Definition Journal Entry is an entry made in the journal is called journal entry. And the process of recording a transaction in a journal is called journalizing. Broadly journal entries are of two types : 1. Simple entry 2. Compound entry Otherwise, they are categorized into seven types which are asRead more

Definition

Journal Entry is an entry made in the journal is called journal entry. And the process of recording a transaction in a journal is called journalizing.

Broadly journal entries are of two types :

1. Simple entry

2. Compound entry

Otherwise, they are categorized into seven types which are as follows :

1. Opening entries

2. Closing entries

3. Rectification entries

4. Transfer entries

5. Adjusting entries

6. Entries on dishonor of bills

7. Miscellaneous entries

Explanation

Now let me explain to you the above types of entries mentioned which are as follows ;

Simple entry

• Is a journal entry in which one account is debited and another account is credited with an equal amount.

• For example, the purchase of goods of Rs 5000 cash. It will affect two accounts,i.e., purchase A/C and cash A/C with the amount of Rs 5000.

Compound entry

• Is a journal entry in which one or more accounts are debited and/or one or more accounts credited or vice versa.

• For example the sale of goods to Sati for Rs 5000, Rs 2000 is received in cash, and the balance is to be received later.

• This transaction of the sale has an effect on three accounts i.e cash or bank A/C, Sati A/C, and sales A/C.

Opening entries

• Are defined as when books are started for the new year, the opening balance of assets and liabilities are journalized. For example bills payable, short-term loans, etc.

Closing entries

• At the end of the year, the profit and loss account has to be prepared. For this purpose, the nominal accounts are transferred to this account. This is done through journal entries called closing entries.

Rectification entries

• If an error has been committed, it is rectification through a journal entry.

Transfer entries

• If some amount is to be transferred from one account to another, the transfer will be made through a journal entry.

Adjusting entries

• At the end of the year, the number of expenses or income may have to be adjusted for amounts received in advance or for amounts not yet settled in cash.

• Such an adjustment is also made through journal entries. Usually, the entries pertain to the following :

Outstanding expenses,i.e., expenses incurred but not yet paid;

Prepared expenses,i.e., expenses paid in advance for some period in the future ;

Interest on capital is the interest proprietor’s investment in the business entity investment; and

Depreciation fall in the value of assets used on account of wear and tear. For all these, journal entries are necessary.

Entries on dishonor of bills

• If someone who accepts a promissory note ( or bill) is not able to pay in on the due date, a journal entry will be necessary to record the non–payment or dishonor.

Miscellaneous entries

The following entries will also require journalizing

• Credit purchase of things other than goods dealt in or materials required for the production of goods e.g. Credit purchase of furniture or machinery will be journalized.

• An allowance to be given to the customers or a charge to be made to them after the issue of the invoice.

• Receipt of promissory notes or issue to them if separate bills books have not been maintained.

• On an amount becoming irrecoverable, say, because, of the customer becoming insolvent.

• Effects of accidents such as loss of property by fire.

• Transfer of net profit to capital account.

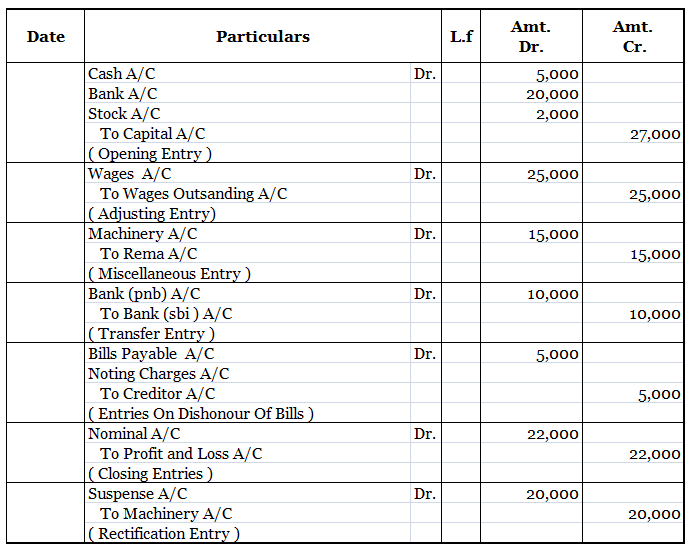

Here are some examples of journal entries showing the above types :

Definition Posting refers to moving the transaction entries from the journal to the ledger books of the company. It is an important part of the accounting cycle. Posting helps us to classify transactions in a better manner. A journal is used to record transactions in chronological order while ledgerRead more

Definition

Posting refers to moving the transaction entries from the journal to the ledger books of the company. It is an important part of the accounting cycle.

Posting helps us to classify transactions in a better manner.

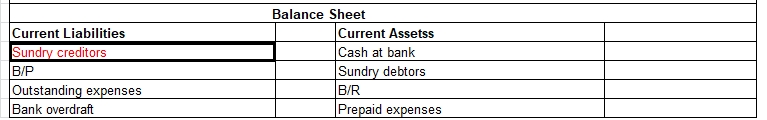

A journal is used to record transactions in chronological order while ledger books are used to classify transactions into assets, liabilities, expenses, and incomes.

Steps of Posting

• Create and name ledger accounts for different items of trial balance

• Identify those entries in the journal that relate to the relevant ledger book under consideration.

• Post the entry on the debit or credit side of the ledger account.

• For example, when salaries are paid a salary account is debited and a bank account is credited. When posting this transaction in the bank account we will debit the bank account and write “To salaries” under the head “particular”. This will indicate that salaries were paid from a bank account causing a reduction in the bank balance.

• After all the journal entries relevant to a particular ledger account have been posted in it, we will tally the total of the debit and the credit side of the ledger account to ascertain any balance left.

• Usually, asset accounts have the debit side exceeding the credit side. That is to say, they have a debit balance. Liability accounts usually have a credit balance.

• It is not necessary that every ledger account may have a balance left at the end. The total of the amounts on the debit side may be equal to the total of the amounts on the credit side in some ledger accounts.

• The last step is to recheck the ledger account to identify and correct any mistakes that may have occurred during the posting process.

Importance of Posting

• Posting helps us to classify transactions in a better and more efficient manner.

• Posting makes the books of accounts more readable.

• An accountant may choose to engage in posting once every month or even once every day as per the requirements of the business and the financial reporting norms.

• Posting is necessary for the creation of financial statements. A trial balance cannot be drafted without determining the balance of each ledger account.

• Posting helps us to know the balance of each account This helps to run the business smoothly by tracking balances timely and making up for any likely deficiency in advance.

• Analysis of how balances of various ledger accounts have changed over time helps us to draw valuable conclusions for the business.

Conclusion

We can conclude by saying that the process of posting refers to transferring the entries from the journal to the ledger accounts.

Posting is an essential step of the accounting cycle and without it, financial statements cannot be prepared. Any error while posting is bound to adversely affect the creation of the financial statements.

See less