The current ratio is a liquidity ratio that measures a firm’s ability to pay off its short-term liabilities with its current assets. The current ratio is important because short-term liabilities are due within a period of twelve months. The current ratio is calculated using two standard figures thatRead more

The current ratio is a liquidity ratio that measures a firm’s ability to pay off its short-term liabilities with its current assets. The current ratio is important because short-term liabilities are due within a period of twelve months.

The current ratio is calculated using two standard figures that are shown in the company’s balance sheet: current assets and current liabilities. The formula for the same goes as:

Current ratio = Current Assets / Current Liabilities

A current ratio of 2:1 is considered ideal. Generally, a ratio between 1.5 to 2 is considered beneficial for the business, which means that the company has more financial resources (Current Assets) to cover its short-term debt (Current Liabilities).

A high current ratio may indicate that the business is having difficulties managing its capital efficiently to generate profits.

On the other hand, a lower current ratio (especially lower than 1) would signify that the company’s current liabilities exceed its current assets and the business may have difficulty covering its short-term debt. Although the definition of a good current ratio may vary in the different industry groups.

Example- Where,

1) CR is 2:1, the company is in a good situation as it has double the Current Assets in order to cover the short-term debt.

2) CR is 0.5:1, the company is not in a good situation as it has only half the Current Assets in order to cover the short-term debt.

See less

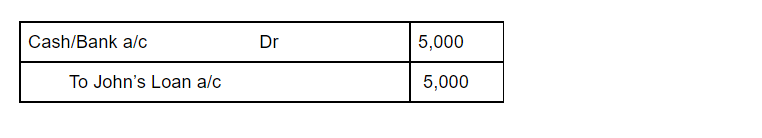

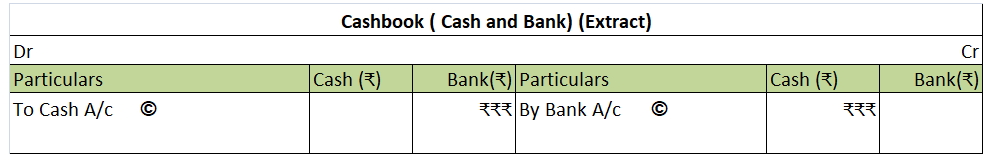

Outstanding Income is the income that is due and is being earned but not yet received. The person/ firm has the legal rights to receive that part of the income which it has earned. Outstanding Income is an Asset Account for the business/ the person. According to the modern approach, for Asset AccounRead more

Outstanding Income is the income that is due and is being earned but not yet received. The person/ firm has the legal rights to receive that part of the income which it has earned.

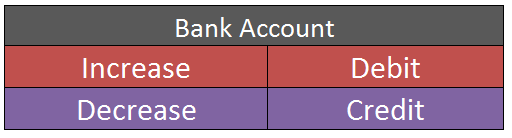

Outstanding Income is an Asset Account for the business/ the person.

According to the modern approach, for Asset Account:

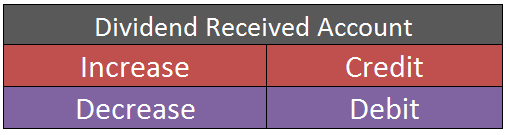

So the journal entry will be-

For Example, Mr. Rashid works as a laborer in a factory and he earns wages @Rs 500/day.

So by the end of the week, he receives a payment of Rs 3000 of Rs 3500 i.e. he receives payment of 6 days instead of 7 days. So here Rs 500 would be an outstanding income of Mr. Rashid as he has earned that income but has not received it yet.

Journal Entry –

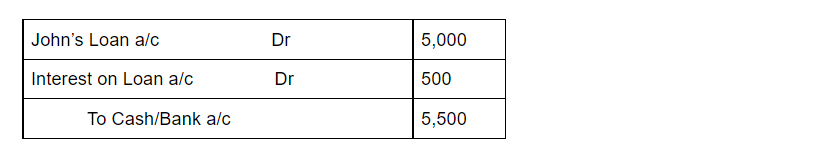

Another example, Yes Bank gave a loan of Rs 10,00,000 to company Ford @ 10% as interest payable monthly. The interest for one month i.e. Rs 1,00,000 has not been received by Yes Bank which is being due. So it will be outstanding income for Yes Bank since it is due but not yet received.

Journal entry-

Accounting Treatment for Outstanding Income-

The Outstanding Income is shown on the credit side of the income statement as the income is earned for the current year but not yet received.

Outstanding Income is an Asset for the business and hence shown on the Assets side of the balance sheet.

See less