A revenue reserve is a type of reserve where a portion of the net profit is set aside for future requirements. It serves as a great source of internal finance for the company to meet its short term requirements. The funds put into this reserve are earned from the daily operations of a company. RevenRead more

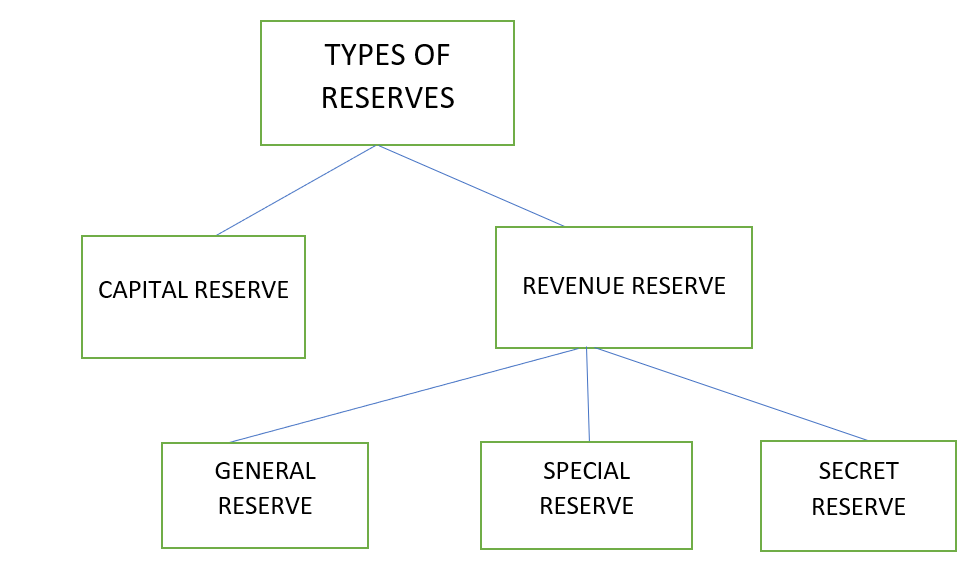

A revenue reserve is a type of reserve where a portion of the net profit is set aside for future requirements. It serves as a great source of internal finance for the company to meet its short term requirements. The funds put into this reserve are earned from the daily operations of a company. Revenue reserves are shown on the liabilities side of a balance sheet under reserves and surplus. Some examples of revenue reserve are :

- General Reserve: This reserve is used for no specific purpose, but the general financial growth of the company. It is a free reserve which means the company is not compelled to make one. It helps to curb future losses which may arise in the future.

- Specific Reserve: These are those reserves that can only be used for specific purposes. This money cannot be used for any other requirement. It is not a free reserve. A reserve created to redeem debentures would be called a debenture redemption reserve.

- Secret Reserve: This is a type of reserve whose existence is not disclosed in the balance sheet. This type of reserve cannot be created by joint-stock companies. However, banks and financial institutions are allowed to create such secret reserves.

Retained Earnings is that part of the net profit which is left after the distribution of dividends to shareholders. This amount can be invested in the company to gain profits. It is not technically a reserve as it is held after distribution of dividends but it can still be used as one.

On the other hand, a capital reserve is not a part of the revenue reserve. It is created from capital profits to finance long term projects of a company. It is used for specific purposes only.

See less

The word, “deferred” means delayed or postponed and “revenue” in layman’s terms means income. Therefore deferred revenue means the revenue which is yet to be recognised as income. It is actually unearned income. In accrual accounting, income is recognised only when it is accrued or earned. DeferredRead more

The word, “deferred” means delayed or postponed and “revenue” in layman’s terms means income. Therefore deferred revenue means the revenue which is yet to be recognised as income. It is actually unearned income.

In accrual accounting, income is recognised only when it is accrued or earned. Deferred revenue is the income received before the performance of the economic activity to earn it.

Example: A shoe shop owner gives an order to a shoe manufacturer of 1000 pair of shoes which is to be delivered after 4 months. He also gives him a cheque of ₹15,000 in advance, the rest ₹5000 is to be given at the time of delivery.

So, in this case, the ₹15,000 is actually is unearned revenue i.e. deferred revenue. It will be recognised as revenue when the shoe manufacture completes the order and deliver it.

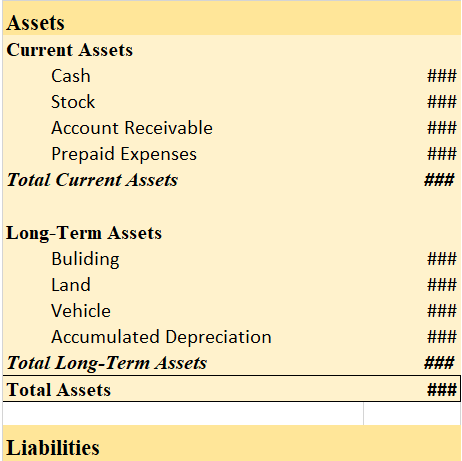

Till then, the deferred revenue is reported as a liability in the balance sheet. Like this:

After recognition as revenue, it will be reported in the statement of profit or loss:

Hence, to summarise, deferred revenue is:

Some examples of deferred revenue are as follows:

Now the question arises why deferred revenue is recognised as a liability. It is due to the fact that the business may not be able to perform the economic activity successfully to earn that revenue.

Taking the above example, suppose the shoe manufacturer is not able to honour its commitment and the shoe shop owner can wait no more, then the advanced money of ₹ 15,000 is to be refunded. That’s why deferred revenue is recognised as a liability because it is a liability if we consider the principle of conservatism (GAAP).

See less