No, drawings are not shown in the statement of profit or loss. By drawings, we mean the withdrawal of cash or goods by the owner of the business for his personal use. Drawings are actually shown in the balance sheet as a deduction from the capital account. Let’s take an example, Mr X runs a tradingRead more

No, drawings are not shown in the statement of profit or loss. By drawings, we mean the withdrawal of cash or goods by the owner of the business for his personal use.

Drawings are actually shown in the balance sheet as a deduction from the capital account.

Let’s take an example, Mr X runs a trading business. For meeting his personal expense we withdrew cash from his business cash of amount Rs. 15,000. It shall be reported like this:

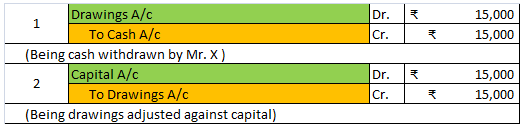

Journal Entries:

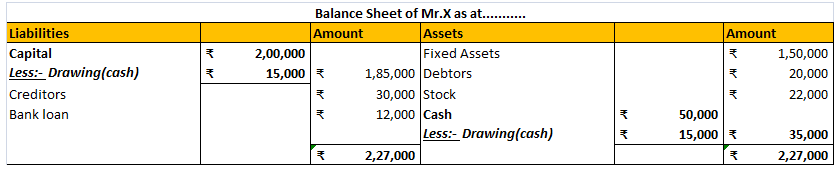

Balance sheet:

Profit and loss account reports only the nominal accounts i.e. incomes and expenses. That’s why drawings are not shown in the statement of profit or loss because it is neither an expense nor an income.

It represents the owner’s withdrawal of capital from business for personal use. Hence, the drawings account is a personal account. Drawings lead to a simultaneous reduction in capital and cash or stock of a business which has nothing to do with Profit and loss A/c.

Therefore it is reported in the balance sheet only.

See less

Sundry Debtors Sundry Debtors are those persons or firms to whom goods have been sold or services rendered on credit and the payment has not been received from them. In other words, Debtors are the persons or firms from whom the payment is to be received by the business. For Example, Ramen Sold goodRead more

Sundry Debtors

Sundry Debtors are those persons or firms to whom goods have been sold or services rendered on credit and the payment has not been received from them. In other words, Debtors are the persons or firms from whom the payment is to be received by the business.

For Example, Ramen Sold goods to Sam on credit, Sam did not pay for the goods immediately, so here Sam is the debtor for Ramen because he owes the amount to Ramen.

Another Example, If goods worth Rs 7000 have been sold to Sid on credit, he will continue to remain as debtor of the business so long as he does not make the full payment.

Treatment:

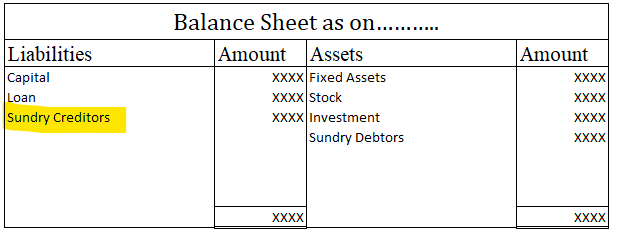

Sundry Debtor is considered as a current asset and hence it is shown on the assets side of the balance sheet under the Current Assets heading.

Sundry Debtors are not considered as an item of profit and loss because it is not considered as an item of income or expense. However, the items associated with sundry debtors such as bad debts or provision for doubtful debts or bad debts recovered are shown in profit and loss accounts in the debit and credit sides respectively.

Sundry Creditors

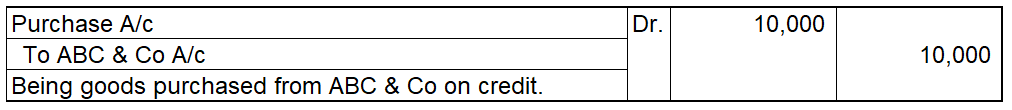

Sundry creditors are those persons or firms from whom goods have been purchased or services rendered on credit and for which payment has not been made. In other words, Creditors are the person or firms to whom some money has to be paid by the business.

For Example, Ramen purchased goods from Sam on credit, Ramen did not pay for the goods immediately, so here Ramen is the creditor for Sam because he owes money to Sam.

Another Example, If Mr. Johnson purchased goods worth Rs 3000 from M/s. Rick & Co. on credit, Mr. Johnson will continue to remain as a creditor of M/s. Rick & Co. as long as the full payment is made by Mr. Johnson.

Treatment:

Sundry Creditor is shown in the liabilities side of the balance sheet under the heading Current Liabilities.

See less