Depletion Amortization Depression

Journal Entry for Interest on Drawings is- Particulars Amount Amount Drawings A/c Dr $$$ To Interest on Drawings A/c $$$ So as per the modern approach: From the point of view of business, Interest on Drawings is an Income. When there is an inRead more

Journal Entry for Interest on Drawings is-

| Particulars | Amount | Amount |

| Drawings A/c Dr | $$$ | |

| To Interest on Drawings A/c | $$$ |

So as per the modern approach: From the point of view of business, Interest on Drawings is an Income.

- When there is an increase in the Income, it is credited.

- When there is a decrease in the Income, it is debited.

From the point of view of the proprietor, Interest on Drawings is a Liability.

So as per the modern approach:

- When there is an increase in the Liability, it is credited.

- When there is a decrease in the Liability, it is debited.

So as per the modern approach, Interest on Drawings is credited because with Interest the income increases for the business. Whereas, the amount of such interest is a loss from the point of view of the owner/ Proprietor, as such the amount of drawings is increased by the amount of interest and hence the Drawings account is debited.

For Example, Harry charged interest on drawings on Rs 10,000 @ 12% for one year.

Explanation:

Step 1: To identify the account heads.

In this transaction, two accounts are involved, i.e. Drawings A/c and Interest on Drawings A/c.

Step 2: To Classify the account heads.

According to the modern approach: From the point of view of business, Interest on Drawings is a Revenue A/c and Drawings A/c is an Expense A/c.

Step 3: Application of Rules for Debit and Credit:

According to the modern approach: As Revenue increases because of interest on drawings received by the business, Interest on Drawings A/c will be Credited. (Rule – increase in Revenue is credited).

Drawings A/c is an expense account for the business and as expense increases, Drawings A/c will be debited. (Rule – increase in the expenses is debited).

