Non-debt capital receipts As we're aware, there are two main sources of the government’s income — revenue receipts and capital receipts. Revenue receipts are all those receipts that neither create any liability nor cause any reduction in assets for the government, whereas, capital receipts are thoseRead more

Non-debt capital receipts

As we’re aware, there are two main sources of the government’s income — revenue receipts and capital receipts. Revenue receipts are all those receipts that neither create any liability nor cause any reduction in assets for the government, whereas, capital receipts are those money receipts of the government that either create a liability for a government or cause a reduction in assets.

Revenue receipts comprise both tax and non-tax revenues while capital receipts consist of capital receipts and non-debt capital receipts. Non-debt capital receipt is a part of capital receipt.

Definition

Non-debt capital receipts, also known as NDCR, are the taxes and duties levied by the government forming the biggest source of its income. Those receipts of the government lead to a decrease in assets, and not an increase in liabilities. It accounts for just 3% of the central government’s total receipts.

The union government usually lists non-debt capital receipts in two categories:

- Recovery of loans – Recovery of loans means the amount recovered when a loan defaults.

- Other receipts – Other receipts basically mean disinvestment proceeds from the sale of the government’s share in public-sector companies.

- Money accrued to the union government from the listing of central government companies and the issue of bonus shares.

For Example – Disinvestment and recovery of loans are non-debt creating capital receipts.

See less

Prepaid Payable Prepaid payable or prepaid expenses refer to the future expenses that have been paid in advance. It is an advance payment made by the business for the goods and services to be received by the business in the future. A prepaid expense is an asset on the balance sheet. The number of prRead more

Prepaid Payable

Prepaid payable or prepaid expenses refer to the future expenses that have been paid in advance. It is an advance payment made by the business for the goods and services to be received by the business in the future.

A prepaid expense is an asset on the balance sheet. The number of prepaid expenses that will be used up within one year is reported on a company’s balance sheet as a current asset. According to generally accepted accounting principles (GAAP), expenses should be recorded in the same accounting period as the benefit generated from the related asset.

Example

ABC Ltd. purchases insurance for the warehouse. It was ₹2,000 per month. The company pays ₹24,000 in cash upfront for a 12-month insurance policy for the warehouse. Each month an adjusting journal entry will be passed, adjusting the amount of insurance used from the prepaid insurance.

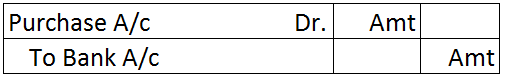

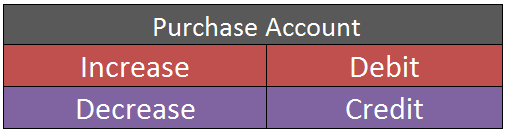

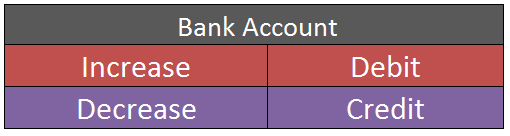

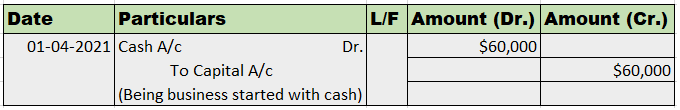

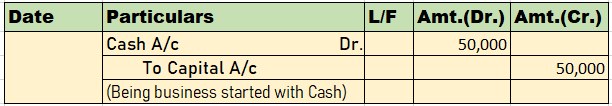

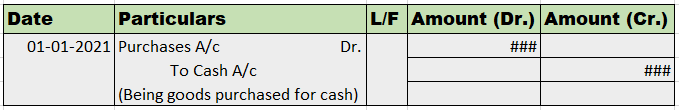

Journal Entry-

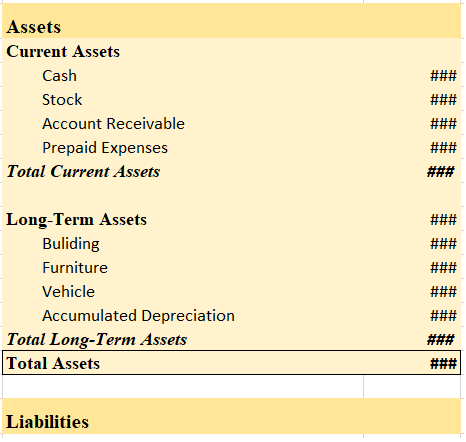

Prepaid Expenses in Balance Sheet-

Prepaid expenses are shown in the balance sheet under the current assets heading as it’s a short-term asset and to be consumed within one accounting year.

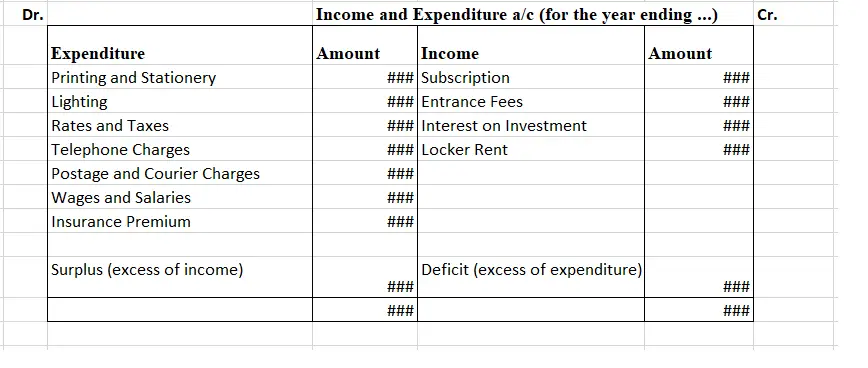

Balance Sheet (for the year ending…)

See less