The correct answer is option B. Wages and salaries are debited to the trading account. The trading account helps us to determine the Gross Profit Or Loss that a company earns or incurs by carrying on its core manufacturing or trading activities. Let us discuss the above items and their treatments inRead more

The correct answer is option B. Wages and salaries are debited to the trading account.

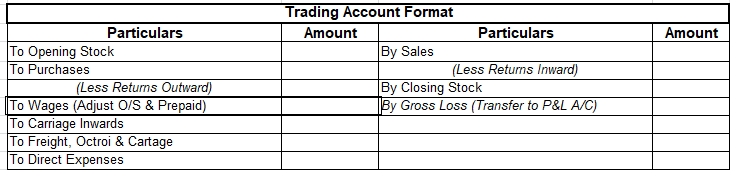

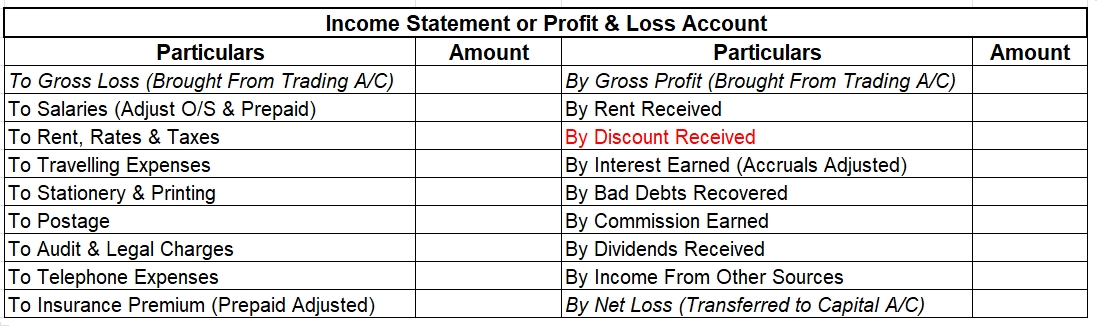

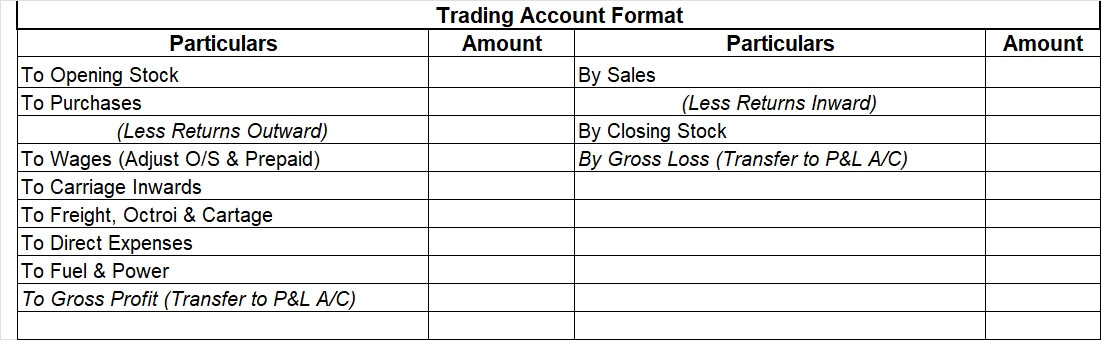

The trading account helps us to determine the Gross Profit Or Loss that a company earns or incurs by carrying on its core manufacturing or trading activities.

Let us discuss the above items and their treatments in the final accounts one at a time:

