1. Credit balance in the cash column of the cash book 2. Credit balance in the bank column of the cash book 3. Neither of the two 4. Both (a) ...

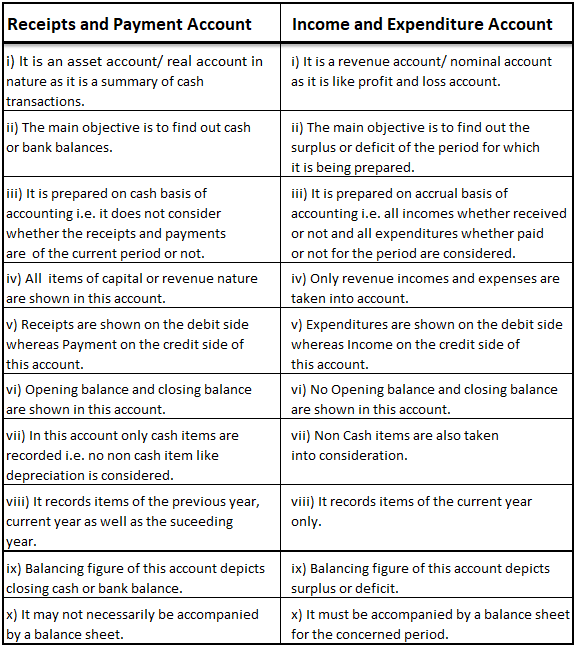

The "Income and Expenditure" account lists all the income and expenses incurred by the entity throughout the year. This account is very identical to the profit and loss account and is generally prepared on an accrual basis irrespective of whether the amount is received or paid. Non-profit organizatiRead more

The “Income and Expenditure” account lists all the income and expenses incurred by the entity throughout the year. This account is very identical to the profit and loss account and is generally prepared on an accrual basis irrespective of whether the amount is received or paid. Non-profit organizations (NPO) prepare this type of account to ascertain surplus earned or deficit incurred by them during the period.

Talking about the format of income and expenditure accounts we generally see that all the expenses are recorded on the debit side while all incomes are recorded on the credit side. One important thing to note is that items so recorded are revenue items while capital nature items are generally ignored because only current period items are recorded in this statement.

Since it is a Nominal account, we follow the golden rules to prepare this, stating “debit all expenses and losses and credit all incomes and gains”. The closing balance at the end shows the surplus or deficit for the year. If the balancing figure appears on the debit side it is surplus and if the balancing figure appears on the credit side it is a deficit for the entity.

Following is the format of income and expenditure account

See less

The correct answer is 2. Credit balance in the bank column of the cash book. The credit balance in the bank column of Cash Book represents the overdraft facility utilized by the business. Overdraft is a credit extension facility offered by banks to both savings and current account holders. It allowsRead more

The correct answer is 2. Credit balance in the bank column of the cash book.

The credit balance in the bank column of Cash Book represents the overdraft facility utilized by the business. Overdraft is a credit extension facility offered by banks to both savings and current account holders. It allows the account holder to borrow a specified sum of money over and above the balance in their accounts.

It is a form of short-term borrowing offered by banks and is extremely useful for businesses to resolve short-term cash flow issues.

The account holder can withdraw money even when his/her account does not have enough balance to cover the withdrawal. Since the business is withdrawing money that is not in its account, an overdraft is represented by a negative bank balance. That is why they are shown as a credit balance in the bank column of the Cash Book.

Overdraft is a liability for the business. Hence, it is shown on the Equity and Liability part of the Balance Sheet under the head Current Liabilities and sub-head Short Term Borrowings.

Banks do not offer this facility to all customers. Only those who have a good reputation and credit score are eligible for this facility. Like any other borrowing, interest is charged on the amount utilized by the account holder as an overdraft.

See less