To begin with, let me explain what is revaluation all about. So basically revaluation is a method of calculating the depreciation of assets where there are multiple identifiable assets of low value such as loose tools, live stocks, etc. Under this method assets like loose tools are revalued at the eRead more

To begin with, let me explain what is revaluation all about. So basically revaluation is a method of calculating the depreciation of assets where there are multiple identifiable assets of low value such as loose tools, live stocks, etc.

Under this method assets like loose tools are revalued at the end of the accounting period and the same is compared with the value at the beginning of the year. the difference amount is considered as depreciation.

The formula goes as :

REVALUATION= OPENING VALUE + PURCHASES – CLOSING VALUE

Let me take an example to show the same. Opening balance of Loose tools amounts to Rs.2,000 during the year, the business purchased loose tools of Rs.500 and at the year-end loose tool amounted to Rs.1,500 then revalued figure which will be shown as depreciation will be

REVALUATION= Rs.(2,000+ 500 – 1,500)

= Rs.1,000

The main discussion is”how to show adjustment of revaluation of the loose tool in financial statements”?

As we all know, loose tools are considered assets for the business, hence shown under the head current assets or fixed assets depending upon the nature of the business and the time for which it is held.

When the trial balance shows the debit value of loose tools, later on in the year-end the loose tools are revalued to a certain amount then the difference amount will be shown as depreciation in the Profit & Loss A/c and the revalued figure will be posted in the balance sheet asset side.

Let me support my explanation with an example,

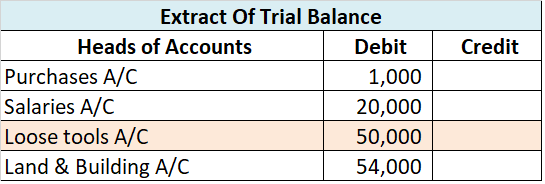

Given is the extracted trial balance of XYZ & Co.

we see the value of Loose tools in the given trial balance as Rs.50,000. At the year-end, these Loose tools were revalued at Rs.40,000.

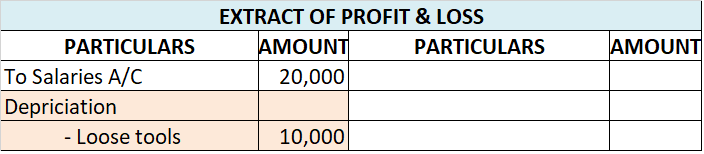

Therefore the adjustment in the financial statement would be like Rs (50,000 – 40,000) i.e Rs. 10,000 would be shown as depreciation under Profit & Loss A/c

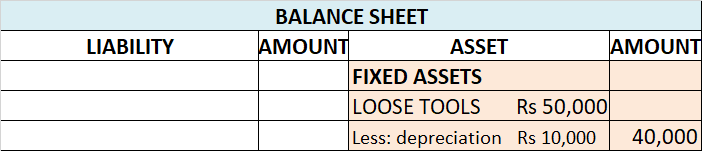

and the adjusted figure of Rs. 40,000 (i.e Rs.50,000 – Rs.10,000), will be shown on the asset side under the head fixed assets of the Balance Sheet.

Fictitious assets are expenses or losses not written off entirely in the profit and loss account during the accounting year in which they occur. Fictitious assets have no realizable value or physical existence. In the above, (C) preliminary expense is a fictitious asset. Preliminary expenses are theRead more

Fictitious assets are expenses or losses not written off entirely in the profit and loss account during the accounting year in which they occur. Fictitious assets have no realizable value or physical existence.

In the above, (C) preliminary expense is a fictitious asset. Preliminary expenses are the expenses incurred before the incorporation of a business. The word ‘fictitious’ means fake, these are not actually the assets of a company even though they are represented in the assets of the balance sheet.

Since the benefit of a fictitious asset is received over a period of time, the whole amount is not charged to the profit and loss account. The amount is amortized over several years. These expenses are non-recurring in nature. These expenses are shown as assets under the head miscellaneous expenditure. Also known as deferred revenue expenditure.

For example: A company incurred $50,000 as promotion costs before the formation of the business. This promotion cost will be deferred over 5 years. In the first year, $10,000 will be charged to the profit and loss account and the remaining $40,000 will be shown as an asset under the heading miscellaneous expenditure. Subsequently, $10000 will be charged to profit and loss for the next 4 years. The amount of $50,000 will be deferred over a span of 5 years.

Some other examples of fictitious assets :

Goodwill

Goodwill is not a fictitious asset because goodwill has a realizable value and can be sold in the market. Goodwill is an intangible asset which does not have a physical existence but can be traded for monetary value. Goodwill has an indefinite life and is sold when the business is sold. Goodwill can be self-generated or purchased. Goodwill is shown as an intangible asset under the heading fixed asset in the financial statements.

Patents

Patents are intangible assets which do not have a physical existence but have realizable value and can be sold in the market. So, patents do not come under the category of fictitious assets. Patents are basically intellectual property. The purchase price of the patent is the initial purchase cost which is amortized over the useful life of the asset. Patents are shown as intangible assets under the heading fixed asset in the balance sheet of the company.

Claim receivable

Claim receivable is an asset if the claim has been authorized by the insurance company. Claim receivable has a monetary value, so does not come under the category of a fictitious asset. If the claim is not yet authorized by an insurance company, it will be shown as a footnote in the financial statements. Authorized claim receivable is shown as a current asset in the financial statement.

See less