Wages Outstanding

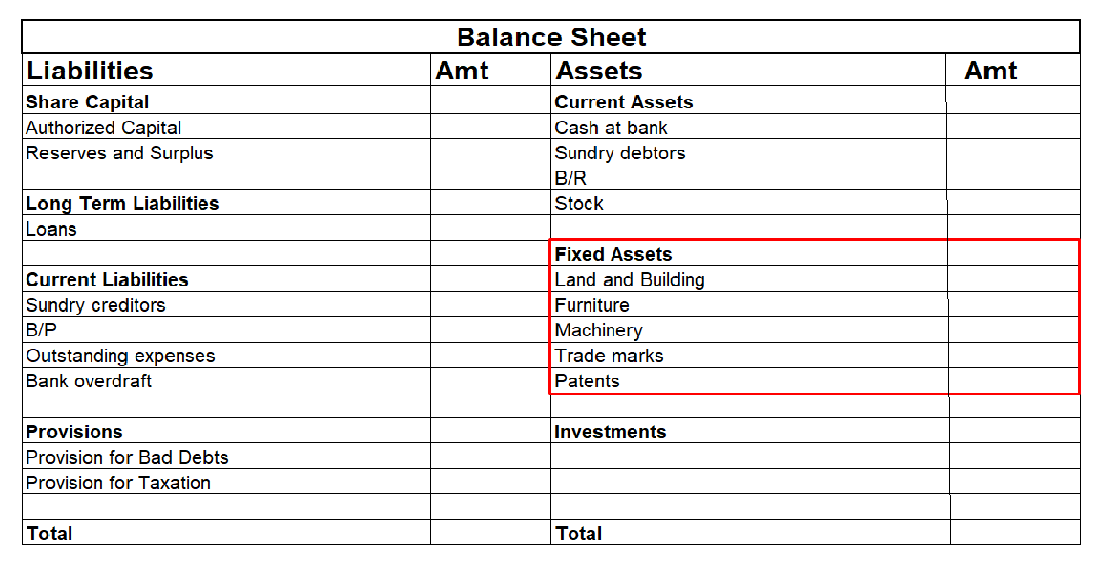

Firstly, “wages outstanding” is not debited into the trading account. It is a liability that is shown in the balance sheet.

Outstanding wages imply remuneration due to be paid to the workers for the services they have already rendered to the business.

Since the company has already received the service, it becomes a legal obligation for it to pay the wages to the workers for those services. Hence, outstanding wages are a liability.

Wages and Salaries

Wages and Salaries are debited to the trading account.

Wages Vs Salaries

Let us understand the difference between wages and salaries. Wages are the regular payments that are made daily, weekly or fortnightly. Such payments are mostly made to factory workers.

Salaries, on the other hand, are assumed to imply the remuneration paid to office workers and sales staff.

Wages are debited to the trading account, while salaries are debited to the Profit and Loss account.

Director’s Remuneration

No, the director’s remuneration is not debited to the trading account. This is because director’s generation is a business expense. It is a kind of salary provided to the director for the services rendered by him to the company.

Directors’ remuneration refers to compensation the company gives to its directors for the services rendered. It is debited to the Profit and Loss Account.

Advance Payment of Wages

No, advance payment of wages is not debited to a trading account. It is shown by reducing it to wages. Advance payment of wages implying paying remuneration to the workers before the commencement of the period for which the wages relate to.

However, one must note that if both wages and prepaid wages appear within the trial balance, then only the figure written against wages would appear in the trading account. There would be no treatment for prepaid wages.

Let us consider a scenario where wages of amount 5,000 is appearing inside trial balance. Outside the trial balance, the following information is provided

- Wages prepaid for the current financial year = 1,000

- Wages prepaid for the next financial year = 2,000

In the above case, the total wages to be debited to the trading account would be 5,000 + 1,000 – 2,000 = 4,000

Significance of the Final Accounts

- It helps in determining the net profit or loss of the entity for the current financial year.

- It is a major source of guidance for investors. Shareholders decide whether or not to invest in a company on the basis of final accounts.

- It allows banks and investors to see your business’s total income, debt load a,nd financial stability.

See less

Definition The trial balance is a list of all the closing balances of the general ledger at the end of the year. Or in other words, I can say that it is a statement showing debit and credit balances. A trial balance is prepared on a particular date and not on a particular period. Importance As the tRead more

Definition

The trial balance is a list of all the closing balances of the general ledger at the end of the year. Or in other words, I can say that it is a statement showing debit and credit balances.

A trial balance is prepared on a particular date and not on a particular period.

Importance

As the trial balance is prepared at the end of the year so it is important for the preparation of financial statements like balance sheet or profit and loss

Purpose of trial balance which are as follows:

Preparation of trial balance

Methods of preparation

These are two methods that you can use to prepare trail balance, now let me explain to you in detail about these methods which are as follows:-

Balance method

Total amount method

Steps to prepare a trial balance

A suspense account is generated when the above case arises that is trial balance did not agree after transferring the balance of all ledger accounts including cash and bank balance.

And also errors are not located in timely, then the trial balance is tallied by transferring the difference between the debit and credit side to an account known as a suspense account.

Rules of trial balance

When we prepare a trial balance from the given list of ledger balances, the following rules to be kept in mind that are as follows :

Are placed in the debit column of the trial balance.

Are placed in the credit column of the trial balance.

See less