Interviews can appear daunting. But don't worry we are here for you. Here is a comprehensive list of journal entries and other technical and behavioral questions mostly asked in interviews. Journal entries for the following situations are most frequently asked: A cashier is absconding with cash wortRead more

Interviews can appear daunting. But don’t worry we are here for you. Here is a comprehensive list of journal entries and other technical and behavioral questions mostly asked in interviews.

Journal entries for the following situations are most frequently asked:

- A cashier is absconding with cash worth 10,000.

- Bad debts worth ₹10,000 have been recovered.

- The Head Office received ₹ 5,000 from its Branch.

- Issue of bonus shares worth 5,00,000

- Depreciation on land

- Contra Entries

- Inventory used for personal purposes

- Personal car transferred to inventory

Besides these, there are certain general questions that are almost always asked. You must be well prepared for these questions. For example,

- Introduce yourself

- Why do you want to join this company?

- Why do you not want to join our competitors? ( prepare one or two specific competitors)

- Why do you think you are fit for this role?

Behavioral Questions

Behavioral questions seek to evaluate your personality and access how you would act or react in certain situations.

Here are some of the most frequently asked behavioral questions:

- Tell me about an experience where you faced stress and how you handled it.

- How do you react when team members do not agree with you?

- How do you react when you do not agree with the team leader?

- What is the biggest challenge that you have ever faced in your life and how did you handle it?

- Tell me about a time when you had to take a leadership role.

- Tell me about a time when you took initiative.

- Tell me about a time when you failed and how you handled it.

- Tell me about a time when you used your problem-solving skills

- Tell me about the biggest mistake you have committed in life.

- Tell me about your strengths and weaknesses.

- Have you ever worked with a team before?

- Where do you see yourself in 5 years?

- Tell me about the biggest mistake you committed in your life.

Technical questions

Technical questions are those that test your academic knowledge of accounting. They intend to assess your conceptual understanding and clarity of the subject. Here’s a list of technical questions related to accounting most frequently asked in interviews:

- What is working capital?

- What is AS 1? ( Prepare all AS)

- What is the P/E ratio?

- A company takes a loan of ₹5,00,000 to buy an asset. State the impact on the cash flow statement and balance sheet.

- A company issues debentures worth ₹10,00,000. State the impact on the cash flow statement and balance sheet.

- What is the difference between a trial balance and a balance sheet?

- Differentiate between dormant and inactive accounts.

- What is Acid-Test Ratio?

- How can we estimate bad debts?

- How can a company improve its market capitalization?

- What is GAAP?

- Why do we need AS?

- What are fictitious assets?

- What is the difference between provision and reserve?

Yes, a creditor is a liability. Creditors are treated as current liability. A creditor is a person who provides money or goods to a business and agrees to receive repayment of the loan or the payment of goods at a later date. The loan may be extended with or without interest. Creditors may be secureRead more

Yes, a creditor is a liability. Creditors are treated as current liability.

A creditor is a person who provides money or goods to a business and agrees to receive repayment of the loan or the payment of goods at a later date. The loan may be extended with or without interest.

Creditors may be secured creditors or unsecured creditors. In the case of secured creditors, some collateral is usually pledged to them. In the case of a default, they can sell or otherwise dispose of the collateral in any manner to recover the money due to them.

In the case of unsecured creditors, no collateral is pledged against the amount due to them. In the case of a default, they can approach a Court to enforce repayment but cannot sell any asset of the company by themselves.

Why are Creditors treated as a liability?

An asset is something from which the business is deriving or is likely to derive economic benefit in the future. The business has legal ownership of that asset which is legally enforceable in a court of law. For example, Plant and Machinery, accrued interest, building, etc

A liability is a legal obligation of the business. It may be in the form of outstanding payments or loans or the owner’s share of the company that the company has to pay them as and when demanded.

As the company has a legal obligation to pay money to the creditor, they are treated as a liability. Most creditors are to be repaid within 1 year and are hence classified as current assets.

Treatment and Importance of Creditors

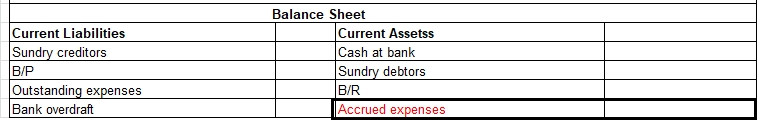

Creditors are mostly treated as current liabilities. They are shown under the head “current liabilities” of the balance sheet of a company.

The significance/importance of creditors is as follows:

We can conclude that the creditor being a person to whom the business is legally liable to pay a certain sum of money after a certain period of time has to be classified as a liability.

Creditors play a major role in determining the success of a business. They act as a major constituent of the supply cycle of the business and affect the cash flows of the business. They are shown under the head “current liabilities” of the balance sheet of a company.

See less