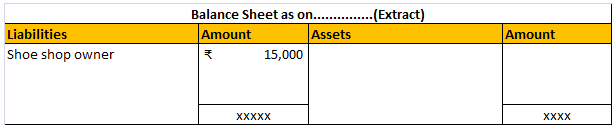

The correct answer is C. Balance Sheet. A Balance Sheet is a financial statement prepared to know the financial position of a company at any particular point in time. Hence, the answer to your question is the balance sheet. It is also known as Position Statement (as it shows financial position) or SRead more

The correct answer is C. Balance Sheet.

A Balance Sheet is a financial statement prepared to know the financial position of a company at any particular point in time. Hence, the answer to your question is the balance sheet.

It is also known as Position Statement (as it shows financial position) or Statement of Affairs (when it is prepared under the Single Entry System of accounting).

The balance sheet shows the assets and liabilities of a firm at any specific point in time. It is a summary of the assets held by a firm and the liabilities owed to outsiders.

As the name suggests, a balance sheet must always be balanced i.e, the total of assets should always be equal to the total of liabilities on any single day. To put it simply,

Assets = Liabilities + Capital

In the case of a sole proprietorship or partnership, capital means the amount invested by the proprietor/partners in the business. In the case of a company, capital means the funds contributed by the shareholders in the form of shares.

Here is a link for the official balance sheet format as per the Companies Act 2013 (page 260 of the pdf),

https://www.mca.gov.in/Ministry/pdf/CompaniesAct2013.pdf

See less

To begin with, let me explain what is revaluation all about. So basically revaluation is a method of calculating the depreciation of assets where there are multiple identifiable assets of low value such as loose tools, live stocks, etc. Under this method assets like loose tools are revalued at the eRead more

To begin with, let me explain what is revaluation all about. So basically revaluation is a method of calculating the depreciation of assets where there are multiple identifiable assets of low value such as loose tools, live stocks, etc.

Under this method assets like loose tools are revalued at the end of the accounting period and the same is compared with the value at the beginning of the year. the difference amount is considered as depreciation.

The formula goes as :

REVALUATION= OPENING VALUE + PURCHASES – CLOSING VALUE

Let me take an example to show the same. Opening balance of Loose tools amounts to Rs.2,000 during the year, the business purchased loose tools of Rs.500 and at the year-end loose tool amounted to Rs.1,500 then revalued figure which will be shown as depreciation will be

REVALUATION= Rs.(2,000+ 500 – 1,500)

= Rs.1,000

The main discussion is”how to show adjustment of revaluation of the loose tool in financial statements”?

As we all know, loose tools are considered assets for the business, hence shown under the head current assets or fixed assets depending upon the nature of the business and the time for which it is held.

When the trial balance shows the debit value of loose tools, later on in the year-end the loose tools are revalued to a certain amount then the difference amount will be shown as depreciation in the Profit & Loss A/c and the revalued figure will be posted in the balance sheet asset side.

Let me support my explanation with an example,

Given is the extracted trial balance of XYZ & Co.

we see the value of Loose tools in the given trial balance as Rs.50,000. At the year-end, these Loose tools were revalued at Rs.40,000.

Therefore the adjustment in the financial statement would be like Rs (50,000 – 40,000) i.e Rs. 10,000 would be shown as depreciation under Profit & Loss A/c

and the adjusted figure of Rs. 40,000 (i.e Rs.50,000 – Rs.10,000), will be shown on the asset side under the head fixed assets of the Balance Sheet.

See less