Outstanding expenses are those expenses that have been incurred during the accounting period but are yet to be paid. Basically, any expense which has become due for payment but is not paid will be called an outstanding expense. Outstanding expenses are treated as a liability as the business is yet tRead more

Outstanding expenses are those expenses that have been incurred during the accounting period but are yet to be paid. Basically, any expense which has become due for payment but is not paid will be called an outstanding expense.

Outstanding expenses are treated as a liability as the business is yet to make payment against them. Examples of outstanding expenses include outstanding rent, salary, wages, etc.

At the end of the accounting year, outstanding expenses have to be accounted for in the book of accounts so that the financial statements reflect the accurate profit/loss of the business.

Journal entry for recording outstanding expenses:

| Expense A/c | Debit |

| To Outstanding Expenses A/c | Credit |

| (Being expenses outstanding at the end of the year) |

The concerned expense A/c is debited as there is an increase in expenses. Outstanding expenses are a liability, hence they are credited.

Let me give you a simple example,

Max, a sole proprietor pays 1,00,000 as salary for his employees at the end of every month. Due to the Covid-19 lockdown, he could not pay his employees’ salaries for March month. So the salary for March (1,00,000) will be treated as an outstanding expense. The following entry is made to record outstanding salaries for the year.

| Salary A/c | 1,00,000 |

| To Outstanding Salaries A/c | 1,00,000 |

| (Being salaries outstanding at the end of the year) |

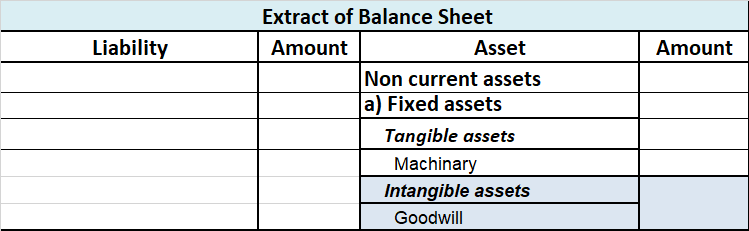

At the end of the year, outstanding salary will be adjusted in the P&L A/c and it will be shown as a Current Liability in the Balance Sheet.

See less

Discount received is the reduction in the price of the goods and services which is received by the buyer from the seller. It is an income for the buyer and is credited to the discount received account and credited to the seller/supplier’s account. Journal entry for discount received as per modern ruRead more

Discount received is the reduction in the price of the goods and services which is received by the buyer from the seller. It is an income for the buyer and is credited to the discount received account and credited to the seller/supplier’s account.

Journal entry for discount received as per modern rules:

Discount allowed is the reduction in the price of the goods which is granted by the seller to the buyer on prompt payment of their account. It is an expense for the seller and is debited to the discount allowed account and credited to the buyer’s account.

Journal entry for discount allowed as per modern rules:

For example, A Ltd. offers a 10% discount to the customers who settle their debts within two weeks. Mr.B a customer purchased goods worth Rs.20,000.

According to modern rules, A Ltd will record this sale as:

Mr.B will record this purchase as:

For a business, the discount received is an income, and the discount allowed is an expense. In the above example, A Ltd has granted a discount and B is the receiver of the discount. Hence, for A Ltd discount allowed is an expense and for B discount received is an income.

See less