So from the above explanation, the Journal Entry will be-

| Particulars | Amount | Amount |

| Drawings A/c Dr | 1,200 | |

| To Interest on Drawings A/c | 1,200 |

See less

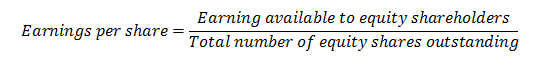

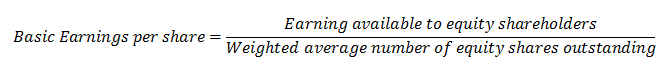

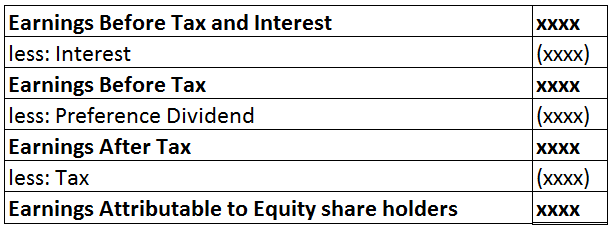

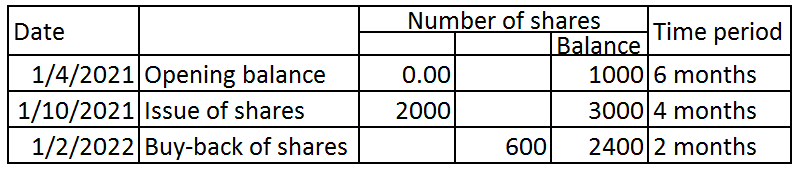

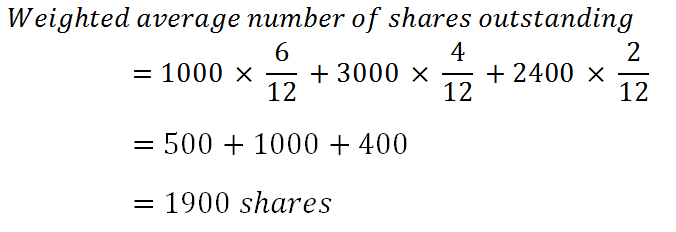

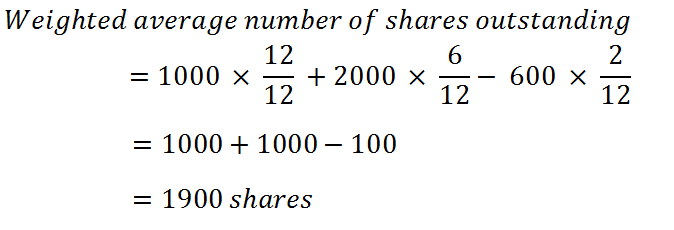

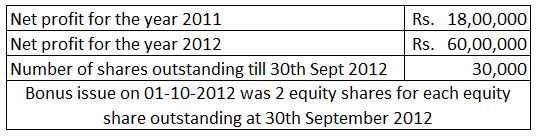

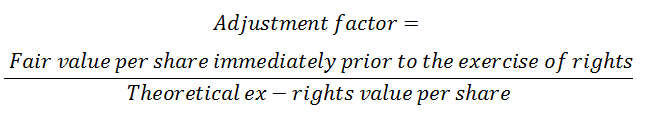

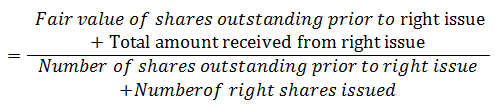

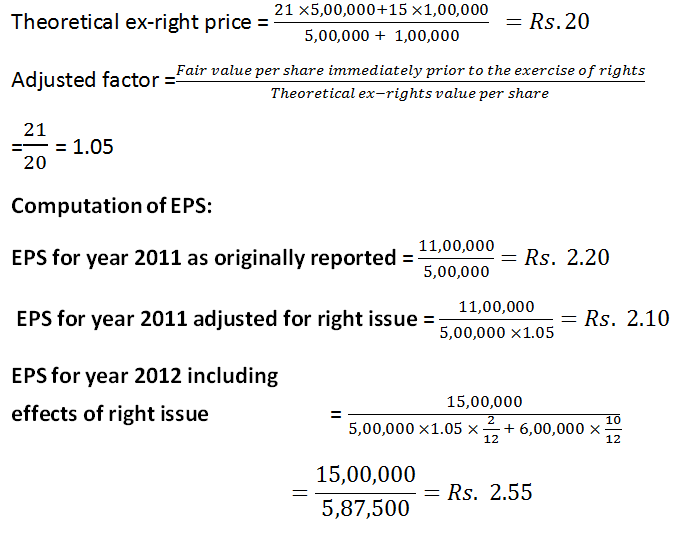

Earnings per share indicate the profit-generating capability of an enterprise and potential investors often compare the EPS of different companies to choose the best investment alternative.

Earnings per share indicate the profit-generating capability of an enterprise and potential investors often compare the EPS of different companies to choose the best investment alternative.

The correct option is 2. Amortization. Depreciation in spirit is similar to Amortization because both depreciation and amortization have the same characteristics except that depreciation is used for tangible assets and amortization for intangible assets. To make it clear, intangible assets are thoseRead more

The correct option is 2. Amortization.

Depreciation in spirit is similar to Amortization because both depreciation and amortization have the same characteristics except that depreciation is used for tangible assets and amortization for intangible assets.

To make it clear, intangible assets are those assets that cannot be touched i.e. they are not physically present. For example, goodwill, patent, trademark, etc. Hence, these assets are amortized over their useful life and not depreciated.

Example for Amortizing intangible assets: A manufacturing company buys a patent for Rs 80,000 for 8 years. Assuming that the residual value of the patent after 8 years to be zero.

The depreciation to be written off will be

Yearly Depreciation = Cost of the patent – Residual value / Expected life of the asset.

= 80,000 – 0 / 8

= Rs 10,000 every year.

Whereas, tangible assets are those assets that can be touched i.e. they are physically present. For example, building, plant & machinery, furniture, etc. Hence, these assets are depreciated over their useful life and not amortized.

Example of Depreciating tangible asset: A manufacturing company bought machinery for Rs 8,10,000 and its estimated life is 8 years, scrap value being Rs 10,000.

The depreciation to be written off will be

Yearly Depreciation = Cost of machinery – Scrap value / Expected life of the asset.

= 8,10,000 – 10,000 / 8

= 8,00,000 / 8

= Rs 1,00,000 every year.

See less