The correct answer is C. Balance Sheet. A Balance Sheet is a financial statement prepared to know the financial position of a company at any particular point in time. Hence, the answer to your question is the balance sheet. It is also known as Position Statement (as it shows financial position) or SRead more

The correct answer is C. Balance Sheet.

A Balance Sheet is a financial statement prepared to know the financial position of a company at any particular point in time. Hence, the answer to your question is the balance sheet.

It is also known as Position Statement (as it shows financial position) or Statement of Affairs (when it is prepared under the Single Entry System of accounting).

The balance sheet shows the assets and liabilities of a firm at any specific point in time. It is a summary of the assets held by a firm and the liabilities owed to outsiders.

As the name suggests, a balance sheet must always be balanced i.e, the total of assets should always be equal to the total of liabilities on any single day. To put it simply,

Assets = Liabilities + Capital

In the case of a sole proprietorship or partnership, capital means the amount invested by the proprietor/partners in the business. In the case of a company, capital means the funds contributed by the shareholders in the form of shares.

Here is a link for the official balance sheet format as per the Companies Act 2013 (page 260 of the pdf),

https://www.mca.gov.in/Ministry/pdf/CompaniesAct2013.pdf

See less

Return inwards are the goods returned by the customer to the seller. The goods are returned for reasons like defects, excess delivery, and low quality. Return inwards are also known as Sales Returns. Sales returns are a contra account to sales revenue. The amount of sales returns is deducted from thRead more

Return inwards are the goods returned by the customer to the seller. The goods are returned for reasons like defects, excess delivery, and low quality. Return inwards are also known as Sales Returns.

Sales returns are a contra account to sales revenue. The amount of sales returns is deducted from the total sales in the Trading section of the Trading and Profit & Loss Account.

In subsidiary books, return inwards are recorded only for those goods which are sold on credit to the customer.

For example, On 1 August E Electronics sold 50 units of television to Hill Hotels on credit for Rs.25,000 each. Out of which 5 units were found to be defective and were returned back to E Electronics. In that accounting period, E Electronics made a total sales of Rs.20,00,000 (including the item sold to Hill Hotels).

E Electronics in its Trading section of Trading and P&L A/c will account for a sales return of Rs.1,25,000 (Rs.25,000*5) and this amount will be deducted from the total sales. The same will be recorded in the subsidiary books as it accounts for sales made on credit.

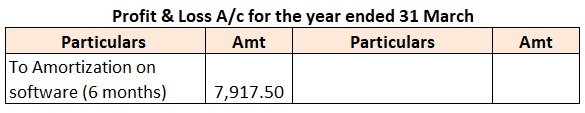

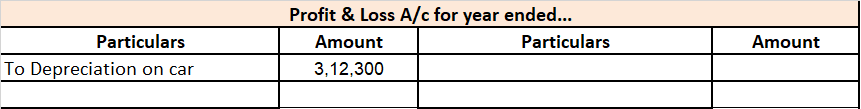

Extract of Profit & Loss Account:

For a business, sales returns will either have a decrease in the sales revenue or it will increase the sales returns and allowances which is a contra account to sales revenue. An increase in sales returns will decrease gross profit.

See less