To understand the accounting treatment of fixed assets under IFRS let us first understand what fixed assets are. What are Fixed Assets? Fixed assets are the assets that are purchased for long-term use by a business and not for resale. Some examples of fixed assets are land, buildings, machinery, furRead more

To understand the accounting treatment of fixed assets under IFRS let us first understand what fixed assets are.

What are Fixed Assets?

Fixed assets are the assets that are purchased for long-term use by a business and not for resale. Some examples of fixed assets are land, buildings, machinery, furniture and fixtures, etc.

Fixed assets are essential for the smooth operations of the business. It often shows the value of the business. The value of fixed assets usually decreases with time, obsolescence, damage, etc.

As per IAS-16 Property, Plant and Equipment, an asset is identified as a fixed asset if it satisfies the following conditions:

- the future economic benefits associated with the asset will probably flow to the entity, and

- the cost of the asset can be measured reliably.

What is IFRS?

IFRS stands for International Financial Reporting Standards. It provides a set of standards to be followed globally by all companies to ensure transparency, comparability, and consistency.

What is the accounting treatment of fixed assets under IFRS?

Under IFRS, the first step is to measure the value of the fixed assets on cost. The cost of the fixed assets includes the following:

- purchase price

- any direct cost related to the asset (such as transportation, installation, etc.)

- duties/taxes

After this step, the entity may choose any one of the following two primary methods:

- Cost Model: According to this model the value is first recognized on a cost basis. This includes the purchase price and direct costs attributable to the asset. Subsequently, depreciation is calculated on the cost of the asset. Depreciation spreads the cost of an asset over its useful life. Impairment checks are conducted to ensure the asset’s value on the books doesn’t exceed what it’s worth.

For example, a company bought a piece of machinery for 60,000. 5,000 were spent on its installation. It has a useful life of 10 years. The machinery would be depreciated over its useful life of 10 years based on its cost which is 65,000.

2. Revaluation model: As per this model, the fixed assets are valued on their fair value, as on the revaluation date. The amount of depreciation and impairment losses is subtracted from the fair value.

If the value of an asset increases, the gain goes to equity (revaluation surplus) unless it can be set off with a past loss recorded in profit or loss.

On the other hand, if the value decreases, the loss goes to profit or loss unless it offsets a past surplus in equity.

For example, a building was purchased for 100,000. On the revaluation date, the fair value of this building was 150,000. Hence, there is a revaluation surplus of 50,000 which shall be credited to the revaluation surplus account.

Impact on Financial Statements

Fixed assets are shown on the Assets side of the Balance Sheet.

Conclusion

From the above discussion, it may be concluded that:

- Fixed assets are the assets that are purchased for long-term use by a business and not for resale.

- Some examples of fixed assets are land, buildings, machinery, furniture and fixtures, etc.

- IFRS provides a set of standards to be followed globally by all companies to ensure transparency, comparability, and consistency.

- Under IFRS, the first step is to measure the value of the fixed assets on cost.

- After this step, the entity may choose any one of the two primary methods which are cost model and the revaluation model.

- Fixed assets are shown on the Assets side of the Balance Sheet.

See less

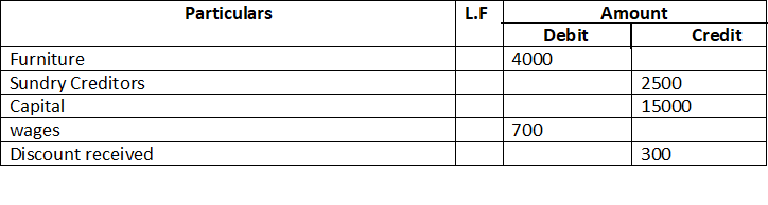

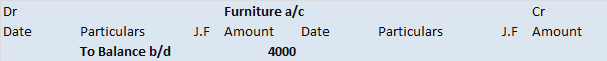

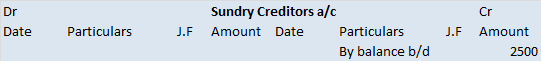

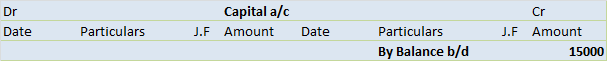

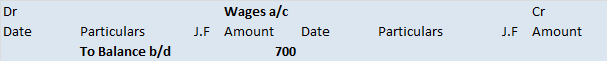

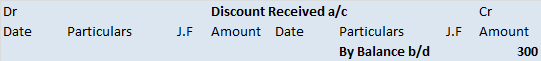

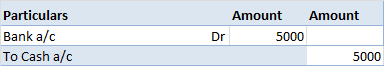

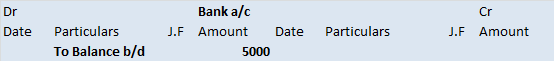

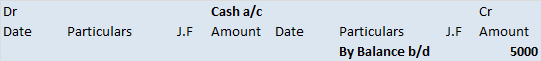

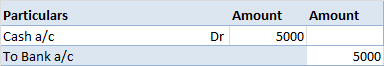

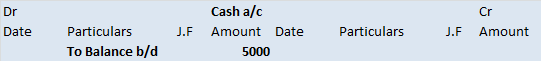

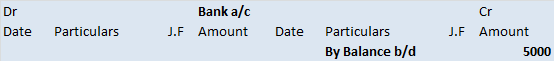

The trial balance shows the opening balance of various accounts. Now posting them in ledger accounts.

The trial balance shows the opening balance of various accounts. Now posting them in ledger accounts.

Definition A ledger may be defined as a book that contains, in a summarized and classified form, a permanent record of all transactions. Or in other words, we can say a group of accounts with different characteristics. It is also called the Principal Book of accounts. For example:- salary account, aRead more

Definition

A ledger may be defined as a book that contains, in a summarized and classified form, a permanent record of all transactions.

Or in other words, we can say a group of accounts with different characteristics.

It is also called the Principal Book of accounts.

For example:– salary account, and debtor account.

Sub- ledger it is defined as a group of accounts with common characteristics. And is a part of ledger accounts.

For example:- customer account, vendor account, etc.

The difference between a ledger and a sub-ledger is that ledger accounts control sub-ledger accounts whereas a sub-ledger is a part of the ledger account.

Features Of Ledger

Features Of Sub-Ledger

Utilities of ledger

The main utilities of a ledger are summarized as follows :

• Provides complete information about a particular account: Complete information relating to a particular account is available in one place in the ledger.

• Information on income and expenses: In the ledger, a separate account is maintained for each income and expense. The amount of total income and total expenses are known from the ledger accounts.

• Preparation of trial balance: Ledger helps in preparing trial balances which ensure arithmetical accuracy of the transaction recorded in the books of account.

• Helps in preparing final accounts: After preparing the trial balance, final accounts are prepared to know the profitability and financial position of the business.

Utilities of sub-ledger

The utilities of the sub-ledger are as follows :

• Track customer information: If a client has an outstanding credit debt or needs money refunded, a company can use a sub-ledger to verify the information quickly.

• Protect financial information: A sub-ledger allows a financial supervisor to isolate certain records so that employees can view only parts of the company’s financial information. This added level of security is important for large corporations.

• Create separate databases: Large companies usually process large amounts of financial data that may be too big for one database. Software programs organize this data into isolated files to calculate financial information in the general ledger of a business.

Conclusion

So here I conclude that a ledger is compulsory in the recording process whereas a sub-ledger is optional.

The ledger is used for preparing trial balance but the sub-ledger is not used for the same.

Sub ledger is controlled by the ledger.

The sub-ledger supports the transaction of each specific account indicated on the ledger.

See less