Definition Gross profit is the excess of the proceeds of goods and services rendered during a period over their cost, before taking into account administration, selling, distribution, and financial expenses. When the result of this computation is negative it is referred to as gross loss Formula : ToRead more

Definition

Gross profit is the excess of the proceeds of goods and services rendered during a period over their cost, before taking into account administration, selling, distribution, and financial expenses.

When the result of this computation is negative it is referred to as gross loss

Formula :

Total Revenues – Cost Of Goods Sold

Net profit is defined as the excess of revenues over expenses during a particular period.

When the result of this computation is negative it is called a net loss.

Net profit may be shown before or after tax.

Formula :

Total Revenues – Expenses

Or

Total Revenues – Total Cost ( Implicit And Explicit Cost )

The basic difference between gross profit and net profit is that gross profit estimates the profitability of a company whereas net profit is to show the performance of the company.

Key points of Gross Profit

Some of the key points of as for gross profits follows :

• Stage of calculation: Gross Profit is calculated in the first stage of the Final Account.

• Purpose of calculation: It is calculated to know the total profit earned during the particular accounting

• Type of balance: Gross Profit shows the credit balance of the Trading Account.

• Dimension: It is a narrow concept as it is a part of Net Profit.

• Treatment: It is not treated directly in the balance sheet. It is transferred to the Profit And Loss Account.

Key points of Net Profit

Some of the key points of as for gross profits follows :

• Stage of calculation: Net Profit is calculated in the second stage of the Final Account.

• Purpose of calculation: It is calculated to know the net profit earned during the particular accounting

• Type of balance: Net Profit shows the credit balance of the Profit And Loss Account.

• Dimension: It is a wider concept as it includes Gross Profit.

• Treatment: It is treated directly in the balance sheet by adding or subtracting from the capital.

Examples

Now let me explain to you by taking an example which is as follows :

In a business organization there were the following data given as purchases made Rs 73000, inventory, in the beginning, was Rs 10000, direct expenses made were Rs 7000, closing inventory which was Rs 5000, revenue from operation during the period was Rs 100000.

Then,

COST OF GOODS SOLD = Purchases + Opening Inventory + Direct Expenses – Closing Inventory.

= Rs ( 73000 + 10000+ 7000- 5000)

= Rs 85000

GROSS PROFIT = REVENUE – COST OF GOODS SOLD

= Rs ( 100000 – 85000 )

= Rs 15000

Now from the above question keeping the gross profit same if the indirect expenses of the organization are Rs 2000 and the other income is Rs 1000.

Then,

NET PROFIT = GROSS PROFIT – INDIRECT EXPENSES + OTHER INCOMES

= Rs ( 15000 – 2000 + 1000)

= Rs 14000

Conclusion

So here I conclude that gross profit is the difference between revenues from sales and/or services rendered and its direct cost.

Whereas net profit is after the deduction of total expenses from the total revenues of the enterprise.

See less

Definition Net profit is defined as the excess of revenues over expenses during a particular period. For a business i.e. company/firm, it is a liability towards shareholders/promoters/partners/proprietors, etc. as it is their capital that has earned these profits. When the result of this computationRead more

Definition

Net profit is defined as the excess of revenues over expenses during a particular period.

For a business i.e. company/firm, it is a liability towards shareholders/promoters/partners/proprietors, etc. as it is their capital that has earned these profits.

When the result of this computation is negative it is called a net loss.

Net profit may be shown before or after tax.

Formula :

Total Revenues – Expenses

Or

Total Revenues – Total Cost ( Implicit And Explicit Cost )

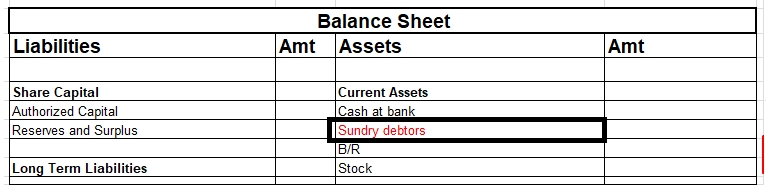

Liabilities

It means the amount owed (payable) by the business. liability towards the owners ( proprietor or partners ) of the business is termed an internal liability.

On the other hand, liability towards outsiders, i.e., other than owners ( proprietors or partners ) is termed as an external liability. For example – taxes owned, trade payables, etc.

For example creditors, bank overdrafts, etc.

Assets

An asset is a resource owned or controlled by a company and will benefit the business in current and future periods.

In other words, it’s something that a company owns or controls and can use to generate profits today and in the future.

For example – cash, building, etc.

Why debtors are treated as a liability?

Now let me explain to you why net profits are treated as a liability and not as an asset because of the following characteristics :

• Net Profit shows the credit balance of the Profit And Loss Account.

• It is treated directly in the balance sheet by adding or subtracting from the capital.

• Net Profit is a measure of the profitability of the company after taking into consideration all costs incurred during the accounting period.

• Net profit is the last line in an income statement and is the figure that concerns most people who use such a statement.

• Net income is reported on the income statement (profit and loss account) and forms a key indicator of a company’s performance.

Importance Of Net Profit

Now I will let you know the importance of net profit which is as follows :

Owners

Net profit allows owners to calculate the tax to be paid and how much earnings need to be distributed to the business owners.

Investors

Investors need to see net profit as they need to access the risk before investing they basically judge the revenue-generating capacity of a firm based on net profit.

Competitors

For making the comparison competitors tend to look at the net profit of the company to know how are they performing in the industry so that they can build themselves strong.

Creditors

Creditors look at the net profit for the purpose of obtaining business loans or we can say that determines a prospective debtor’s capacity to pay future debts.

Conclusion

Now after the above explanation, we can say that,

Net Profit is shown on the liability side as it belongs to shareholders so the company has to give it to shareholders so we are showing it under the liability side.

Net Profit with respect to the company is a liability as it has to pay it to shareholders.

Net Profit with respect to shareholders is an asset.

See less