No, forensic accounting and auditing are not the same thing. Forensic accounting is a much more detailed task that is normally done when fraud or other illegal activity is suspected. The evidence collected by forensic accountants is used in the court of law. Forensic accounting is mostly done when aRead more

No, forensic accounting and auditing are not the same thing. Forensic accounting is a much more detailed task that is normally done when fraud or other illegal activity is suspected.

The evidence collected by forensic accountants is used in the court of law. Forensic accounting is mostly done when a suit has already been filed or is likely to be filed.

How Forensic Accounting Differs from Auditing?

Auditing means an inspection of financial statements done by experts with a view to obtaining reasonable assurance as to whether or not the financial statements correctly state the financial position and financial performance of the entity during the period under audit.

Forensic accounting is the use of accounting skills to detect any fraud, embezzlement or other illegal activity that may have occurred within the entity.

This is how forensic accounting differs from auditing:

- Forensic accounting is different from auditing in that forensic accounting is done with an intention to identify and uncover frauds while auditing is normally done to provide the users of financial statements reasonable assurance that the statements are correct and true.

- Auditing usually identifies only those misstatements that are material. Materiality is the one of the main concerns of auditors. However, in forensic auditing every type of misstatement is scrutinized as material. The forensic accountants try to identify fraud in every misstatement.

- Forensic accounting is usually done only when fraud and other illegal activities are suspected and some suit has been filed or is likely to be filed while auditing of annual financial statements is mandatory for firms meeting certain threshold limits of turnover/gross receipt/revenue.

Importance of Forensic Accounting

- Forensic accounting is used to detect frauds, forgery, misappropriation of assets and other illegal activities.

- The evidence collected during forensic accounting can be used in a court of law. Often, those conducting forensic accounting are also called upon to testify as experts in a court.

- Forensic accounting identifies loopholes in the internal controls of an entity that has been or may be exploited for conducting frauds and other illegal activities.

- Forensic accountants suggest different measures that an entity can take to make it’s internal controls more effective and prevent illegal activities in the future.

Conclusion

Forensic accounting and auditing are very different from each other. While auditing is done to identify only material misstatement, forensic accounting is done with an objective of detecting possible fraud or other illegal activity. Auditing of financial statements is mandatory for firms exceeding certain threshold limits of turnover/gross receipts/revenue while financial accounting is usually done when a suit for fraud, embezzlement etc has been filed or is likely to be filed.

See less

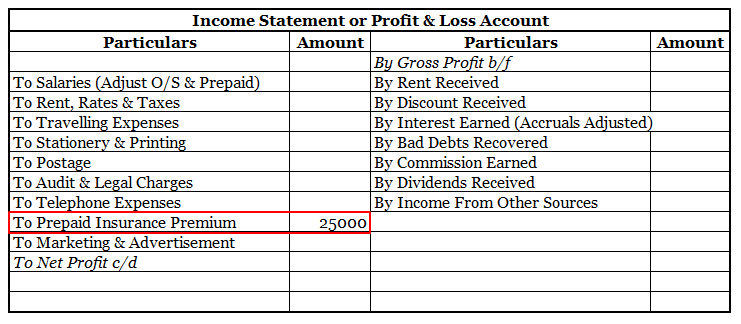

Accrued expenses are those expenses that have already been incurred but not paid. The business has already received the benefit of these goods or services but is yet to pay for them. For example, X Ltd took an insurance policy on 30th September 20XX. The premium is to be paid annually on 30th SeptemRead more

Accrued expenses are those expenses that have already been incurred but not paid. The business has already received the benefit of these goods or services but is yet to pay for them.

For example,

Why does the concept of accrued expenses arise in accounting?

The concept of accrued expenses arises in accounting because accounting records transactions on an accrual and not cash basis.

Accounting on an accrual basis implies recording transactions as and when they are incurred while recording transactions on a cash basis means recording them as and when cash is actually paid for receiving those services.

For example,

Treatment of Accrued Expenses

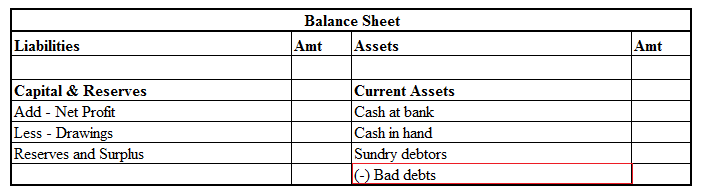

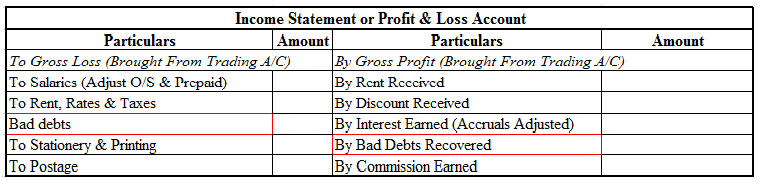

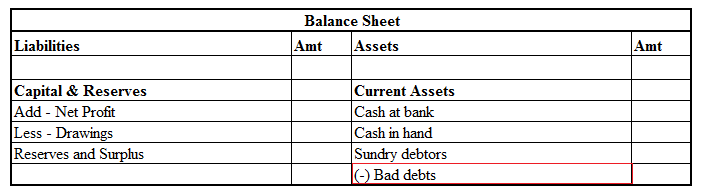

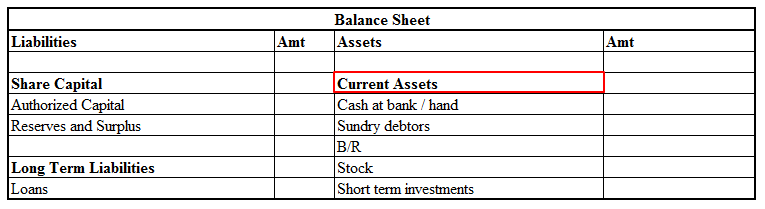

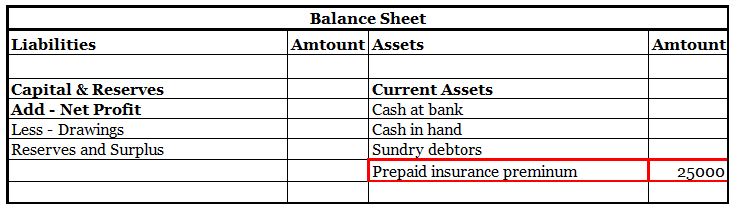

Accrued expenses are classified as current liabilities. That is because the business has a short-term obligation to pay these expenses. The other party has a legal right to receive the amount due. In other words, accrued expenses become payable in the near term.

As current liabilities, accrued expenses are carried in the balance sheet on the liabilities side. They are also recognized in the income statement as an expense as per the concept of accrual basis of accounting.

Conclusion

Accrued expenses are the expenses for which the business has already received the benefit of goods or services but which are payable in an accounting period other than the one in which such benefit is received.

As per the accrual basis of accounting, they are recognized in the year in which the expense is incurred. The expense is carried forward as a current liability until the period in which it is actually paid.

See less