What is net credit sales? Net credit sales are those revenues by a business entity, less all sales returns and allowances. Immediate payment in cash is not included in net credit sales. Formula The formula for net credit sales is as follows: Net credit sales = Sales on credit - Sales returns - SalRead more

What is net credit sales?

Net credit sales are those revenues by a business entity, less all sales returns and allowances. Immediate payment in cash is not included in net credit sales.

Formula

The formula for net credit sales is as follows:

Net credit sales = Sales on credit – Sales returns – Sales allowances

In the balance sheet, you can find credit sales in the “short-term assets “section. It can be calculated from account receivables, bills receivables, and debtors of the balance sheet.

Credit sales = closing debtors + receipts – opening debtors

Steps to calculate net credit sales

- Calculate total sales for the period

- Subtract the Sales Returns

- Subtract the Sales Allowances

- Subtract the Cash Sales ( if any )

Terms relevant to understand before calculation

Sales return: A sales return is when a customer or client returns or sends a product back to the seller. And this can happen due to various reasons, including:

- Excess quantity ordered

- Not upto Customer expectations

- Shipping delays ( product arrived late )

- Accidentally ordered an item and there can be more such reasons.

Sales allowance: A sales allowance is a discount that a seller offers a buyer as an alternative to the buyer for returning the product.

Because of a problem or issue with the buyer’s order or we can say that he is not satisfied with the product.

Cash sales: Cash sales are sales in which the payment is done at once or I can say that buyer has obligation to make payment to the seller.

Cash sales are considered to include bills, checks, credit cards, and money orders as forms of payment.

Example

Now after understanding the terms used in the formula let me explain to you with an example which is as follows:-

-

- First, we will calculate the Total Sales for the Period:- In the month of May, Flipkart company had cash sales of Rs 80,000. The total amount in Accounts Receivables is Rs 150,000, with Rs 30,000 as the carryover from April’s receivables.

-

- Since you only want to know about credit sales in the current period (September), you subtract Rs 30,000 from the total. This means that for the month of September, Flipcart Company had sales totaling Rs 200,000 (80,000 + 120,000).

-

- Second, we will subtract the Sales Returns:- During the month of September, Flipcart Company issued Rs 20,000 in refunds, because several items were damaged during shipment, so the customer could not use them.

-

- This amount would reduce the total number of cash sales if the accounts receivable balance was from a credit customer. This reduces the total sales to Rs 180,000 (Rs 200,000 in total sales – Rs 20,000 in returns).

-

- Thirdly we will subtract the Sales Allowances:- Sales allowances are discounts offered to customers for not asking for full refunds.

-

- For example, an item that had been shipped to a customer was the wrong size, but the customer told that he will agree to keep the item if the price could be adjusted. Flipcart Company issued Rs 10,000 in allowances in May.

-

- After this deduction, the total sales for May are Rs 170,000 (Rs 180,000 – Rs 10,000).

-

- Then at last there are any cash sales then subtract:- After figuring out the total number of sales for September and then subtracting the sales returns and allowances, the cash sales are deducted since you are focusing on net credit sales for the period.

-

- After deducting the Rs 60,000 in cash sales, Flipcart Company has Rs 110,000 as net credit sales.

Why do we need net credit sales?

- Net Credit sales help to calculate the accounts receivable turnover ratio.

- Net credit sales also indicate the amount of credit you offer to your customer.

- Net credit sale is also used to calculate other financial analysis items like days sales outstanding.

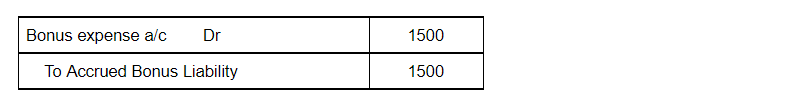

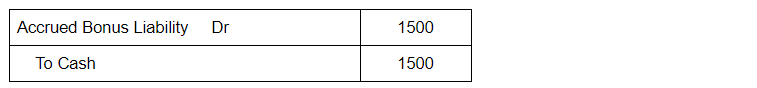

The bonus expense account is debited because according to the modern rule of accounting “Increase in expense is debited”. Accrued bonus liability is credited because according to the rule of accounting, “Increase in liability is credited”.

The bonus expense account is debited because according to the modern rule of accounting “Increase in expense is debited”. Accrued bonus liability is credited because according to the rule of accounting, “Increase in liability is credited”.

A Profit and Loss (P&L) statement is a financial statement that records a summary of all expenses and incomes of a business during a period of time. It helps in determining the financial performance of the business. After recording all transactions in an account, if the debit side is greater thaRead more

A Profit and Loss (P&L) statement is a financial statement that records a summary of all expenses and incomes of a business during a period of time. It helps in determining the financial performance of the business.

After recording all transactions in an account, if the debit side is greater than the credit side, then the account is said to have a debit balance. Similarly, if the credit side is greater than the debit side, then the account has a credit balance.

In a P&L account, when the expenses (debit) are greater than the incomes (credit), the business is said to be in a net loss. This loss is what we call the debit balance of a Profit and Loss account. A P&L account with a debit balance can be subtracted from Capital or be shown on the asset side of the Balance Sheet.

As you can see above, the net loss is shown on the right side of the P&L account. This represents the debit balance of P&L. Once it is transferred to the balance sheet, it is either subtracted from capital or shown on the asset side as shown in the second image. However, they cannot be shown on both sides of the balance sheet at the same time.

However, if the credit side is greater, that is if income is greater than expenses, then the P&L account shows a credit balance which is also known as net profit. This profit is added with Capital to show the final balance in the Balance Sheet.

Debit balance of Profit & Loss account is not preferable for a business. Hence they should put in efforts to either reduce costs or increase their income to gain profits.

See less