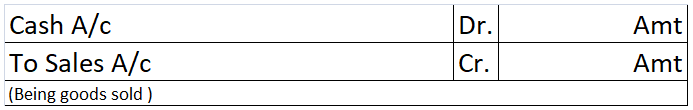

9. Depreciation amount charged on a machinery will be debited to depreciation account.

Depreciation is an expense and depreciation account will be debited since depreciation is a nominal account, as per traditional method, and all expenses are debited. Also, as per modern rules of accounting, increase in expenses are debited.

When depreciation is charged there is a decrease in the value of assets therefore machinery account will be credit also depreciation cannot be classified under repair account or cash account heads. Thus, C is the correct option.

10. In accounting, becoming out of date or obsolete is known as obsolescence.

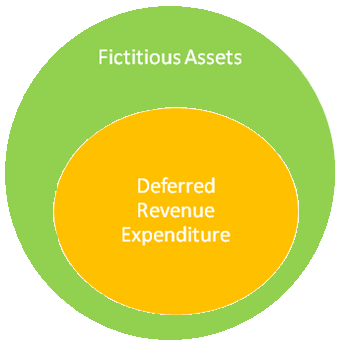

Amortization means decrease in the value of intangible assets of an entity. Depletion means exhaustion of existing wasting assets such as coal mines. Physical deterioration means fall in value of asset due to physical damage to the asset. Therefore, the correct answer is Obsolescence.

See less

Working capital is defined as the difference between current assets and current liabilities of a business. Current assets include cash, debtors and stock whereas current liabilities include creditors and short term loans etc. FORMULA Current Assets - Current Liabilities = Working Capital Zero workinRead more

Working capital is defined as the difference between current assets and current liabilities of a business. Current assets include cash, debtors and stock whereas current liabilities include creditors and short term loans etc.

FORMULA

Current Assets – Current Liabilities = Working Capital

Zero working capital is when a company has the exact same amount of current assets and current liabilities. When both are equal, the difference becomes zero and hence the name, Zero working capital. Working Capital may be positive or negative. When current assets exceed current liabilities, it shows positive working capital and when current liabilities exceed current assets, it shows negative working capital.

Zero working capital can be operated by adopting demand-based production. In this method, the business only produces units as and when they are ordered by the customers. Through this method, all stocks of finished goods will be eliminated. Also, raw material is only ordered based on the amount of demand.

This reduces the investment in working capital and thus the investment in long term assets can increase. The company can also use the funds for other purposes like growth or new opportunities.

EXAMPLE

Suppose a company has Inventory worth Rs 3,000, Debtors worth Rs 4,000 and cash worth Rs 2,000. The creditors of the company are Rs 6,000 and short term borrowings are Rs 3,000.

Now, total assets = Rs 9,000 ( 3,000 + 4,000 + 2,000)

And total liabilities = Rs 9,000 ( 6,000 + 3,000)

Therefore, working capital = 9,000 – 9,000 = 0

See less